Answered step by step

Verified Expert Solution

Question

1 Approved Answer

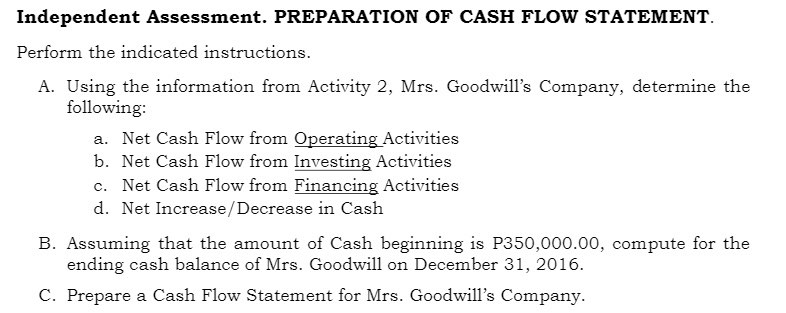

Independent Assessment. PREPARATION OF CASH FLOW STATEMENT. Perform the indicated instructions. A. Using the information from Activity 2, Mrs. Goodwill's Company, determine the following:

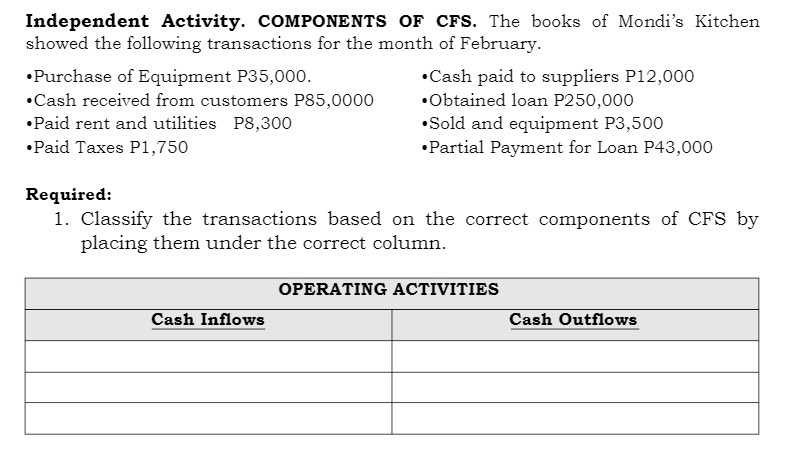

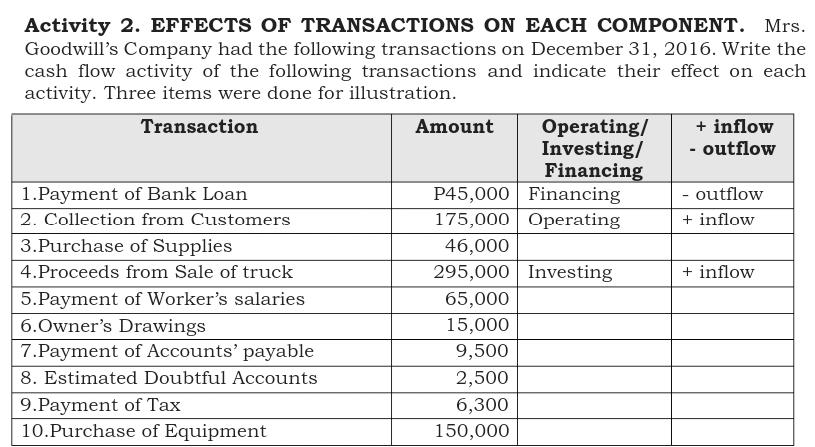

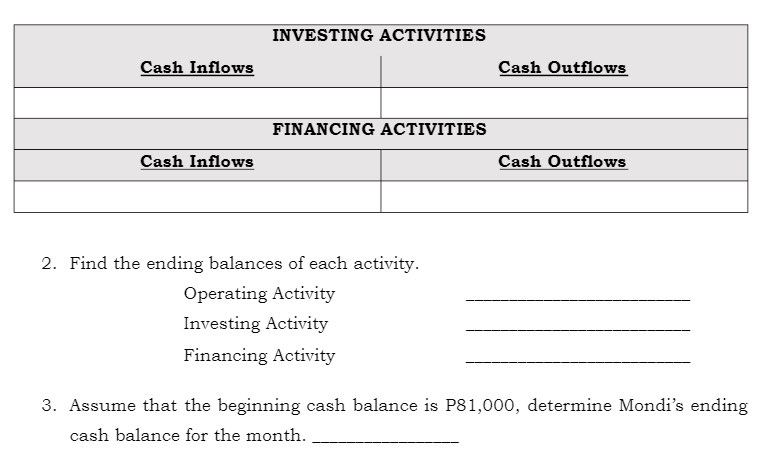

Independent Assessment. PREPARATION OF CASH FLOW STATEMENT. Perform the indicated instructions. A. Using the information from Activity 2, Mrs. Goodwill's Company, determine the following: a. Net Cash Flow from Operating Activities b. Net Cash Flow from Investing Activities c. Net Cash Flow from Financing Activities d. Net Increase/Decrease in Cash B. Assuming that the amount of Cash beginning is P350,000.00, compute for the ending cash balance of Mrs. Goodwill on December 31, 2016. C. Prepare a Cash Flow Statement for Mrs. Goodwill's Company. Independent Activity. COMPONENTS OF CFS. The books of Mondi's Kitchen showed the following transactions for the month of February. Purchase of Equipment P35,000. Cash received from customers P85,0000 Paid rent and utilities P8,300 Paid Taxes P1,750 Cash paid to suppliers P12,000 Obtained loan P250,000 Cash Inflows Sold and equipment P3,500 Partial Payment for Loan P43,000 Required: 1. Classify the transactions based on the correct components of CFS by placing them under the correct column. OPERATING ACTIVITIES Cash Outflows Activity 2. EFFECTS OF TRANSACTIONS ON EACH COMPONENT. Mrs. Goodwill's Company had the following transactions on December 31, 2016. Write the cash flow activity of the following transactions and indicate their effect on each activity. Three items were done for illustration. Transaction 1.Payment of Bank Loan 2. Collection from Customers 3.Purchase of Supplies 4.Proceeds from Sale of truck 5.Payment of Worker's salaries 6.Owner's Drawings 7.Payment of Accounts' payable 8. Estimated Doubtful Accounts 9.Payment of Tax 10. Purchase of Equipment Amount Operating/ Investing/ Financing P45,000 Financing 175,000 Operating 46,000 295,000 Investing 65,000 15,000 9,500 2,500 6,300 150,000 + inflow - outflow - outflow + inflow + inflow Cash Inflows Cash Inflows INVESTING ACTIVITIES FINANCING ACTIVITIES 2. Find the ending balances of each activity. Operating Activity Investing Activity Financing Activity Cash Outflows Cash Outflows 3. Assume that the beginning cash balance is P81,000, determine Mondi's ending cash balance for the month. Independent Assessment. PREPARATION OF CASH FLOW STATEMENT. Perform the indicated instructions. A. Using the information from Activity 2, Mrs. Goodwill's Company, determine the following: a. Net Cash Flow from Operating Activities b. Net Cash Flow from Investing Activities c. Net Cash Flow from Financing Activities d. Net Increase/Decrease in Cash B. Assuming that the amount of Cash beginning is P350,000.00, compute for the ending cash balance of Mrs. Goodwill on December 31, 2016. C. Prepare a Cash Flow Statement for Mrs. Goodwill's Company. Independent Activity. COMPONENTS OF CFS. The books of Mondi's Kitchen showed the following transactions for the month of February. Purchase of Equipment P35,000. Cash received from customers P85,0000 Paid rent and utilities P8,300 Paid Taxes P1,750 Cash paid to suppliers P12,000 Obtained loan P250,000 Cash Inflows Sold and equipment P3,500 Partial Payment for Loan P43,000 Required: 1. Classify the transactions based on the correct components of CFS by placing them under the correct column. OPERATING ACTIVITIES Cash Outflows Activity 2. EFFECTS OF TRANSACTIONS ON EACH COMPONENT. Mrs. Goodwill's Company had the following transactions on December 31, 2016. Write the cash flow activity of the following transactions and indicate their effect on each activity. Three items were done for illustration. Transaction 1.Payment of Bank Loan 2. Collection from Customers 3.Purchase of Supplies 4.Proceeds from Sale of truck 5.Payment of Worker's salaries 6.Owner's Drawings 7.Payment of Accounts' payable 8. Estimated Doubtful Accounts 9.Payment of Tax 10. Purchase of Equipment Amount Operating/ Investing/ Financing P45,000 Financing 175,000 Operating 46,000 295,000 Investing 65,000 15,000 9,500 2,500 6,300 150,000 + inflow - outflow - outflow + inflow + inflow Cash Inflows Cash Inflows INVESTING ACTIVITIES FINANCING ACTIVITIES 2. Find the ending balances of each activity. Operating Activity Investing Activity Financing Activity Cash Outflows Cash Outflows 3. Assume that the beginning cash balance is P81,000, determine Mondi's ending cash balance for the month.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A For Mrs Goodwills Company a Net Cash Flow from Operating Activities Compute by analyzing the companys operational cash transactions b Net Cash Flow ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started