Answered step by step

Verified Expert Solution

Question

1 Approved Answer

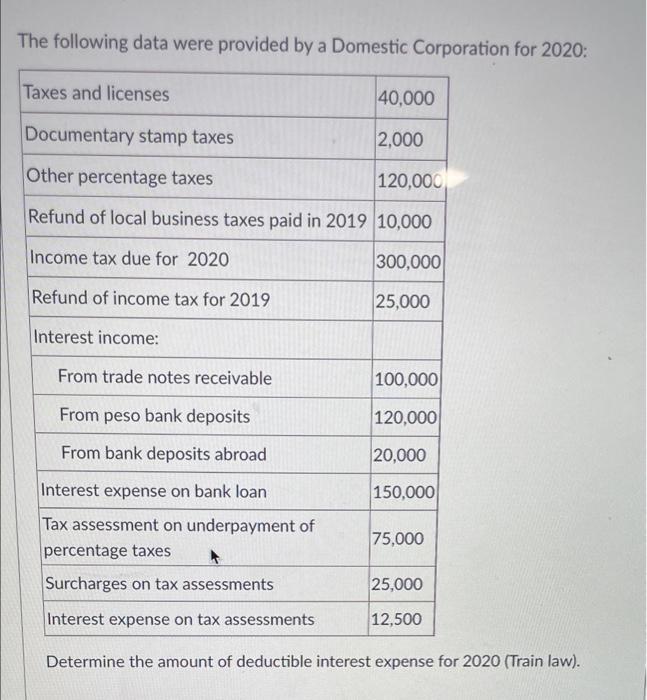

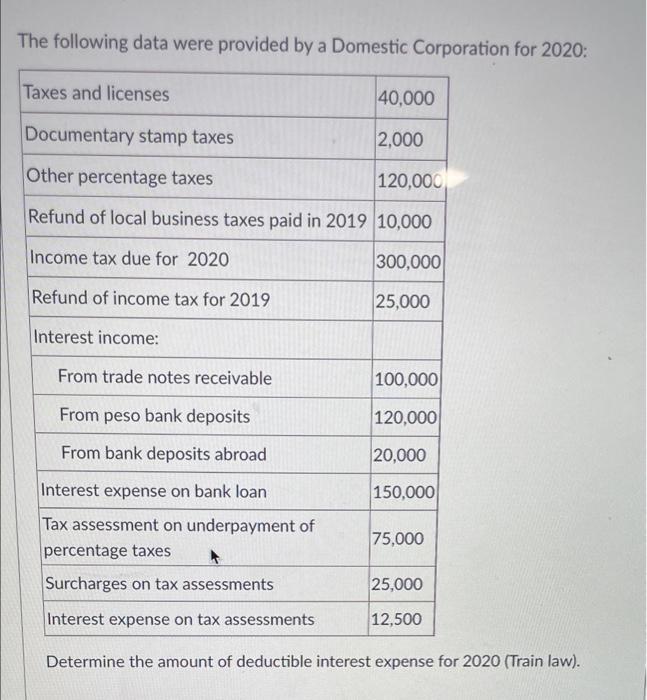

Income Taxation (Philippines) please indicate the solution on how you computed the answer. thank you The following data were provided by a Domestic Corporation for

Income Taxation (Philippines)

The following data were provided by a Domestic Corporation for 2020: Taxes and licenses 40,000 Documentary stamp taxes 2,000 Other percentage taxes 120,000 Refund of local business taxes paid in 2019 10,000 Income tax due for 2020 300,000 Refund of income tax for 2019 25,000 Interest income: From trade notes receivable 100,000 From peso bank deposits 120,000 From bank deposits abroad 20,000 Interest expense on bank loan 150,000 75,000 Tax assessment on underpayment of percentage taxes Surcharges on tax assessments 25,000 Interest expense on tax assessments 12,500 Determine the amount of deductible interest expense for 2020 (Train law). The following data were provided by a Domestic Corporation for 2020: Taxes and licenses 40,000 Documentary stamp taxes 2,000 Other percentage taxes 120,000 Refund of local business taxes paid in 2019 10,000 Income tax due for 2020 300,000 Refund of income tax for 2019 25,000 Interest income: From trade notes receivable 100,000 From peso bank deposits 120,000 From bank deposits abroad 20,000 Interest expense on bank loan 150,000 75,000 Tax assessment on underpayment of percentage taxes Surcharges on tax assessments 25,000 Interest expense on tax assessments 12,500 Determine the amount of deductible interest expense for 2020 (Train law) please indicate the solution on how you computed the answer. thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started