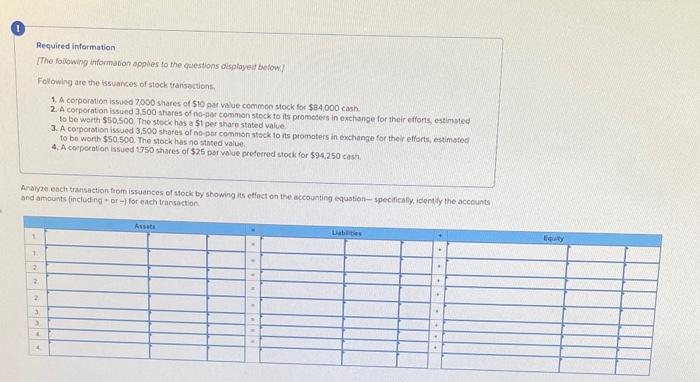

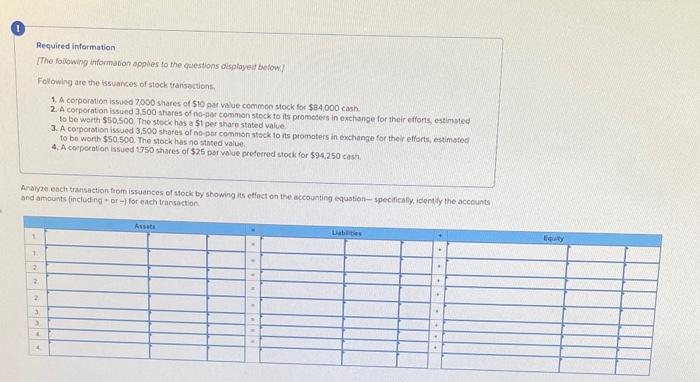

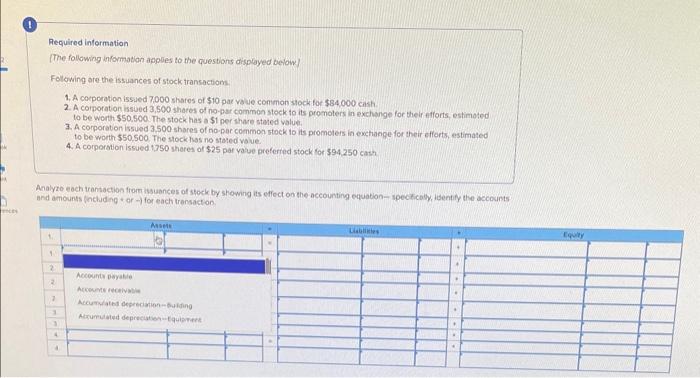

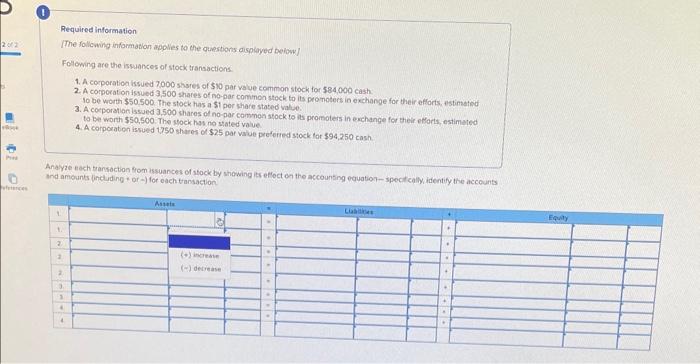

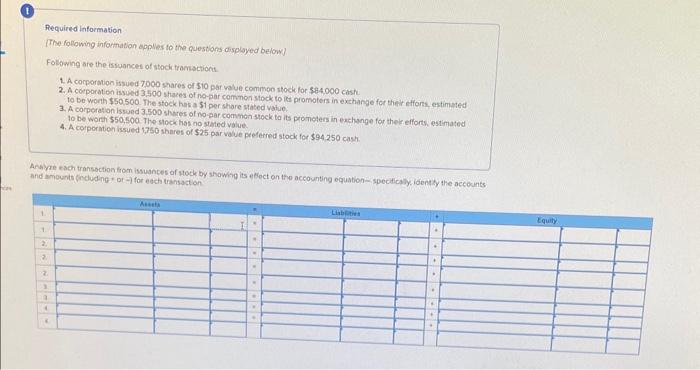

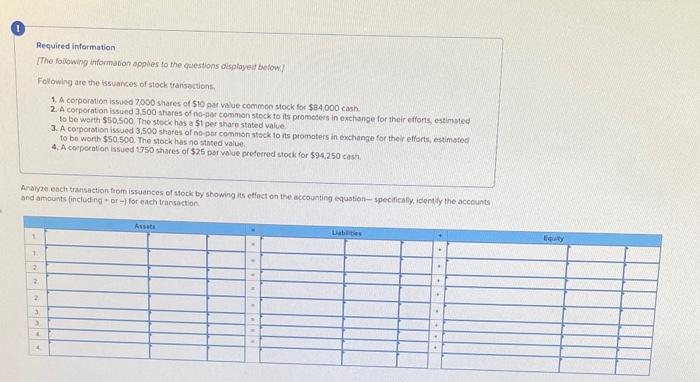

Indentify the accounts and amounts (+,-) for each transaction

Required information [The foilowing kiformation apples to the questions cisplayed below] Folowing are the issuances of stock transecticns. 1. A corporstion issued 7,000 shares of $10 par value common stock for $84,000 cash. 2. A corporaton issued 3.500 shares of no-pat comman stock to its promoters in exchange for their efforts, estimsted to be warth $50,500. The stock has a 51 per share stated value 3. A corporation issued 3,500 shares of no-por common steck to its promaters in exchange for their efforts, estimoted to bo worth $50,500. The stock has no stoted value. 4. A corporation issued 1750 shares of $25 par volue predered stock for $94,250 cassi. Aralyze each transaction from issuances of shock by showing its etiect on tho eccounting equation-specilicaly, identily the accounts and amounts fincluding + or 1 for each transaction. Required information [The following informatian apples to the questions displayed below] Folowing are the issuances of stock transactioms. 1. A corporation issued 7,000 shares of $10 par vaue contmon shock for $84,000cish. 2. A coiporation issued 3,500 shares of no-par common stock to its promoters in exchange for their ifforts, estimoted to be worth $50.500. The stock has a $1 per thare stated value. 3. A corporation issued 3,500 shares of no-par common stock io its promolers in exchanpe for their efforts, estimated to be warth $50,500. The stock has no staied volve. 4. A corporation Iscued 1750 theres of $25 par yaue preferred stock for $94,250 cash Analyzo each trantaction from ibsuances of stock by showing its effect on the accounting equation-specfically, lisentity the accounts and amounts (nekiding + of for each trensact on. Required information [The follcwing information applies to che questions displayed beiowk] Folowing are the issuances of stock transactions. 1. A corporation issued 7000 shsres of $10 par vaye common stock for 584,000 cash. 2. A corporation issued 3,500 shares of no-par common stock to its promoters in exchange for their effarts, istintatisof 10 be worth $50,500. The stock has a $1 per share stated value: 3. A corporation issued 3,500 thares of no-por common syock to its promolets in exchange for their elforts, estimated to bit worth 550,500 . The Nock has no stated value. 4. A corporation issued 1750 shares of $725 par varue prefetted stock for $94,250 cash. Anayze tech transoction fom issuances of atock by showing its effoct en the accounting equation-spect cally, identify the accounts And amounts (includine or ) for each tansaction Pequired information [The following information oppless to the questions displayed below] Folowing are the issuances of stock tramistions. 1. A copporation issued 7000 shares of $10 par value common stoch for $84000cish 2. A coeporation issued 3,500 shaces of no-par common stock to its promoters in exchange for their elforse estimated to be worh $50,500. The stock has a $1 per share stated vatue. 3. A corporation issued 3.500 shares of no-par common stock ta its prometers in exchange for their efforts, estimated to be worth $50,500. The stock has no stated value. 4. A coporation issued 1,750 shares of $25 par value prefered stock for $94.250cash. Ansyre each transoction from issusnces of Hock by showhe its effect on the accounting oquation- specticaly. loent th the accounts And amounits (reluding : ot 1 for edch transacton