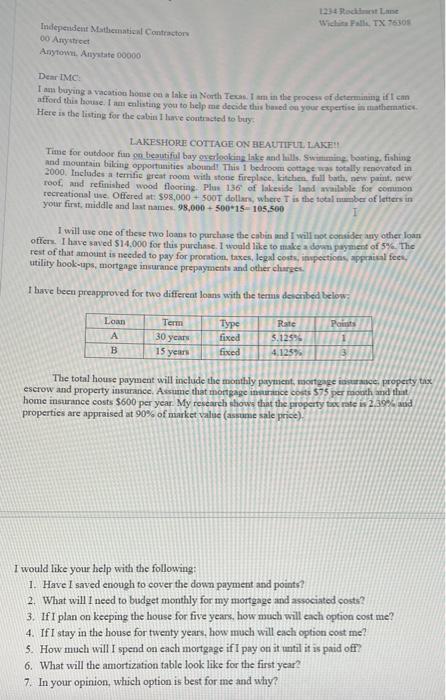

Independent Matheuatienl Contractors 00 Arystrect Anytorve. Anystate 00000 Dear IMC: I ana buying a vacatiou boone ba a lake in North Tewas. I im in the peosess of determinang if I cmn afford this bouse, I am colisting you to belp mie decide this based on your expertive in mathematice: Here is the liting for the catin I have oontnsted to buy. LAKFSHORE COTTAGE ON HEAUTIFUL, IAKF! Tate for outdoor fin on bevutifal bay overookging lake and hills. Swumming, bosting, fishing and mountain bilcing opportanities abound! This 1 bodroom comtage mas totally renevated in 2000. Includes a temific geat room with stone fireplsec, litehen. full bath, new pamt. new roof, and refinished wood flooting. Plus 136 of lakevide land available for common recreational twe Offered at 598,000+500 dollars, where I is the total mubler of letters in your firnt, middle and lat names, 98,000+50015=105,500 I will uxe one of these two loans to purchase the cabin and I will not convider any other loan ofters. I have saved $14,000 for this purchase. 1 would like to make a domn payment of 5%. The rest of that amount is needed to pay for promation, taxes, legal conte, inpections, appraikal fees, utility hoolsoups, mortgnge insurance prepayments and other clarpes. I have been preapproved for two different loans with the terms deneribed below: The total house payment will include the monthly payment, mostgage iaguracke, property tix. escrow and property insurance. Arsume that montgage innurance costs 575 per month and that home instrance costs $600 per year. My research shows that the property tos rate is 2.39%6 and properties are appraised at 90% of market value (assume sale price). I would like your help with the following: 1. Have I saved enough to cover the down payment and points? 2. What will I need to budget monthly for my mortgage and associated costs? 3. If I plan on keeping the hotse for frve yeark, how much will ench option cost me? 4. If I stay in the house for twenty years, how much will each option cost me? 5. How much will I spend on each mortgage if I pay on it mitil it is paid off? 6. What will the amortization table look like for the first year? 7. In your opinion, which option is best for me and why