Answered step by step

Verified Expert Solution

Question

1 Approved Answer

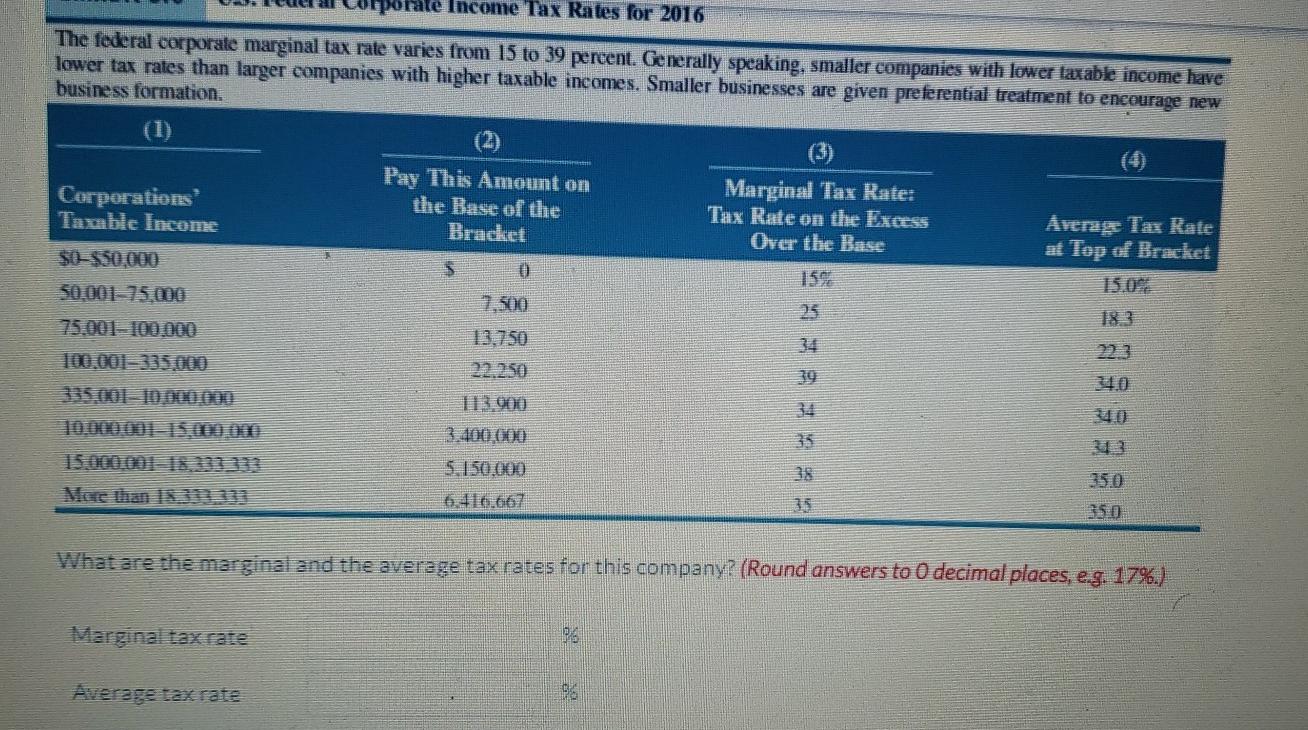

Income Tax Rates for 2016 The federal corporate marginal tax rate varies from 15 to 39 percent. Generally speaking, smaller companies with lower taxable income

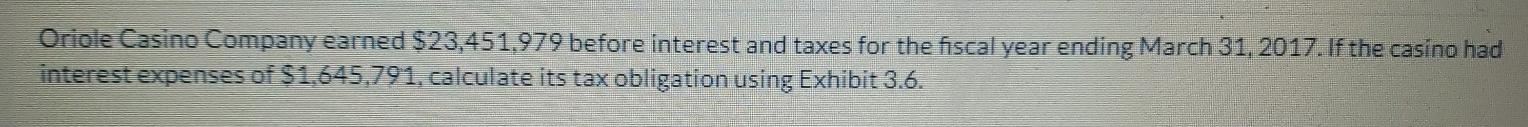

Income Tax Rates for 2016 The federal corporate marginal tax rate varies from 15 to 39 percent. Generally speaking, smaller companies with lower taxable income have lower tax rates than larger companies with higher taxable incomes. Smaller businesses are given preferential treatment to encourage new business formation. Pay This Amount on the Base of the Bracket Marginal Tax Rate: Tax Rate on the Exess Over the Base Average Tax Rate af Top of Bracket 3 O 15.02 Corporations Tamble Income $0-$50.000 50.000 75.000 75.001- 100.000 100.0013335.000 335010000000 10,00000000 15.0000018333 Here than 33 33 7,500 13.750 222250 113.000 3,400,000 5.150.000 6.410.06 350 350 What are the marginal and the average tax rates for this company? (Round answers to O decimal places, e.g. 17%.) Marginal tax rate 2 Average tax rate Oriole Casino Company earned $23,451,979 before interest and taxes for the fiscal year ending March 31, 2017. If the casino had interest expenses of $1,645,791, calculate its tax obligation using Exhibit 3.6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started