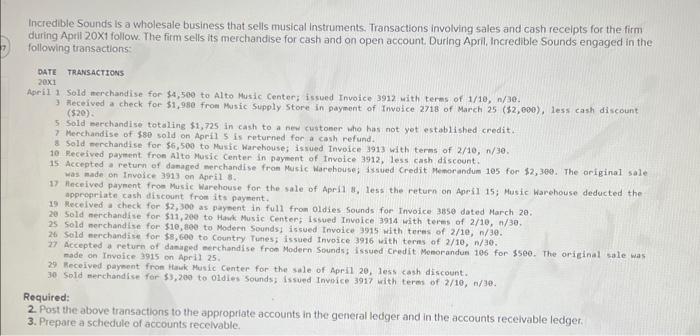

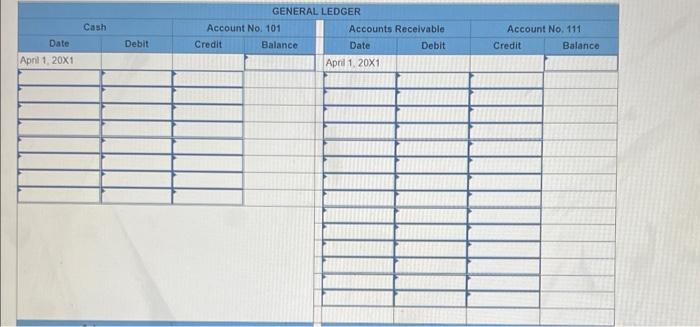

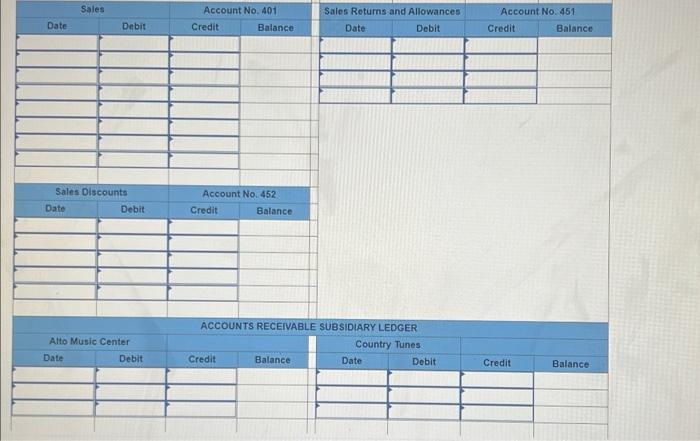

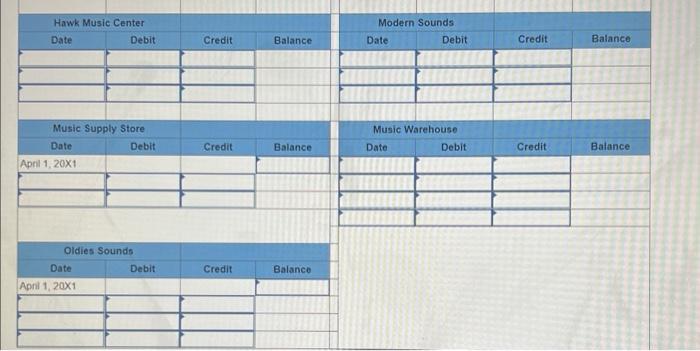

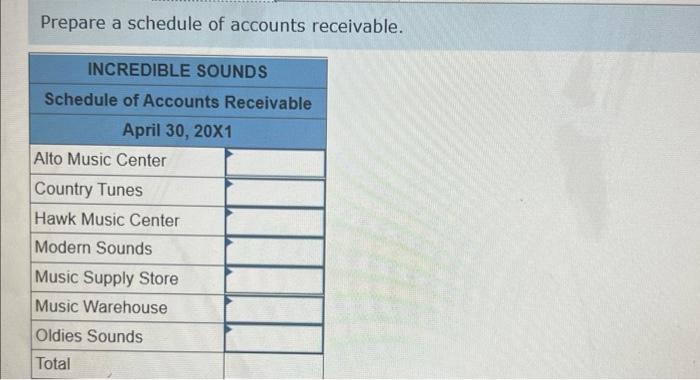

Incredible Sounds is a wholesale business that sells musical instruments. Transactions involving sales and cash recelpts for the firm during Apill 20X1 follow. The firm sells its merchandise for cash and on open account. During April. Incredible Sounds engaged in the following transactions: DATE TRANSACTIONS 201. Sold merchandise for $4,500 to Alto Music Center; issued Invoice 3912 with terns of 1/10,n/30. 3 Feceived a check for $1,980 from Music supply Store in payment of Invoice 2718 of March 25($2,000), less cash discount (\$20). 5 Sold merchandise totaling $1,725 in cash to a nen custoner who has not yot established credit. 7 Wecchandise of $80 sold on Aprif 5 is roturned for a cash refund. s sold merchandise for 56,500 to Music Warehouse; is a cal Invoice 3913 with terms of 2/10,n/30. 10 Received payment fron Alto Music Center in payment of tnvoice 3912, less cash discount. 15. Accepted a return of damaged merchandise fron Music Warehouse; issued Credit Menorandum 105 for \$2; 309. The original sale was made on involice 3913 on April 8. 1) Anceived payment from Music Warehouse for the sale of Apri1 8, less the return on Aprif 15; Music Warehouse deducted the appropriate cash ditcount from its payment. 19 Received a check for $2,300 as paysent in full from oldies sounds for Invoice 38se dated March 20. 20 Sold nerchandive for $11,200 to Hank Music Center; Issued Invoice 3914 with terms of 2/10,n/30. 25 Sold merchandise for $10, 100 to Modern Sounds: is sued Invoice 3915 with teres of 2/10,n/39. 26 Sold nerchandize for 58,600 to Country Tunes: issued Invoice 3916 with terns of 2/10,n/30. 27 Accepted a return of daesed eerchandise from Modern Sounds; issued credit Monorandun 106 for $500. The original sale was made on Irvoice 3915 on April 25 , 29 Heceived payment fron Hawk Music center for the sale of April 20, less cash discount. 30 sold eerchandise for $3,200 to oldies sounds; issued Invofice 3917 with teres of 2/10, 7/30. Required: 2. Post the above transactions to the approprlate accounts in the general ledger and in the accounts recelvable ledget. 3. Prepare a schedule of accounts recelvable. Prepare a schedule of accounts receivable. Complete this question by entering your answers in the tabs below. What were the total sales on account in April, prior to any returns, allowances, or discounts