Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Indicate the answer choice that best completes the statement or answers the question. 30. Landis received $90,000 cash and a capital asset (basis of $50,000,

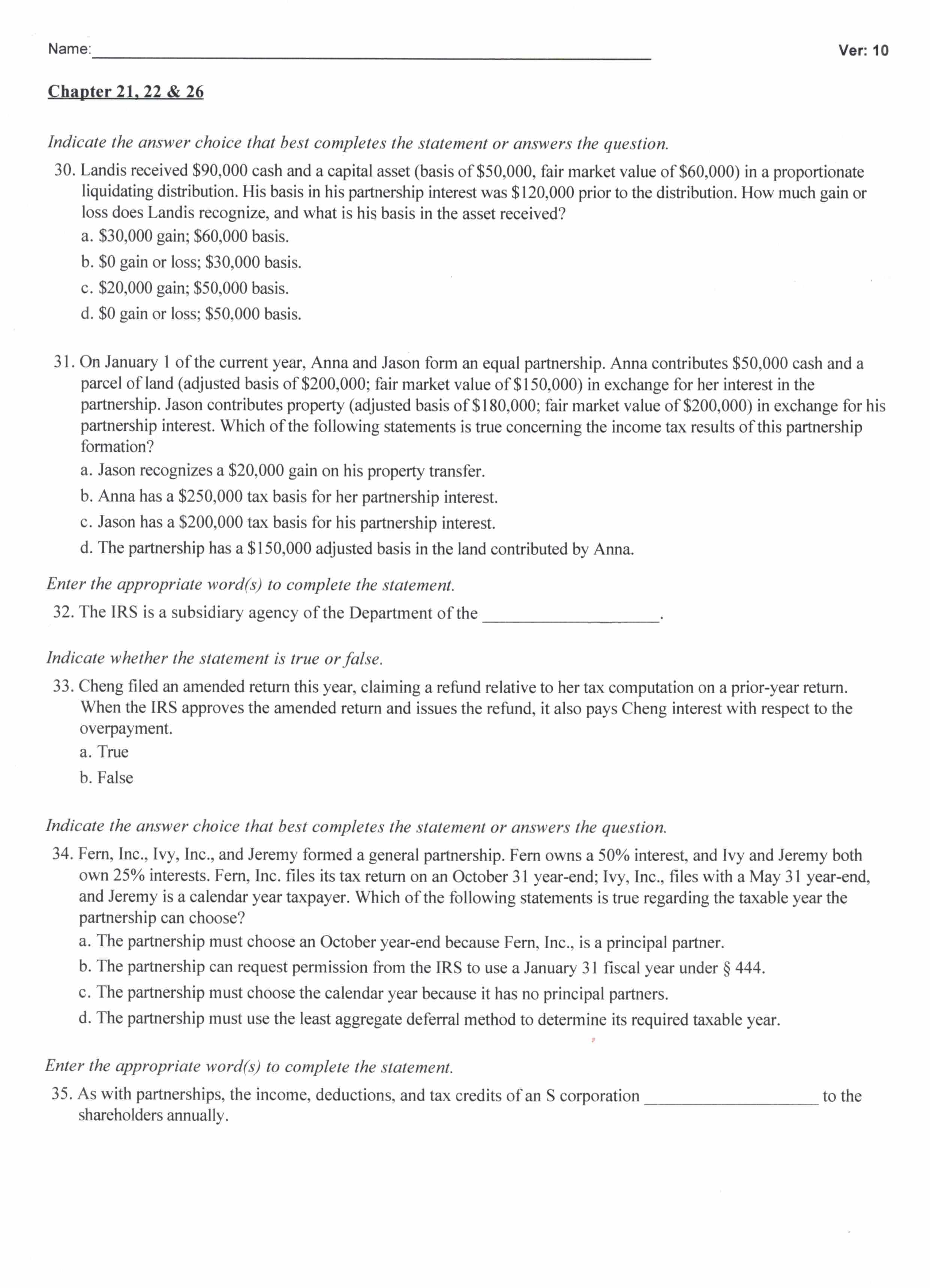

Indicate the answer choice that best completes the statement or answers the question. 30. Landis received $90,000 cash and a capital asset (basis of $50,000, fair market value of $60,000 ) in a proportionate liquidating distribution. His basis in his partnership interest was $120,000 prior to the distribution. How much gain or loss does Landis recognize, and what is his basis in the asset received? a. $30,000 gain; $60,000 basis. b. $0 gain or loss; $30,000 basis. c. $20,000 gain; $50,000 basis. d. $0 gain or loss; $50,000 basis. 31. On January 1 of the current year, Anna and Jason form an equal partnership. Anna contributes $50,000 cash and a parcel of land (adjusted basis of $200,000; fair market value of $150,000 ) in exchange for her interest in the partnership. Jason contributes property (adjusted basis of $180,000; fair market value of $200,000 ) in exchange for his partnership interest. Which of the following statements is true concerning the income tax results of this partnership formation? a. Jason recognizes a $20,000 gain on his property transfer. b. Anna has a $250,000 tax basis for her partnership interest. c. Jason has a $200,000 tax basis for his partnership interest. d. The partnership has a $150,000 adjusted basis in the land contributed by Anna. Enter the appropriate word(s) to complete the statement. 32. The IRS is a subsidiary agency of the Department of the Indicate whether the statement is true or false. 33. Cheng filed an amended return this year, claiming a refund relative to her tax computation on a prior-year return. When the IRS approves the amended return and issues the refund, it also pays Cheng interest with respect to the overpayment. a. True b. False Indicate the answer choice that best completes the statement or answers the question. 34. Fern, Inc., Ivy, Inc., and Jeremy formed a general partnership. Fern owns a 50\% interest, and Ivy and Jeremy both own 25% interests. Fern, Inc. files its tax return on an October 31 year-end; Ivy, Inc., files with a May 31 year-end, and Jeremy is a calendar year taxpayer. Which of the following statements is true regarding the taxable year the partnership can choose? a. The partnership must choose an October year-end because Fern, Inc., is a principal partner. b. The partnership can request permission from the IRS to use a January 31 fiscal year under 444. c. The partnership must choose the calendar year because it has no principal partners. d. The partnership must use the least aggregate deferral method to determine its required taxable year. Enter the appropriate word(s) to complete the statement. 35. As with partnerships, the income, deductions, and tax credits of an S corporation to the shareholders annually

Indicate the answer choice that best completes the statement or answers the question. 30. Landis received $90,000 cash and a capital asset (basis of $50,000, fair market value of $60,000 ) in a proportionate liquidating distribution. His basis in his partnership interest was $120,000 prior to the distribution. How much gain or loss does Landis recognize, and what is his basis in the asset received? a. $30,000 gain; $60,000 basis. b. $0 gain or loss; $30,000 basis. c. $20,000 gain; $50,000 basis. d. $0 gain or loss; $50,000 basis. 31. On January 1 of the current year, Anna and Jason form an equal partnership. Anna contributes $50,000 cash and a parcel of land (adjusted basis of $200,000; fair market value of $150,000 ) in exchange for her interest in the partnership. Jason contributes property (adjusted basis of $180,000; fair market value of $200,000 ) in exchange for his partnership interest. Which of the following statements is true concerning the income tax results of this partnership formation? a. Jason recognizes a $20,000 gain on his property transfer. b. Anna has a $250,000 tax basis for her partnership interest. c. Jason has a $200,000 tax basis for his partnership interest. d. The partnership has a $150,000 adjusted basis in the land contributed by Anna. Enter the appropriate word(s) to complete the statement. 32. The IRS is a subsidiary agency of the Department of the Indicate whether the statement is true or false. 33. Cheng filed an amended return this year, claiming a refund relative to her tax computation on a prior-year return. When the IRS approves the amended return and issues the refund, it also pays Cheng interest with respect to the overpayment. a. True b. False Indicate the answer choice that best completes the statement or answers the question. 34. Fern, Inc., Ivy, Inc., and Jeremy formed a general partnership. Fern owns a 50\% interest, and Ivy and Jeremy both own 25% interests. Fern, Inc. files its tax return on an October 31 year-end; Ivy, Inc., files with a May 31 year-end, and Jeremy is a calendar year taxpayer. Which of the following statements is true regarding the taxable year the partnership can choose? a. The partnership must choose an October year-end because Fern, Inc., is a principal partner. b. The partnership can request permission from the IRS to use a January 31 fiscal year under 444. c. The partnership must choose the calendar year because it has no principal partners. d. The partnership must use the least aggregate deferral method to determine its required taxable year. Enter the appropriate word(s) to complete the statement. 35. As with partnerships, the income, deductions, and tax credits of an S corporation to the shareholders annually Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started