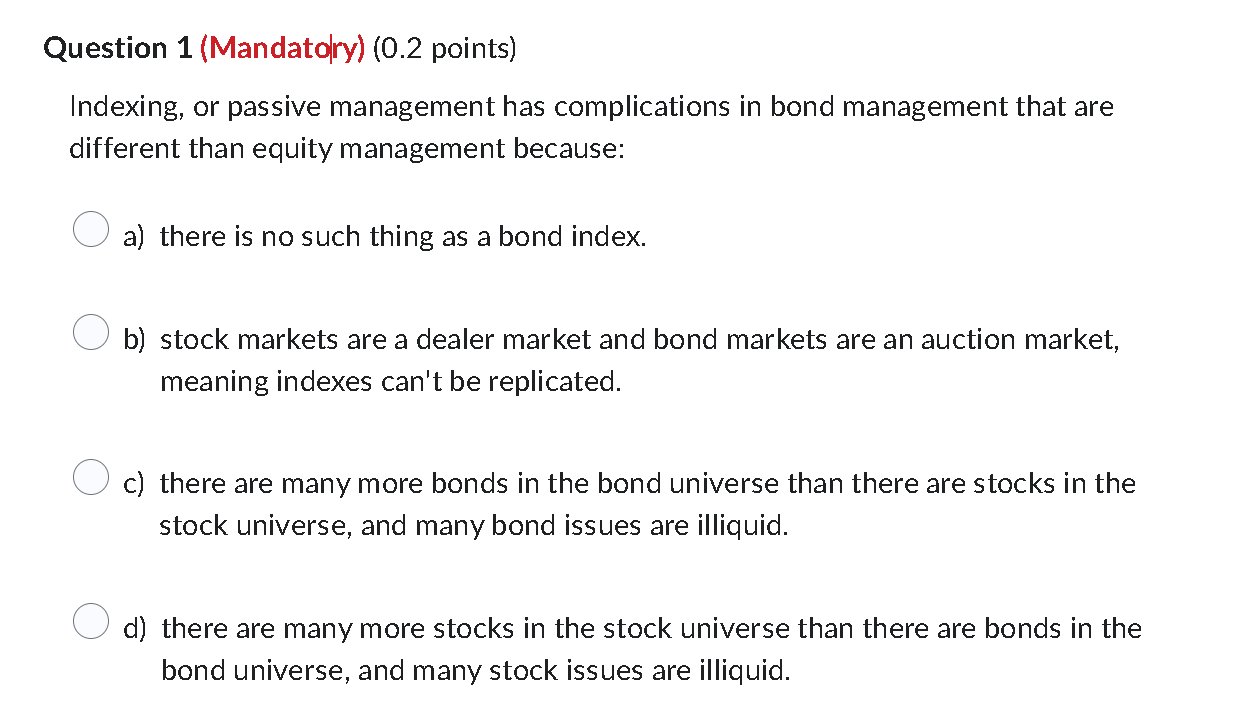

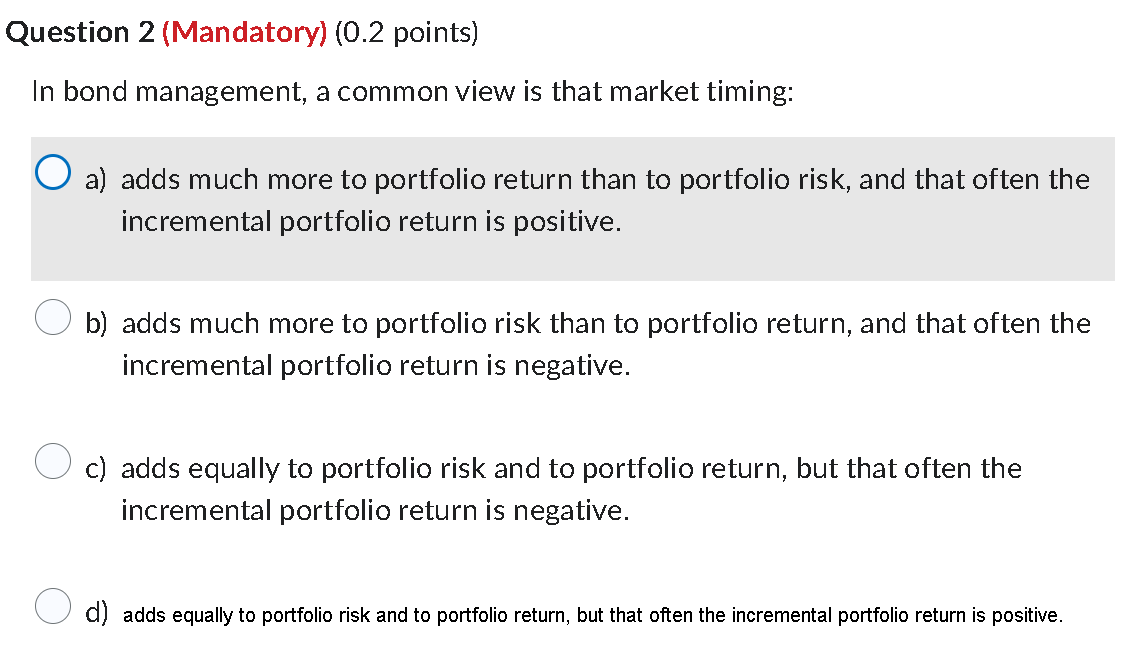

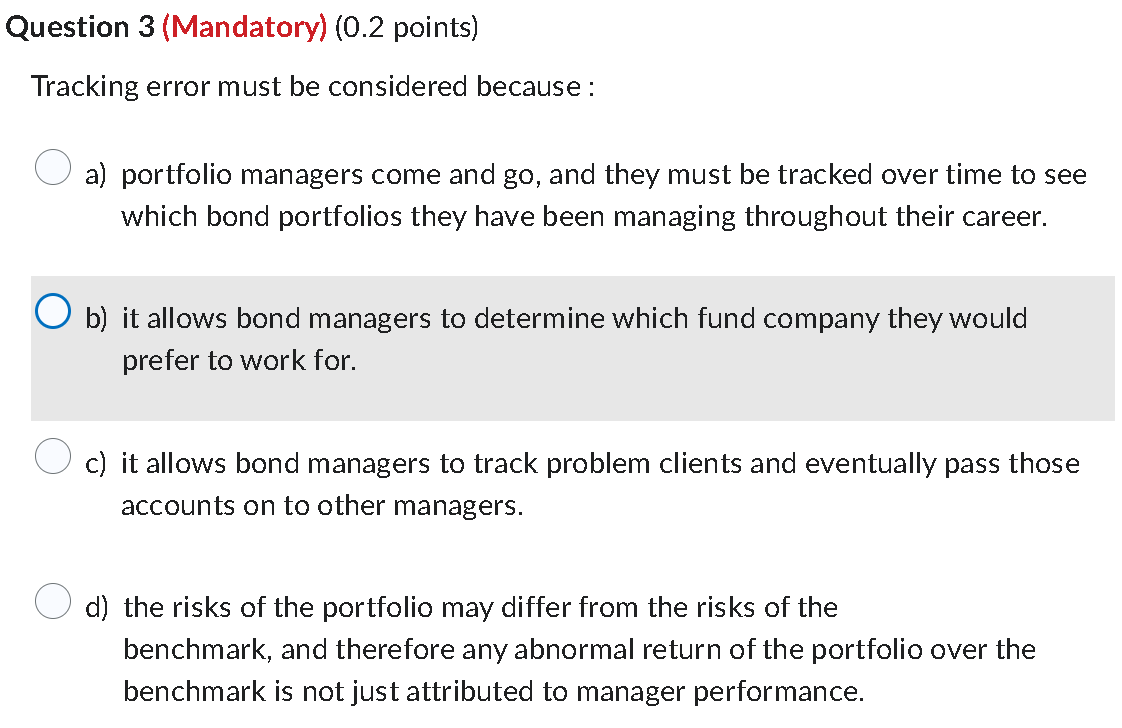

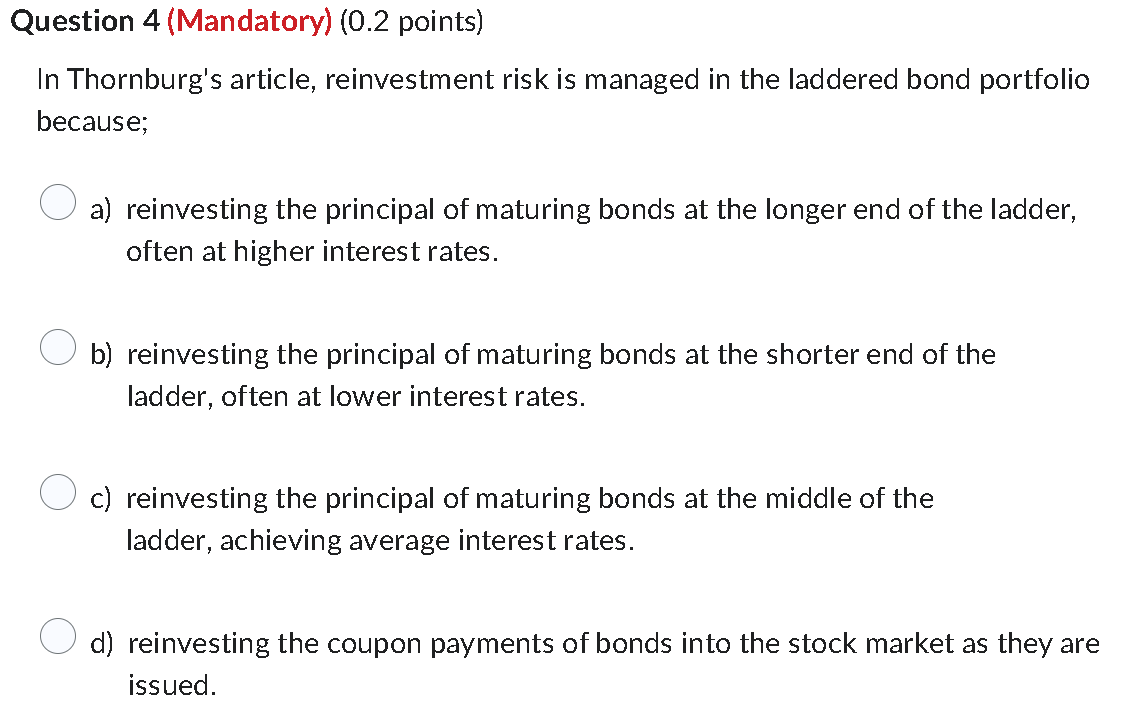

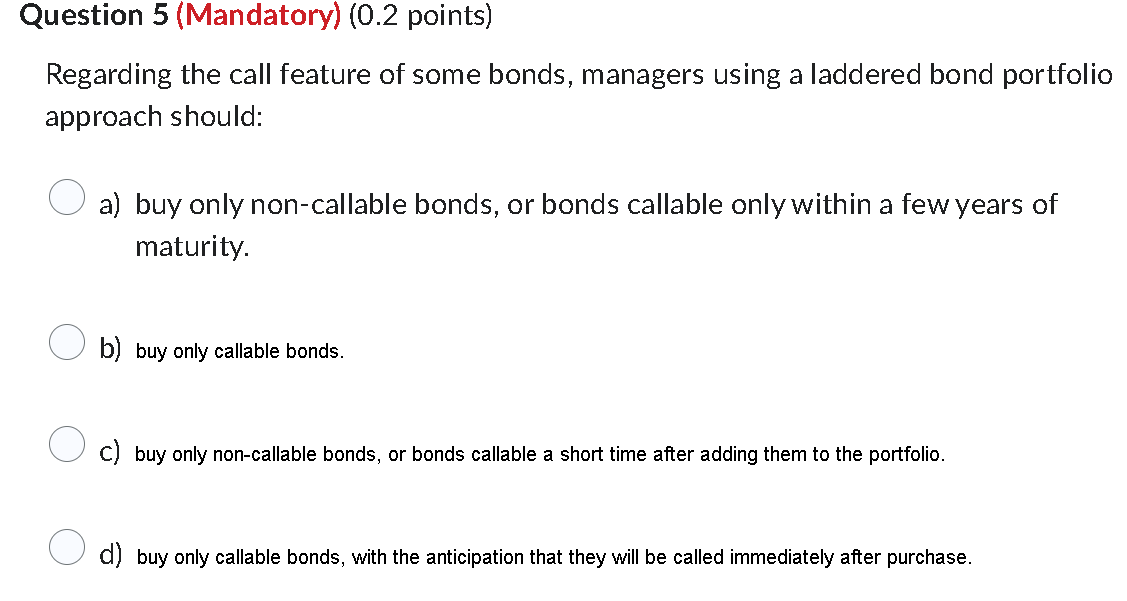

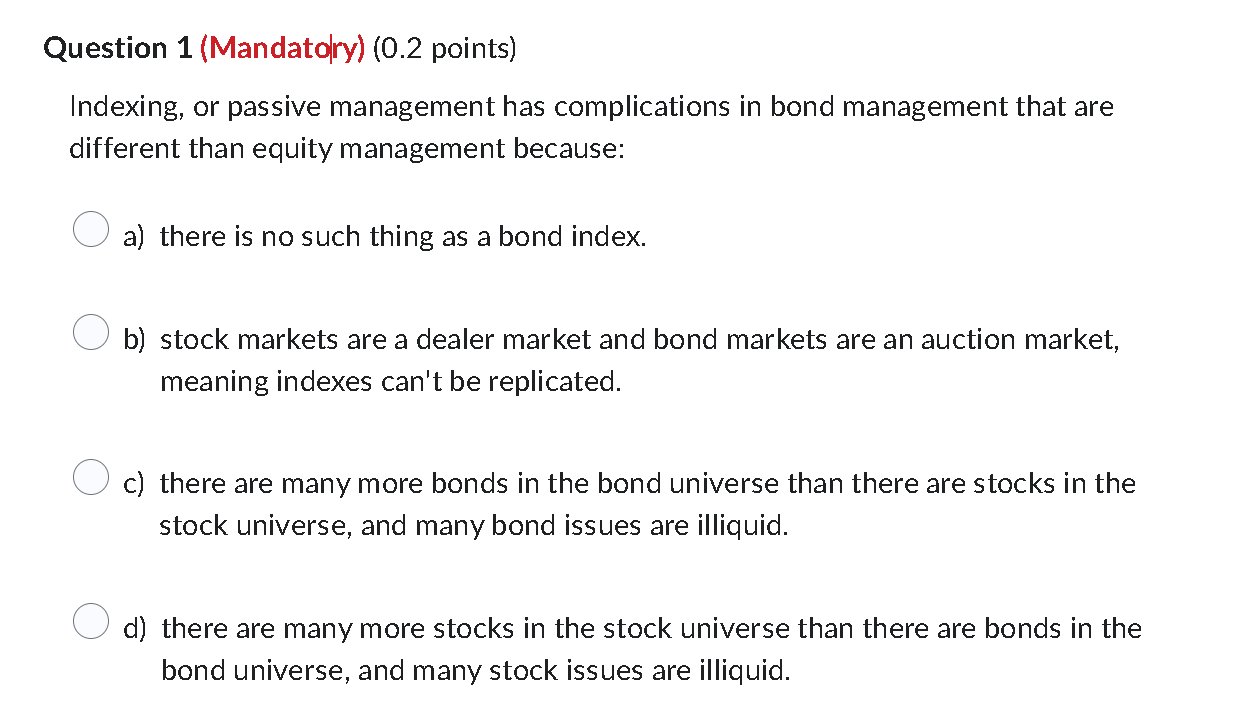

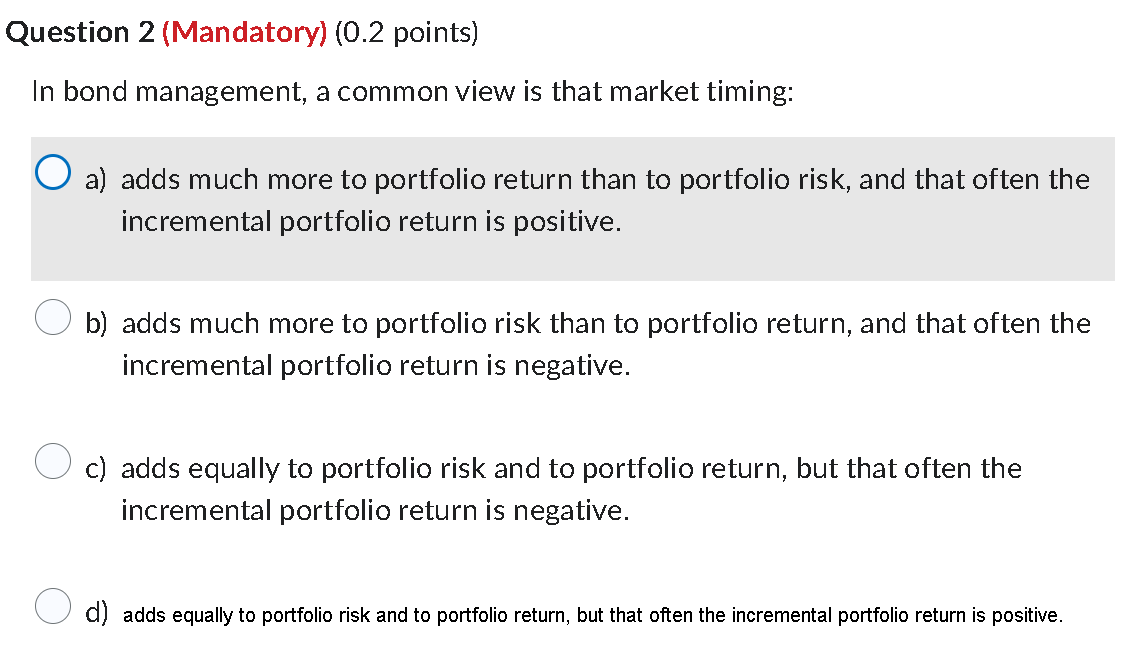

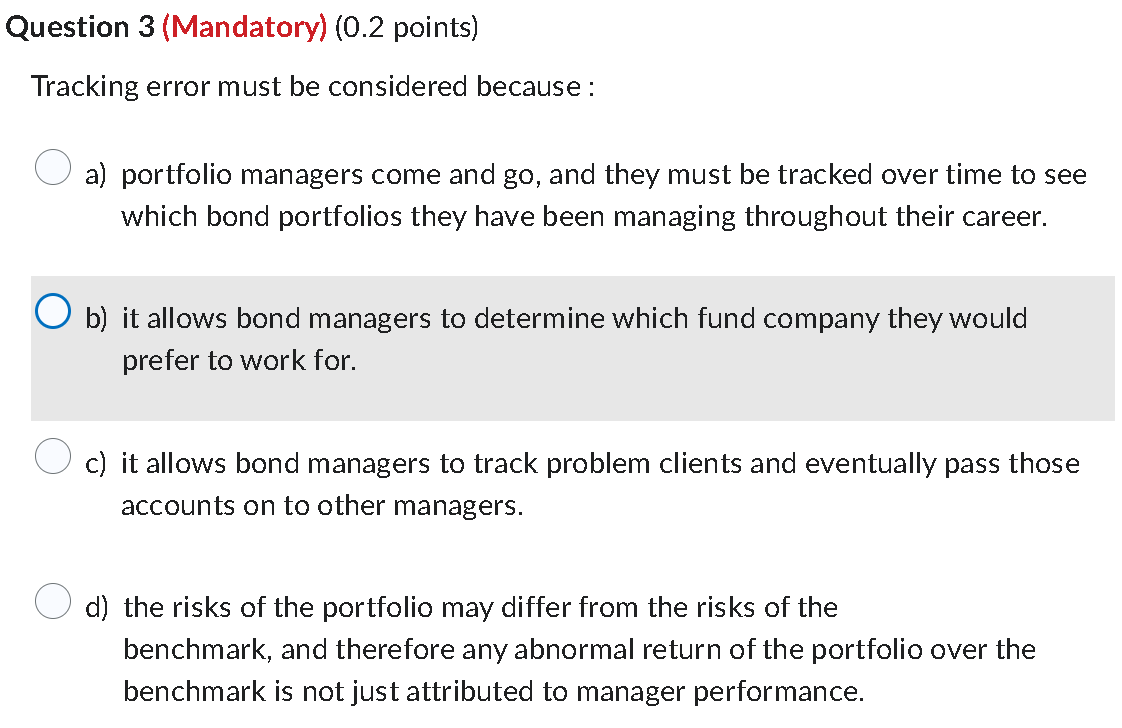

Indexing, or passive management has complications in bond management that are different than equity management because: a) there is no such thing as a bond index. b) stock markets are a dealer market and bond markets are an auction market, meaning indexes can't be replicated. c) there are many more bonds in the bond universe than there are stocks in the stock universe, and many bond issues are illiquid. d) there are many more stocks in the stock universe than there are bonds in the bond universe, and many stock issues are illiquid. In bond management, a common view is that market timing: a) adds much more to portfolio return than to portfolio risk, and that often the incremental portfolio return is positive. b) adds much more to portfolio risk than to portfolio return, and that often the incremental portfolio return is negative. c) adds equally to portfolio risk and to portfolio return, but that often the incremental portfolio return is negative. d) adds equally to portfolio risk and to portfolio return, but that often the incremental portfolio return is positive. Tracking error must be considered because : a) portfolio managers come and go, and they must be tracked over time to see which bond portfolios they have been managing throughout their career. b) it allows bond managers to determine which fund company they would prefer to work for. c) it allows bond managers to track problem clients and eventually pass those accounts on to other managers. d) the risks of the portfolio may differ from the risks of the benchmark, and therefore any abnormal return of the portfolio over the benchmark is not just attributed to manager performance. Question 4 (Mandatory) (0.2 points) In Thornburg's article, reinvestment risk is managed in the laddered bond portfolio because; a) reinvesting the principal of maturing bonds at the longer end of the ladder, often at higher interest rates. b) reinvesting the principal of maturing bonds at the shorter end of the ladder, often at lower interest rates. c) reinvesting the principal of maturing bonds at the middle of the ladder, achieving average interest rates. d) reinvesting the coupon payments of bonds into the stock market as they are issued. Question 5 (Mandatory) (0.2 points) Regarding the call feature of some bonds, managers using a laddered bond portfolio approach should: a) buy only non-callable bonds, or bonds callable only within a few years of maturity. b) buy only callable bonds. C) buy only non-callable bonds, or bonds callable a short time after adding them to the portfolio. d) buy only callable bonds, with the anticipation that they will be called immediately after purchase