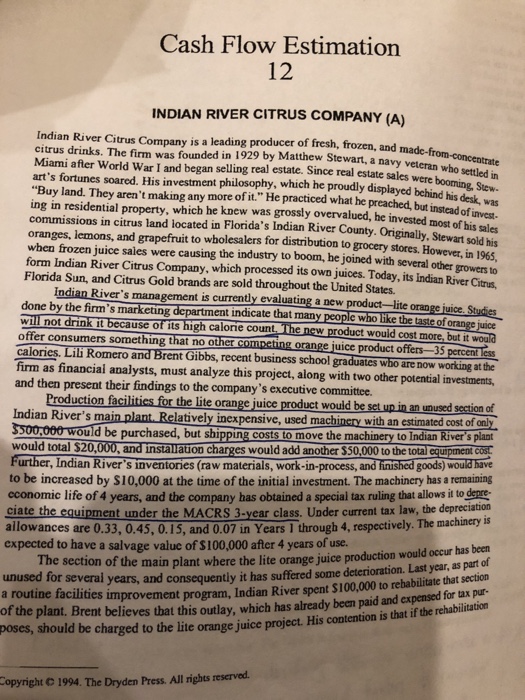

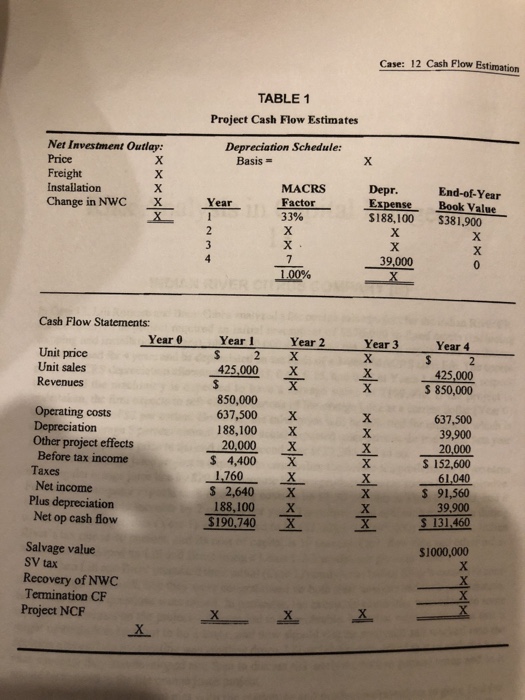

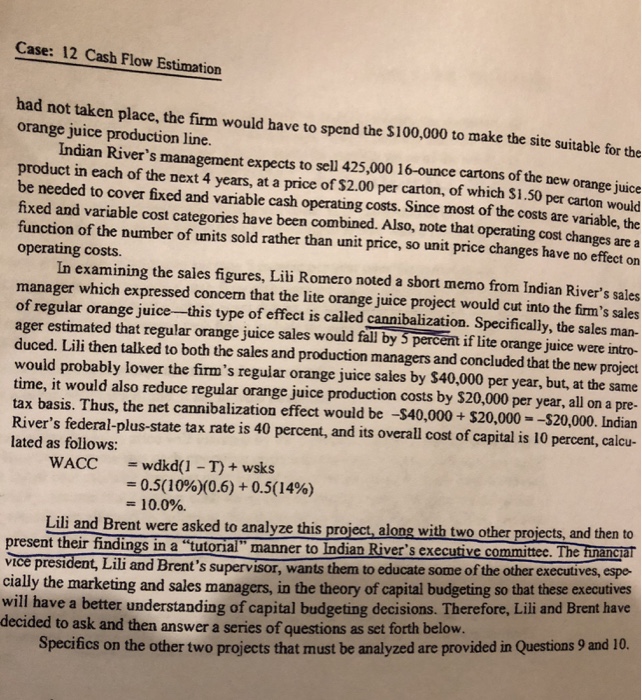

Indian river citrus table 1

Cash Flow Estimation 12 INDIAN RIVER CITRUS COMPANY (A) Indian River Citrus Company is a leading producer of fresh, frozen, and made-f citrus drinks. The firm was founded in 1929 by Matthew Stewart, a navy veteran who Miami aftler World War I and began selling real estate. Since real estate sales were booming s rom-concentrate settled in art's fortunes soared. His investment philosophy, which he proudly displayed behind his desk we "Buy land. They aren't making any more ofit." He practiced what he preached, but instcadof inves ing in residential property, which he knew was grossly overvalued, he invested most of his sales commissions in citrus land located in Florida's Indian River County. Originally, Stewart sold his oranges, lemons, and grapefruit to wholesalers for distribution to grocery stores. However, in 1965 when frozen juice sales were causing the industry to boom, he joined with several other growers to form Indian River Citrus Company, which processed its own juices. Today, its indian River Citrus Florida Sun, and Citrus Gold brands are sold throughout the United States indian River's management is currently evaluating a new product -lite orange juice. Studies done by the firm's marketing departiment indicate that many people who ike the taste of oran will not drink it because of its high calorie count The new product would cost more, but it would offer consumers something that no other competing orange juice product offers-35 percent less calories. Lili Romero and Brent Gibbs, recent business school graduates wbo are now working at the firm as financial analysts, must analyze this project, along with two other potential investments, and then present their findings to the company's executive committee. ion of Production facilities for the lite orange juice product would be set up in an unused seat Indian River's main plant Relatively inexpe sooooo would be purchased, but sh Further, Indian River's inventories (raw materials, work-in-process, and hnished goods) would have to be increased by S10,000 at the time of the initial investment. The machinery has a remaining economic life of 4 years, and the company has obtained a special tax ruling that allows it to dence ciate the equipment under the MACRS 3-year class. Under current tax law, the depreciation respectively. The machinery allowances are 0.33, 0.45, 0.15, and 0.07 in Years 1 through 4, expected to have a salvage value of $100,000 after 4 years of use. The section of the main plant where the lite orange juice production would occur me deterioration. Last year, as part of unused for several years, and consequently it has suffered so of the plant. Brent believes that this outlay, which has already been paid and expensed for ax pur- e orange juice project. His contention is that if the rehabilitation routine facilities improvement program, Indian River spent $100,000 to rebabilitate that section poses, should be charged to the li opyright C 1994. The Dryden Press. All rights reserved. Cash Flow Estimation 12 INDIAN RIVER CITRUS COMPANY (A) Indian River Citrus Company is a leading producer of fresh, frozen, and made-f citrus drinks. The firm was founded in 1929 by Matthew Stewart, a navy veteran who Miami aftler World War I and began selling real estate. Since real estate sales were booming s rom-concentrate settled in art's fortunes soared. His investment philosophy, which he proudly displayed behind his desk we "Buy land. They aren't making any more ofit." He practiced what he preached, but instcadof inves ing in residential property, which he knew was grossly overvalued, he invested most of his sales commissions in citrus land located in Florida's Indian River County. Originally, Stewart sold his oranges, lemons, and grapefruit to wholesalers for distribution to grocery stores. However, in 1965 when frozen juice sales were causing the industry to boom, he joined with several other growers to form Indian River Citrus Company, which processed its own juices. Today, its indian River Citrus Florida Sun, and Citrus Gold brands are sold throughout the United States indian River's management is currently evaluating a new product -lite orange juice. Studies done by the firm's marketing departiment indicate that many people who ike the taste of oran will not drink it because of its high calorie count The new product would cost more, but it would offer consumers something that no other competing orange juice product offers-35 percent less calories. Lili Romero and Brent Gibbs, recent business school graduates wbo are now working at the firm as financial analysts, must analyze this project, along with two other potential investments, and then present their findings to the company's executive committee. ion of Production facilities for the lite orange juice product would be set up in an unused seat Indian River's main plant Relatively inexpe sooooo would be purchased, but sh Further, Indian River's inventories (raw materials, work-in-process, and hnished goods) would have to be increased by S10,000 at the time of the initial investment. The machinery has a remaining economic life of 4 years, and the company has obtained a special tax ruling that allows it to dence ciate the equipment under the MACRS 3-year class. Under current tax law, the depreciation respectively. The machinery allowances are 0.33, 0.45, 0.15, and 0.07 in Years 1 through 4, expected to have a salvage value of $100,000 after 4 years of use. The section of the main plant where the lite orange juice production would occur me deterioration. Last year, as part of unused for several years, and consequently it has suffered so of the plant. Brent believes that this outlay, which has already been paid and expensed for ax pur- e orange juice project. His contention is that if the rehabilitation routine facilities improvement program, Indian River spent $100,000 to rebabilitate that section poses, should be charged to the li opyright C 1994. The Dryden Press. All rights reserved