Question

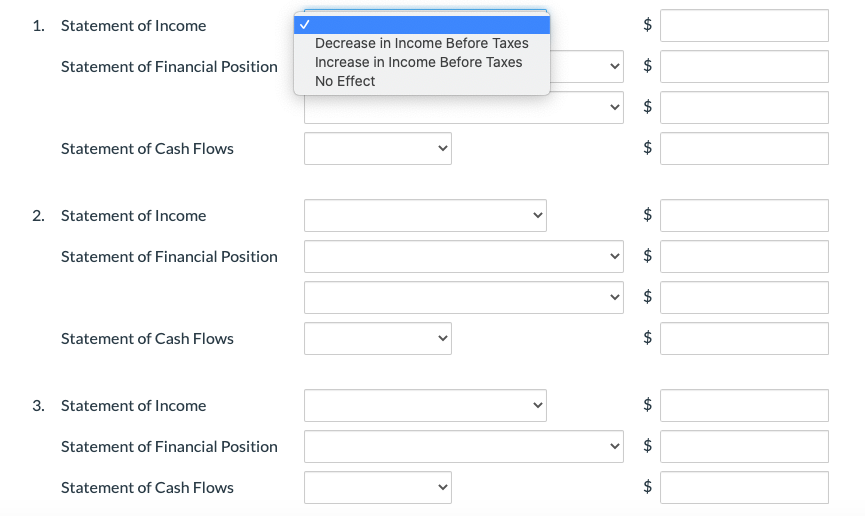

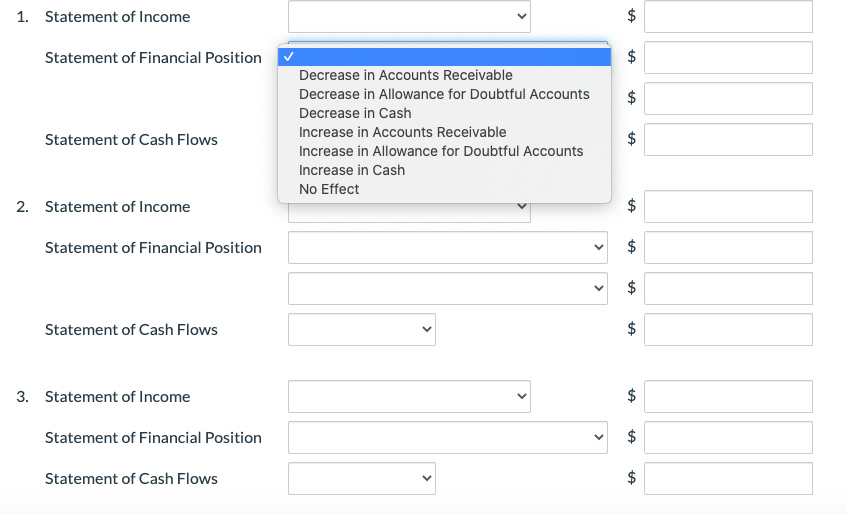

Indicate how each of the following transactions would affect AlarmIT Ltd.s statement of income, statement of financial position, and statement of cash flows. If there

Indicate how each of the following transactions would affect AlarmIT Ltd.s statement of income, statement of financial position, and statement of cash flows. If there would be no effect, then state that. AlarmIT uses the allowance method of accounting for bad debts.

1. AlarmIT recovered a $26,300 receivable from a customer whose account had been previously written off.

2. AlarmIT wrote off a receivable from a customer in the amount of $17,100.

3. AlarmIT recorded bad debts expense for the period totalling $51,800. The amount was determined based on an aging of accounts receivable.

I am attaching two screenshots that are of same statement but showing options from drop down arrow for choice that are available.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started