Answered step by step

Verified Expert Solution

Question

1 Approved Answer

incorrect answers are marked When entering Social Security numbers (SSNs) or Empibyer Identification Numbers (EINs). replace the X's as directed, or with any four digits

incorrect answers are marked

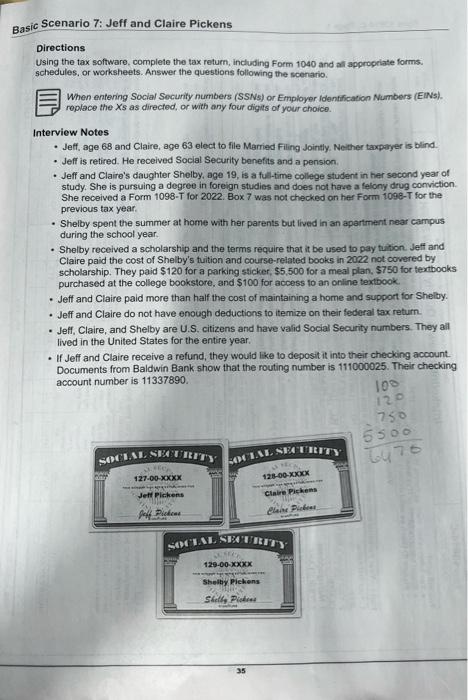

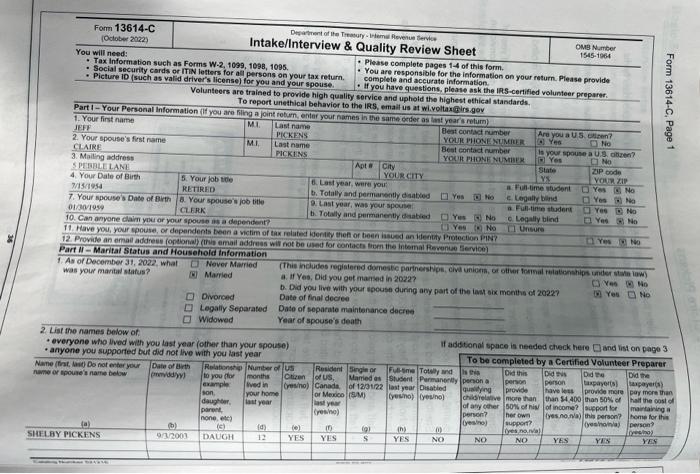

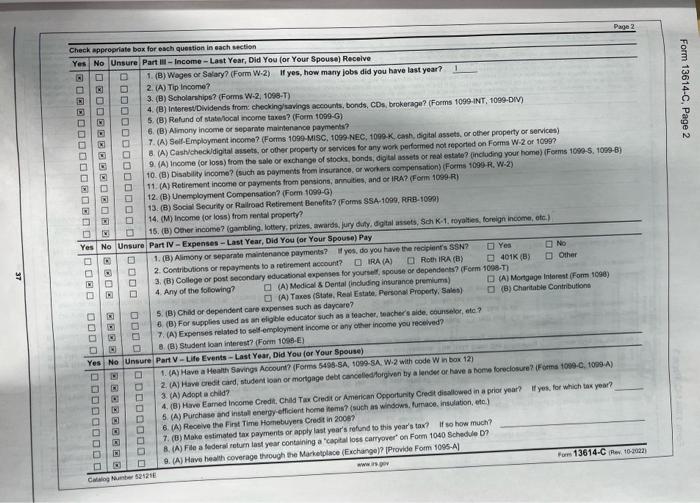

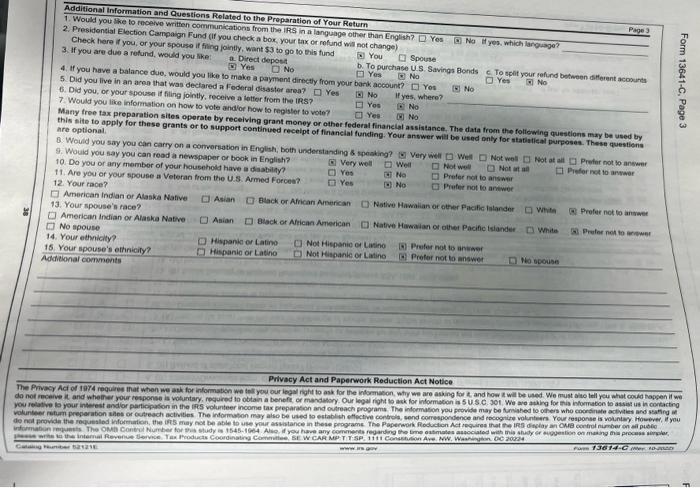

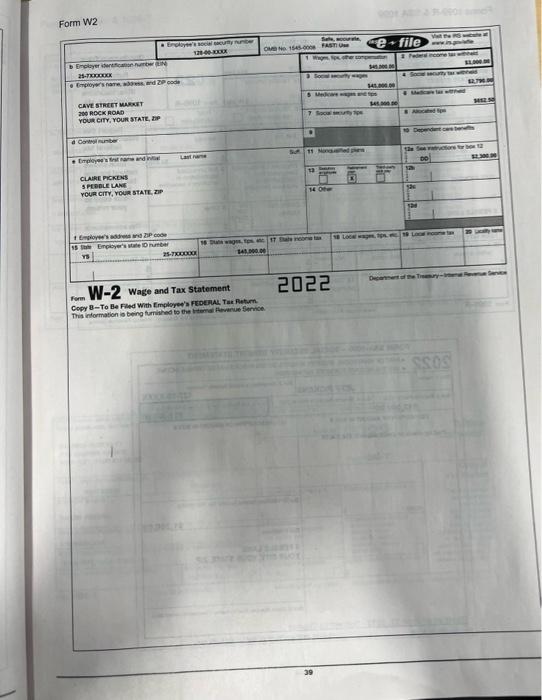

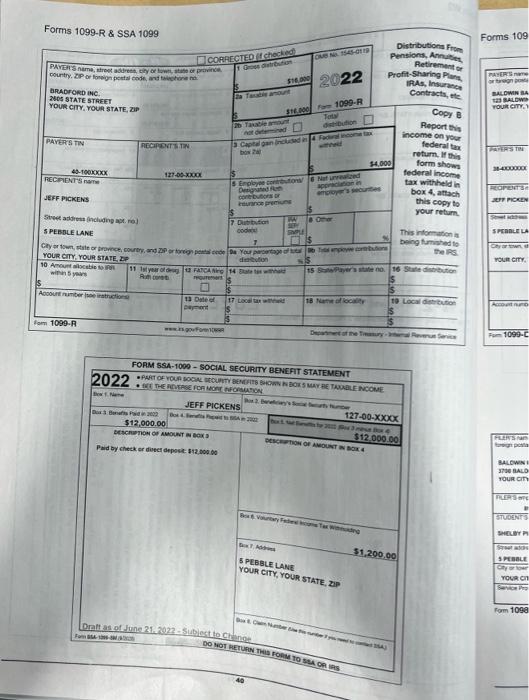

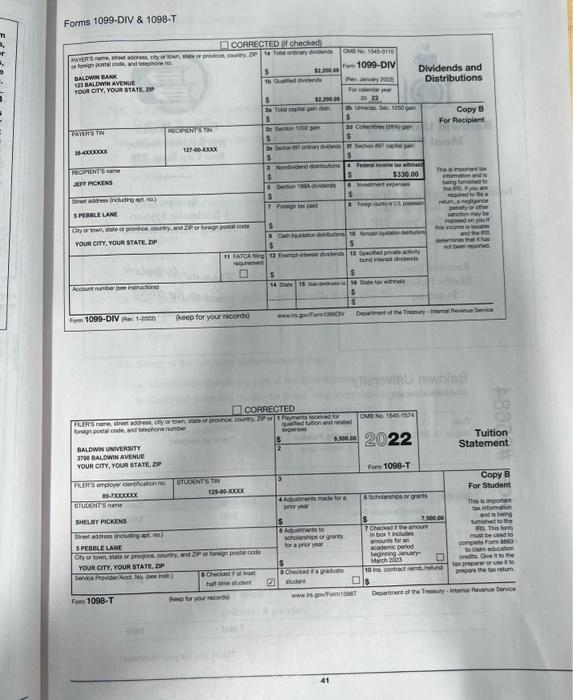

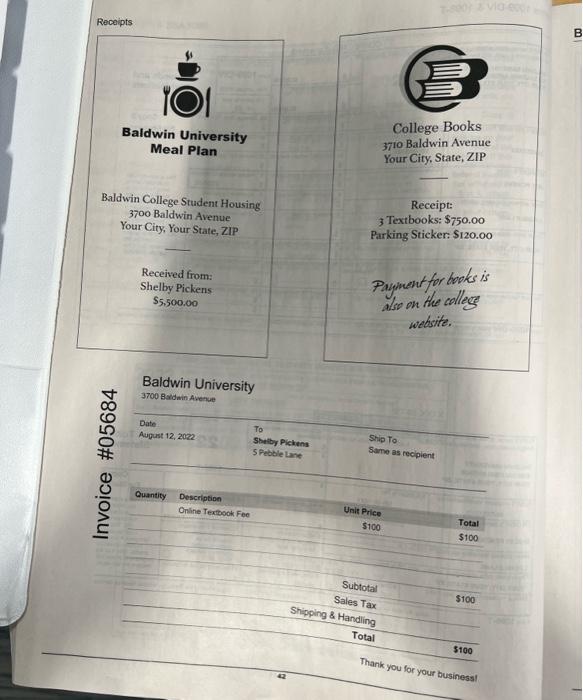

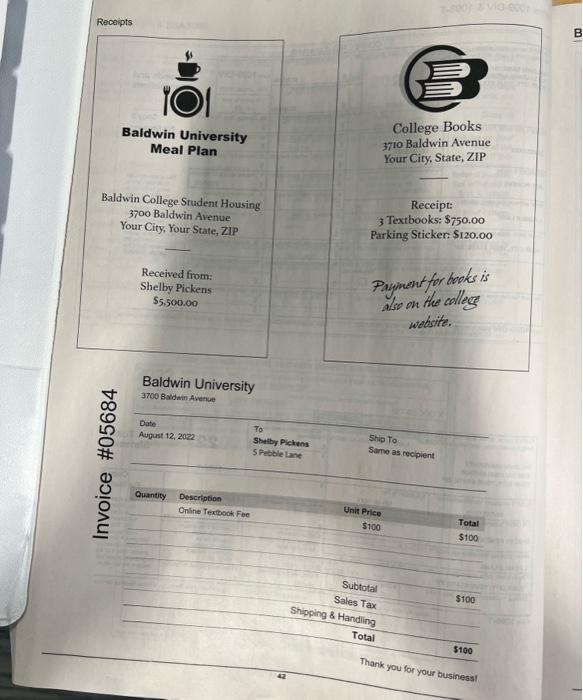

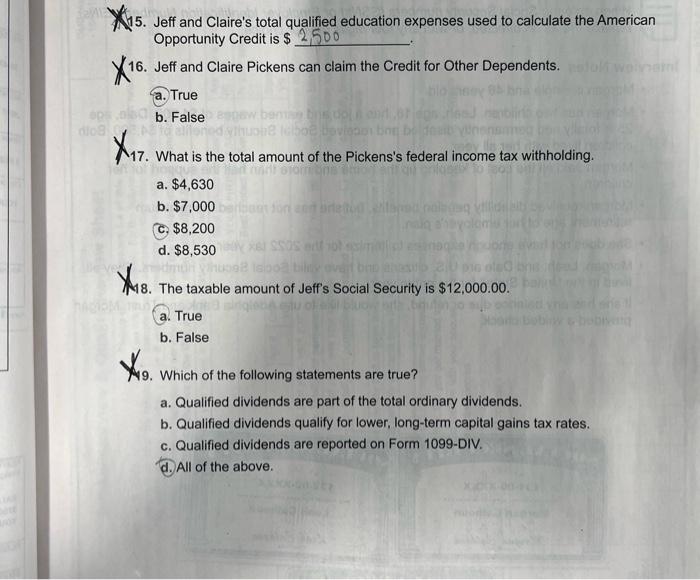

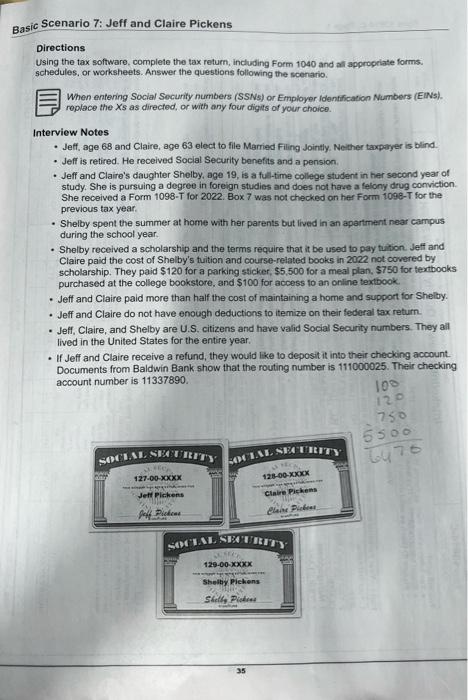

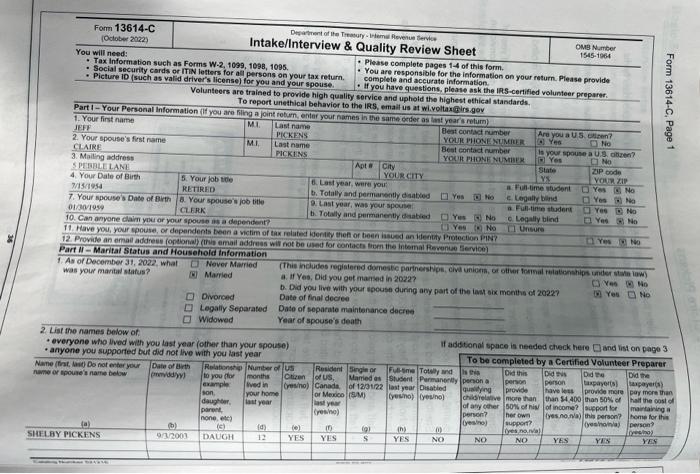

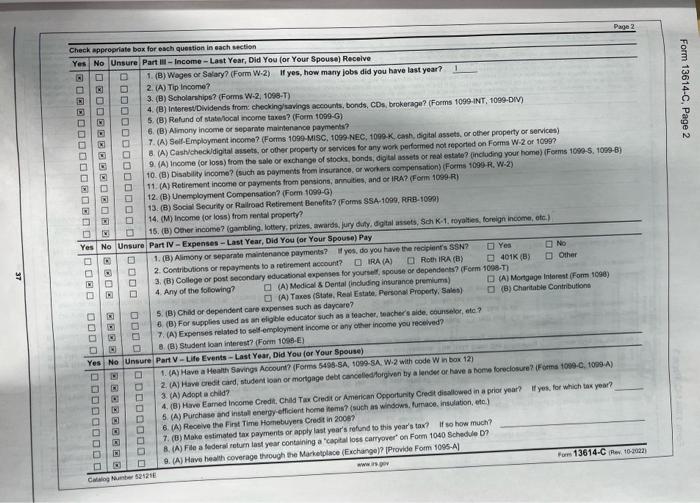

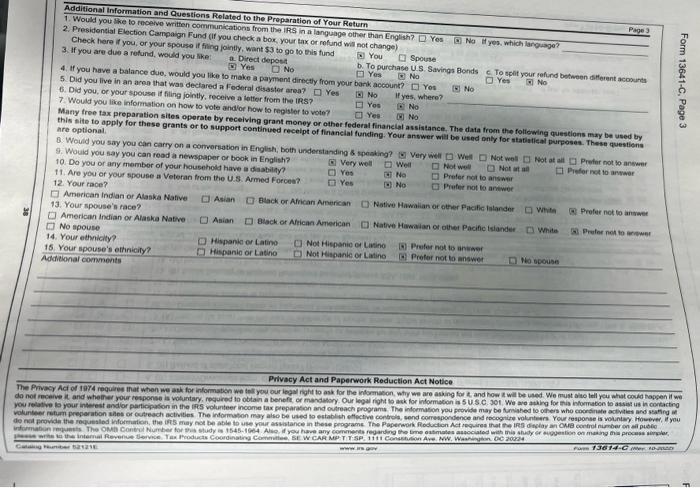

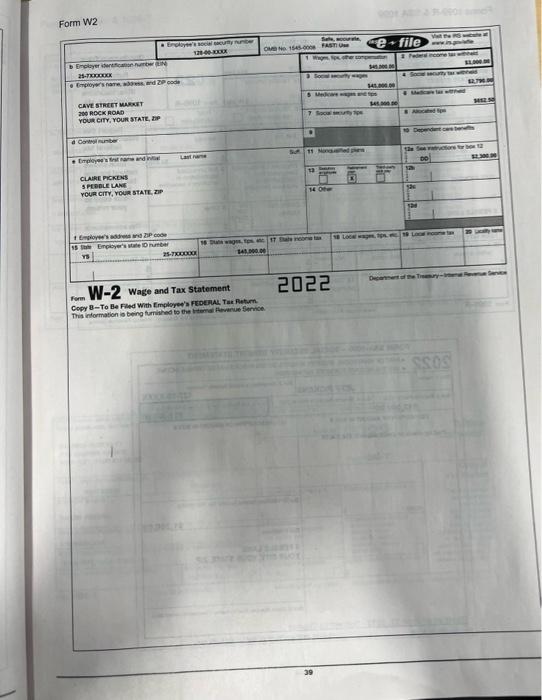

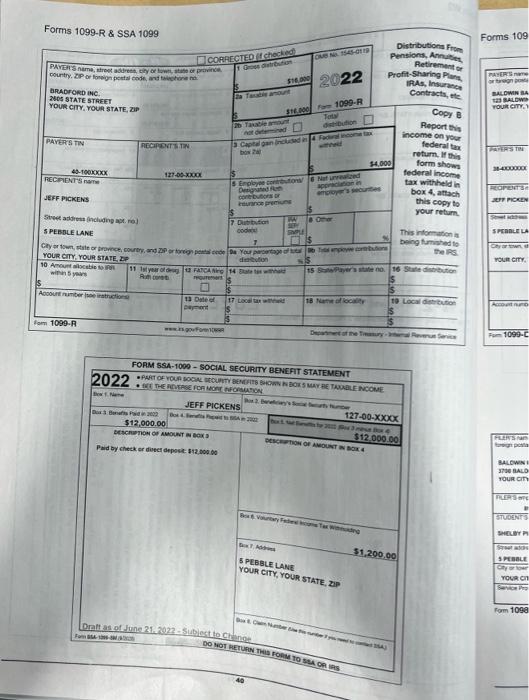

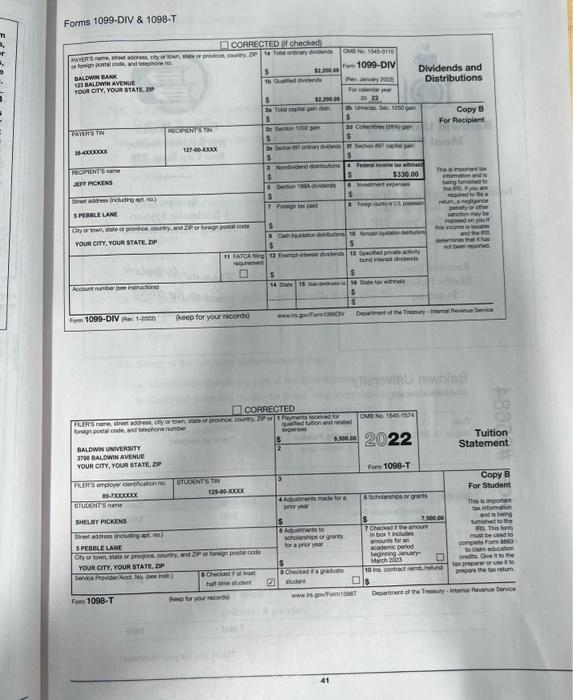

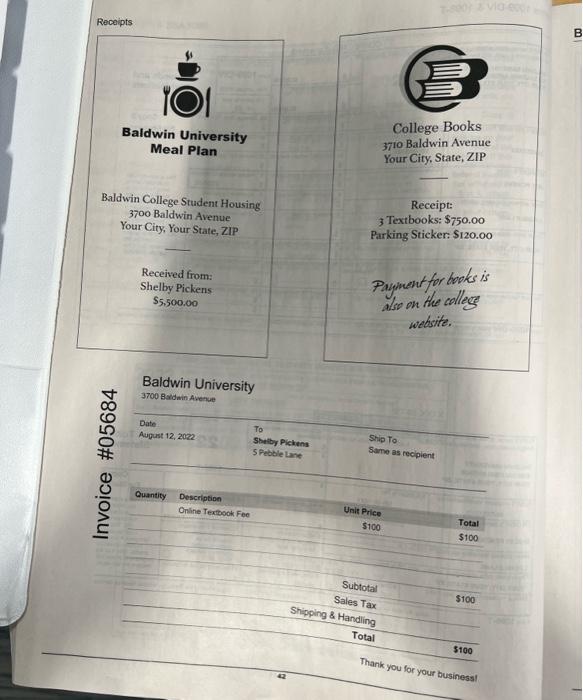

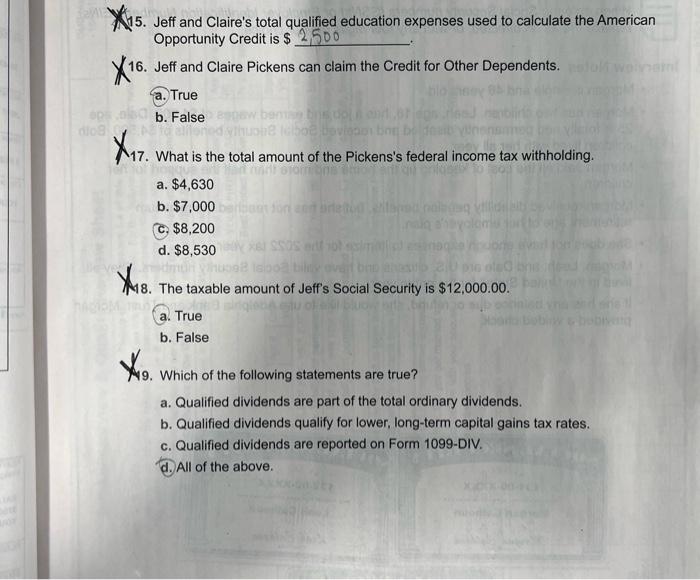

When entering Social Security numbers (SSNs) or Empibyer Identification Numbers (EINs). replace the X's as directed, or with any four digits of your choice. Interview Notes - Jeff, age 68 and Claire, age 63 elect to file Married Filing Jointly. Neither taxpayer is blind. - Jeff is retired. He received Social Security benefits and a pension. - Jeff and Claire's daughter Shelby, age 19, is a full-time college student in her second year of study. She is pursuing a degree in foreign studies and does not have a felony drug conviction. She received a Form 1098-T for 2022. Box 7 was not checked on her Form 1098-T for the previous tax year. - Shelby spent the summer at home with her parents but lived in an apartment near carnpus during the school year. - Shelby received a scholarship and the terms require that it be used to pay tuition. Jeff and Claire paid the cost of Shelby's tuition and course-related books in 2022 not covered by scholarship. They paid $120 for a parking sticker, $5.500 for a meal plan, $750 for textbooks purchased at the college bookstore, and $100 for access to an online textbook. - Jeff and Claire paid more than half the cost of maintaining a home and support for Shelby. - Jeff and Claire do not have enough deductions to itemize on their federal tax return. - Jeff, Claire, and Shelby are U.S. citizens and have valid Social Security numbers. They all lived in the United States for the entire year. - If Jeff and Claire receive a refund, they would like to deposit it into their checking account. Documents from Baldwin Bank show that the routing number is 111000025 . Their checking account number is 11337890 . 1. Would you inke to recense written communteations the Preparation of Your Retum 2. Presidential Election Campaign Fund (if you check a bos ifs in a language other than English? Check hare if you, or your spouse if filing joinfly, want $3 to gou to tax or mfund will not change) 3. If you are diwe a retund, woild you ilke: a. Direct depoest to this fund 4. If you have a balance due, would you thke to thake a payment directly from your bank account? 5. Did you live in an areo that was declared a Federal disaster area? 6. Did you, or your spousen it filing jointly, receive a lother from the iRs? Yes 7. Would you like information on how to vote andior how from the IRS? Many tree tax preparation sites operate by receiving grant money or other federat finanelal assistar this site to opply for these grants or to support continued receipt of finenelat funding. Your answer are optional. [i) No If yes, where? [I Yos Yos No English, both understandino s spesting? a Yes No Page 3 (6) No Privacy Act and Paperwork Reduction Act Notice Carding thenter kivas! form P=2 Wage and Tax Statement Coey 8-To Be Filed With Employee' a Frosilu. Tae fotum. This intormation io being furniahed to the biende Aevarue firrice. Ea Forms 1099-DIV \& 1098-T B. B. N5. Jeff and Claire's total qualified education expenses used to calculate the American Opportunity Credit is $ 16. Jeff and Claire Pickens can claim the Credit for Other Dependents. a. True b. False 17. What is the total amount of the Pickens's federal income tax withholding. a. $4,630 b. $7,000 c. $8,200 d. $8,530 48. The taxable amount of Jeff's Social Security is $12,000.00. a. True b. False 49. Which of the following statements are true? a. Qualified dividends are part of the total ordinary dividends. b. Qualified dividends qualify for lower, long-term capital gains tax rates. c. Qualified dividends are reported on Form 1099-DIV. d. All of the above. When entering Social Security numbers (SSNs) or Empibyer Identification Numbers (EINs). replace the X's as directed, or with any four digits of your choice. Interview Notes - Jeff, age 68 and Claire, age 63 elect to file Married Filing Jointly. Neither taxpayer is blind. - Jeff is retired. He received Social Security benefits and a pension. - Jeff and Claire's daughter Shelby, age 19, is a full-time college student in her second year of study. She is pursuing a degree in foreign studies and does not have a felony drug conviction. She received a Form 1098-T for 2022. Box 7 was not checked on her Form 1098-T for the previous tax year. - Shelby spent the summer at home with her parents but lived in an apartment near carnpus during the school year. - Shelby received a scholarship and the terms require that it be used to pay tuition. Jeff and Claire paid the cost of Shelby's tuition and course-related books in 2022 not covered by scholarship. They paid $120 for a parking sticker, $5.500 for a meal plan, $750 for textbooks purchased at the college bookstore, and $100 for access to an online textbook. - Jeff and Claire paid more than half the cost of maintaining a home and support for Shelby. - Jeff and Claire do not have enough deductions to itemize on their federal tax return. - Jeff, Claire, and Shelby are U.S. citizens and have valid Social Security numbers. They all lived in the United States for the entire year. - If Jeff and Claire receive a refund, they would like to deposit it into their checking account. Documents from Baldwin Bank show that the routing number is 111000025 . Their checking account number is 11337890 . 1. Would you inke to recense written communteations the Preparation of Your Retum 2. Presidential Election Campaign Fund (if you check a bos ifs in a language other than English? Check hare if you, or your spouse if filing joinfly, want $3 to gou to tax or mfund will not change) 3. If you are diwe a retund, woild you ilke: a. Direct depoest to this fund 4. If you have a balance due, would you thke to thake a payment directly from your bank account? 5. Did you live in an areo that was declared a Federal disaster area? 6. Did you, or your spousen it filing jointly, receive a lother from the iRs? Yes 7. Would you like information on how to vote andior how from the IRS? Many tree tax preparation sites operate by receiving grant money or other federat finanelal assistar this site to opply for these grants or to support continued receipt of finenelat funding. Your answer are optional. [i) No If yes, where? [I Yos Yos No English, both understandino s spesting? a Yes No Page 3 (6) No Privacy Act and Paperwork Reduction Act Notice Carding thenter kivas! form P=2 Wage and Tax Statement Coey 8-To Be Filed With Employee' a Frosilu. Tae fotum. This intormation io being furniahed to the biende Aevarue firrice. Ea Forms 1099-DIV \& 1098-T B. B. N5. Jeff and Claire's total qualified education expenses used to calculate the American Opportunity Credit is $ 16. Jeff and Claire Pickens can claim the Credit for Other Dependents. a. True b. False 17. What is the total amount of the Pickens's federal income tax withholding. a. $4,630 b. $7,000 c. $8,200 d. $8,530 48. The taxable amount of Jeff's Social Security is $12,000.00. a. True b. False 49. Which of the following statements are true? a. Qualified dividends are part of the total ordinary dividends. b. Qualified dividends qualify for lower, long-term capital gains tax rates. c. Qualified dividends are reported on Form 1099-DIV. d. All of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started