Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Incurring long - term debt with an arrangement whereby lenders receive an option to buy common stock during all or a portion of the time

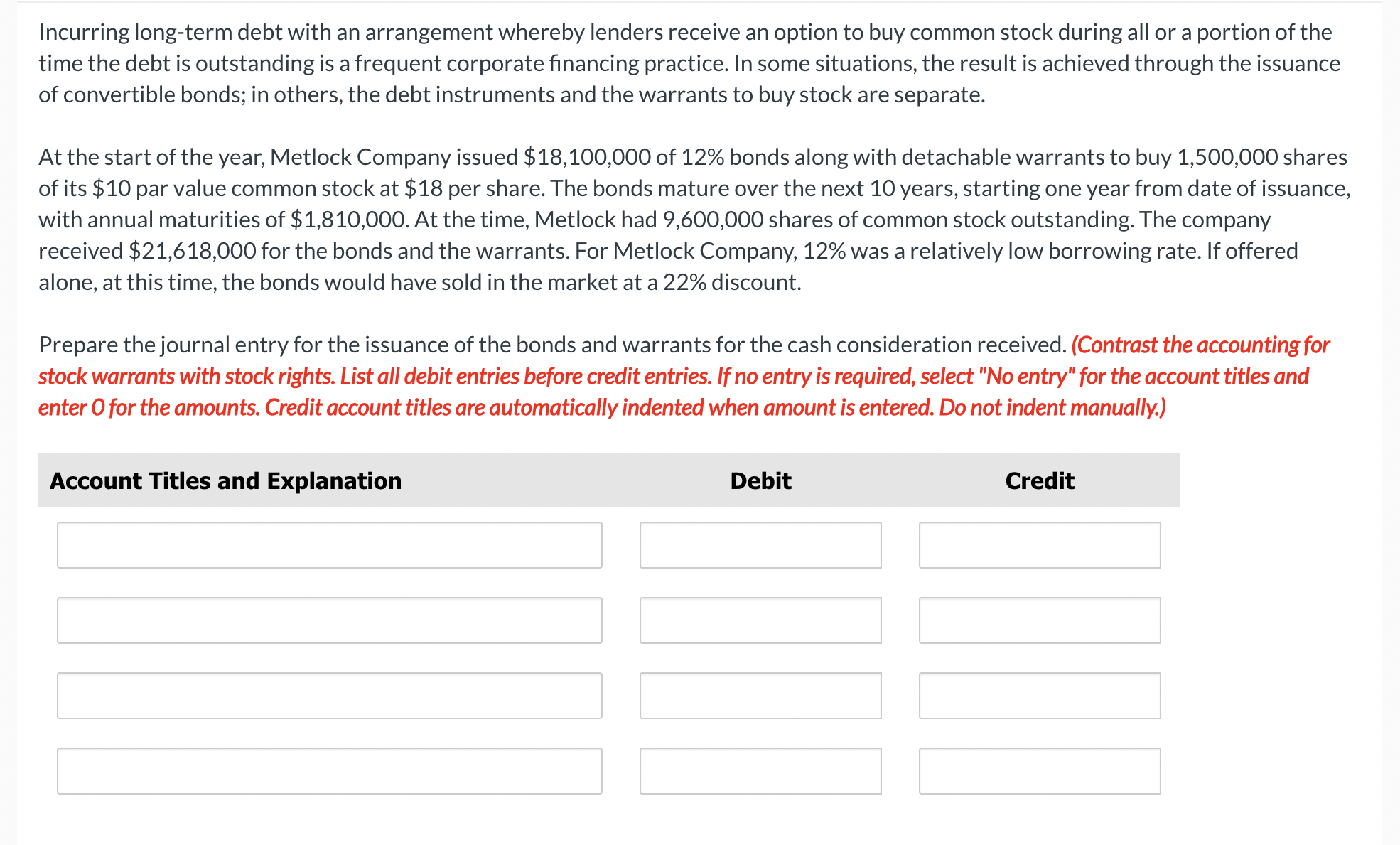

Incurring longterm debt with an arrangement whereby lenders receive an option to buy common stock during all or a portion of the

time the debt is outstanding is a frequent corporate financing practice. In some situations, the result is achieved through the issuance

of convertible bonds; in others, the debt instruments and the warrants to buy stock are separate.

At the start of the year, Metlock Company issued $ of bonds along with detachable warrants to buy shares

of its $ par value common stock at $ per share. The bonds mature over the next years, starting one year from date of issuance,

with annual maturities of $ At the time, Metlock had shares of common stock outstanding. The company

received $ for the bonds and the warrants. For Metlock Company, was a relatively low borrowing rate. If offered

alone, at this time, the bonds would have sold in the market at a discount.

Prepare the journal entry for the issuance of the bonds and warrants for the cash consideration received. Contrast the accounting for

stock warrants with stock rights. List all debit entries before credit entries. If no entry is required, select No entry" for the account titles and

enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started