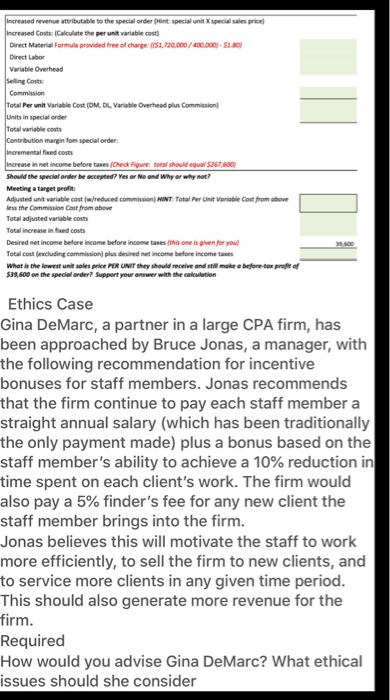

increased revenue attributable to the special order (Hint: special unit X special sales price increased Costs: (Calculate the per unit variable cost) Direct Material Formula provided free of charge 151.720,000/400.000 - $1.00 Direct Labor Variable Overhead seling Costs Commission Total Per unit Variable Cost (OM, DL, Variable Overhead plus Commission) Units in special order Total variable costs Contribution margin from special order: incremental foved costs increase in net income before taxes Check Figure total should equal $267,600 Should the special order be accepted? Yes or No and Why or why not? Meeting a target profit Adjusted unit variable cost (reduced commission) HINT: Total Per Unit Variable Cost from above less the Commission Cost from above Total adjusted variable costs Total increase in fed costs Desired net income before income before income taxes this one is given for you! Total cost (excluding commission plus desired net income before income taxes What is the lowest une sales price PER UNIT hey should receive and still make e before-tex propter $39,600 on the special order? Support your answer with the calculation Ethics Case Gina DeMarc, a partner in a large CPA firm, has been approached by Bruce Jonas, a manager, with the following recommendation for incentive bonuses for staff members. Jonas recommends that the firm continue to pay each staff member a straight annual salary (which has been traditionally the only payment made) plus a bonus based on the staff member's ability to achieve a 10% reduction in time spent on each client's work. The firm would also pay a 5% finder's fee for any new client the staff member brings into the firm. Jonas believes this will motivate the staff to work more efficiently, to sell the firm to new clients, and to service more clients in any given time period. This should also generate more revenue for the firm. Required How would you advise Gina DeMarc? What ethical issues should she consider increased revenue attributable to the special order (Hint: special unit X special sales price increased Costs: (Calculate the per unit variable cost) Direct Material Formula provided free of charge 151.720,000/400.000 - $1.00 Direct Labor Variable Overhead seling Costs Commission Total Per unit Variable Cost (OM, DL, Variable Overhead plus Commission) Units in special order Total variable costs Contribution margin from special order: incremental foved costs increase in net income before taxes Check Figure total should equal $267,600 Should the special order be accepted? Yes or No and Why or why not? Meeting a target profit Adjusted unit variable cost (reduced commission) HINT: Total Per Unit Variable Cost from above less the Commission Cost from above Total adjusted variable costs Total increase in fed costs Desired net income before income before income taxes this one is given for you! Total cost (excluding commission plus desired net income before income taxes What is the lowest une sales price PER UNIT hey should receive and still make e before-tex propter $39,600 on the special order? Support your answer with the calculation Ethics Case Gina DeMarc, a partner in a large CPA firm, has been approached by Bruce Jonas, a manager, with the following recommendation for incentive bonuses for staff members. Jonas recommends that the firm continue to pay each staff member a straight annual salary (which has been traditionally the only payment made) plus a bonus based on the staff member's ability to achieve a 10% reduction in time spent on each client's work. The firm would also pay a 5% finder's fee for any new client the staff member brings into the firm. Jonas believes this will motivate the staff to work more efficiently, to sell the firm to new clients, and to service more clients in any given time period. This should also generate more revenue for the firm. Required How would you advise Gina DeMarc? What ethical issues should she consider