Question: incorrect answer straight away down vote. .. please don't copy from Chegg... it's incorrect answer completely... don't copy.... straight away report against your answer Slow

incorrect answer straight away down vote. ..

please don't copy from Chegg... it's incorrect answer completely...

don't copy.... straight away report against your answer

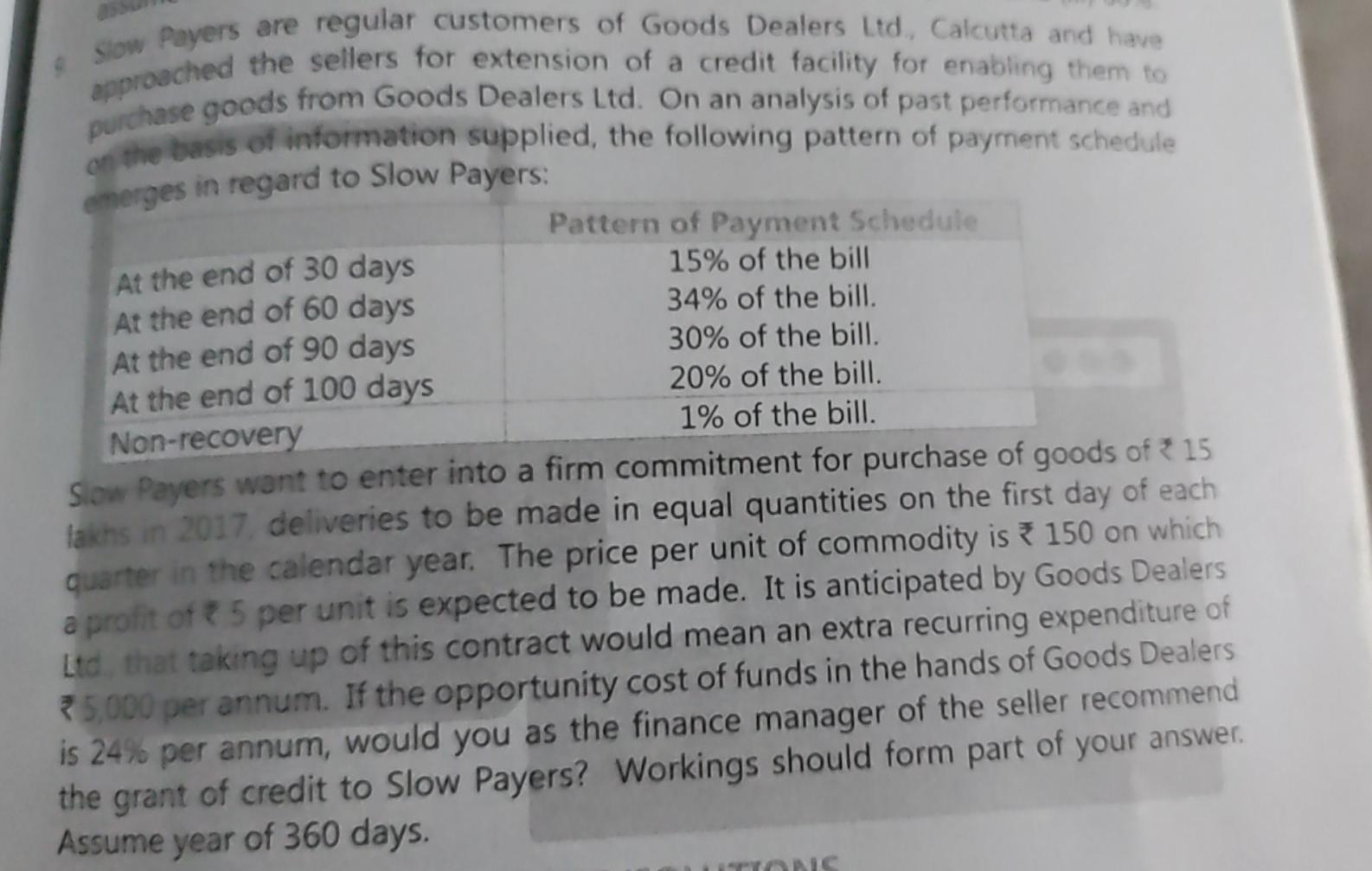

Slow Payers are regular customers of Goods Dealers Ltd., Calcutta and have approached the sellers for extension of a credit facility for enabling them to purchase goods from Goods Dealers Ltd. On an analysis of past performance and on the basis of information supplied, the following pattern of payment schedule emerges in regard to Slow Payers: Pattern of Payment Schedule At the end of 30 days 15% of the bill At the end of 60 days 34% of the bill. At the end of 90 days 30% of the bill. At the end of 100 days 20% of the bill. Non-recovery 1% of the bill. Slow Payers want to enter into a firm commitment for purchase of goods of 15 lakhs in 2017 deliveries to be made in equal quantities on the first day of each quarter in the calendar year. The price per unit of commodity is * 150 on which a profit of 5 per unit is expected to be made. It is anticipated by Goods Dealers Ltd, that taking up of this contract would mean an extra recurring expenditure of 25,000 per annum. If the opportunity cost of funds in the hands of Goods Dealers is 24% per annum, would you as the finance manager of the seller recommend the grant of credit to Slow Payers? Workings should form part of your answer. Assume year of 360 days. TIONS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts