Answered step by step

Verified Expert Solution

Question

1 Approved Answer

INCOMPLETE SOLUTION WILL FETCH YOU A DOWNVOTE WRONG ANSWER WILL FETCH YOU A DOWNVOTE PLEASE DON'T ATTEMPT IF YOU CANNOT ANSWER WITHIN HALF AN HOUR

INCOMPLETE SOLUTION WILL FETCH YOU A DOWNVOTE WRONG ANSWER WILL FETCH YOU A DOWNVOTE PLEASE DON'T ATTEMPT IF YOU CANNOT ANSWER WITHIN HALF AN HOUR

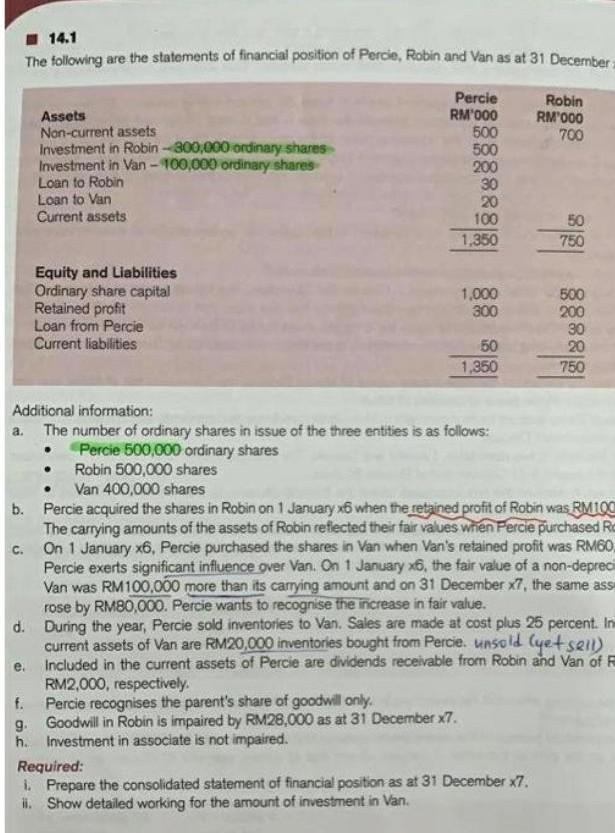

14.1 The following are the statements of financial position of Percie, Robin and Van as at 31 December Percie Robin Assets RM 000 RM'000 Non-current assets 500 700 Investment in Robin - 300,000 ordinary shares 500 Investment in Van - 100,000 ordinary shares 200 Loan to Robin 30 Loan to Van 20 Current assets 100 50 1,350 750 Equity and Liabilities Ordinary share capital Retained profit Loan from Percie Current liabilities 1.000 300 500 200 30 20 750 50 1,350 Additional information: a The number of ordinary shares in issue of the three entities is as follows: Percie 500,000 ordinary shares Robin 500,000 shares Van 400,000 shares b. Percie acquired the shares in Robin on 1 January 26 when the retained profit of Robin was RMIO The carrying amounts of the assets of Robin reflected their fair values when Percie purchased R c. On 1 January x6. Percie purchased the shares in Van when Van's retained profit was RM60 Percie exerts significant influence over Van. On 1 January 26, the fair value of a non-deprec Van was RM100,000 more than its carrying amount and on 31 December x7, the same ass rose by RM80,000. Percie wants to recognise the increase in fair value. d. During the year, Percie sold inventories to Van. Sales are made at cost plus 25 percent. In current assets of Van are RM20,000 inventories bought from Percie, unsold (yet sell) Included in the current assets of Percie are dividends receivable from Robin and Van of R RM2,000, respectively. f. Percie recognises the parent's share of goodwill only. 9. Goodwill in Robin is impaired by RM28,000 as at 31 December x7. h. Investment in associate is not impaired. Required: Prepare the consolidated statement of financial position as at 31 December 7. l. Show detailed working for the amount of investment in Van

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started