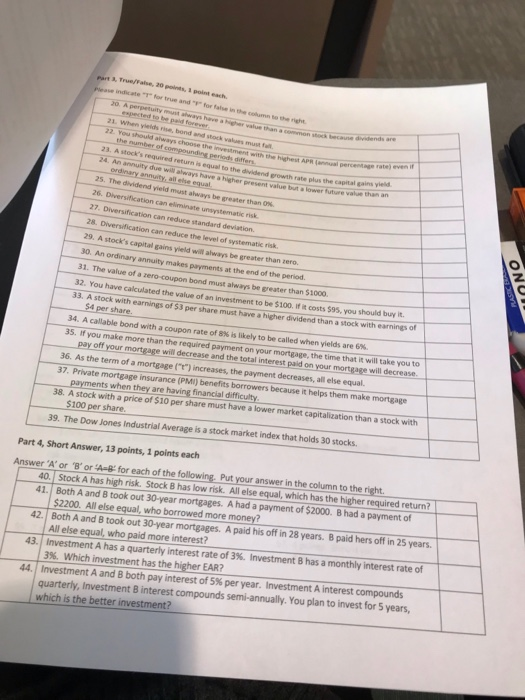

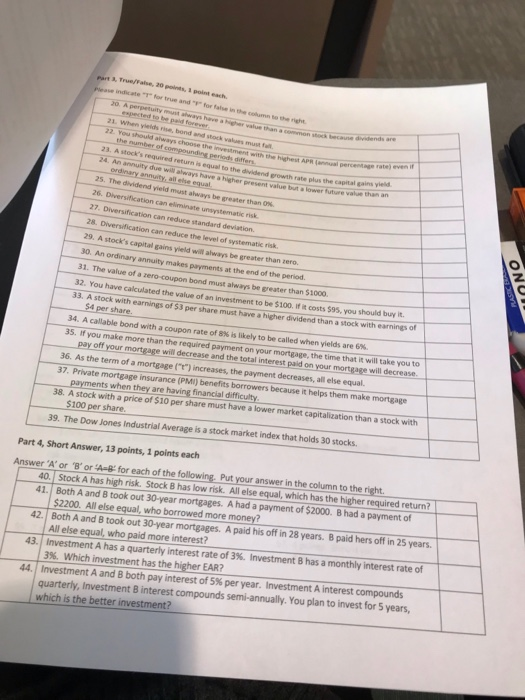

indicate T for true and" for false in the column to the right periods differs ighest APR (nual percetage rate) even 23. A stock's required return is equal to the dividend growth rate yield 25. The dividend yield must always be greater tharn 0% 27. Diversificat tion can reduce standard deviation. can reduce the level of systematic risk A stock's capital gains yield will always be greater than zero 30. An ordinary annuity makes payments at the end of the period. a zero-coupon bond must always be greater than 51000 31. The value of You have calculated the value of an investment to be $100. if it costs $95, you should buy it 33. A stock with earnings of $3 per share must have a higher dividend than a stock with earnings S4 per share. 34. A callable bond with a coupon rate of 8% is likely to be called when yields are 6% 35. If you make more than the required payment on your mortgage, the time that it will take you to off wil decrease and the total interest paid on your mortgage will decrease 36. As the term of a mortgage ("t") increases, the payment decreases, all else equal. 37. Private mortgage insurance (PMI) benefits borrowers because it helps them make mortgage Payments when theyarehavingfinancialdifficulty. 38. A stock with a price of $10 per share must have a lower market capitalization than a stock with 5100 per share 39. The Dow Jones Industrial Average is a stock market index that holds 30 stocks Part 4, Short Answer, 13 points, 1 points each Answer A' or B' or A-E for each of the following. Put your answer in the column to the right. 40. Stock A has high risk. Stock B has low risk. All else equal, which has the higher required return? 41 Both A and B took out 30-year mortgages. A had a payment of $2000. B had a payment of 42. Both A and B took out 30-year mortgages. A paid his off in 28 years. B paid hers off in 25 years 43.1 Investment A has a quarterly interest rate of 3%. Investment B has a monthly interest rate of 441 Investment A and B both pay interest of 5% per year. Investment A interest compounds $2200. All else equal, who borrowed more money? All else equal, who paid more interest? 3% Which investment has the higher EAR? quarterly, Investment B interest compounds semi-annually. You plan to invest for 5 years which is the better investment