Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Indicate the answer choice that best completes the statement or answers the question. 12. Which one of the following statements is true regarding a partner's

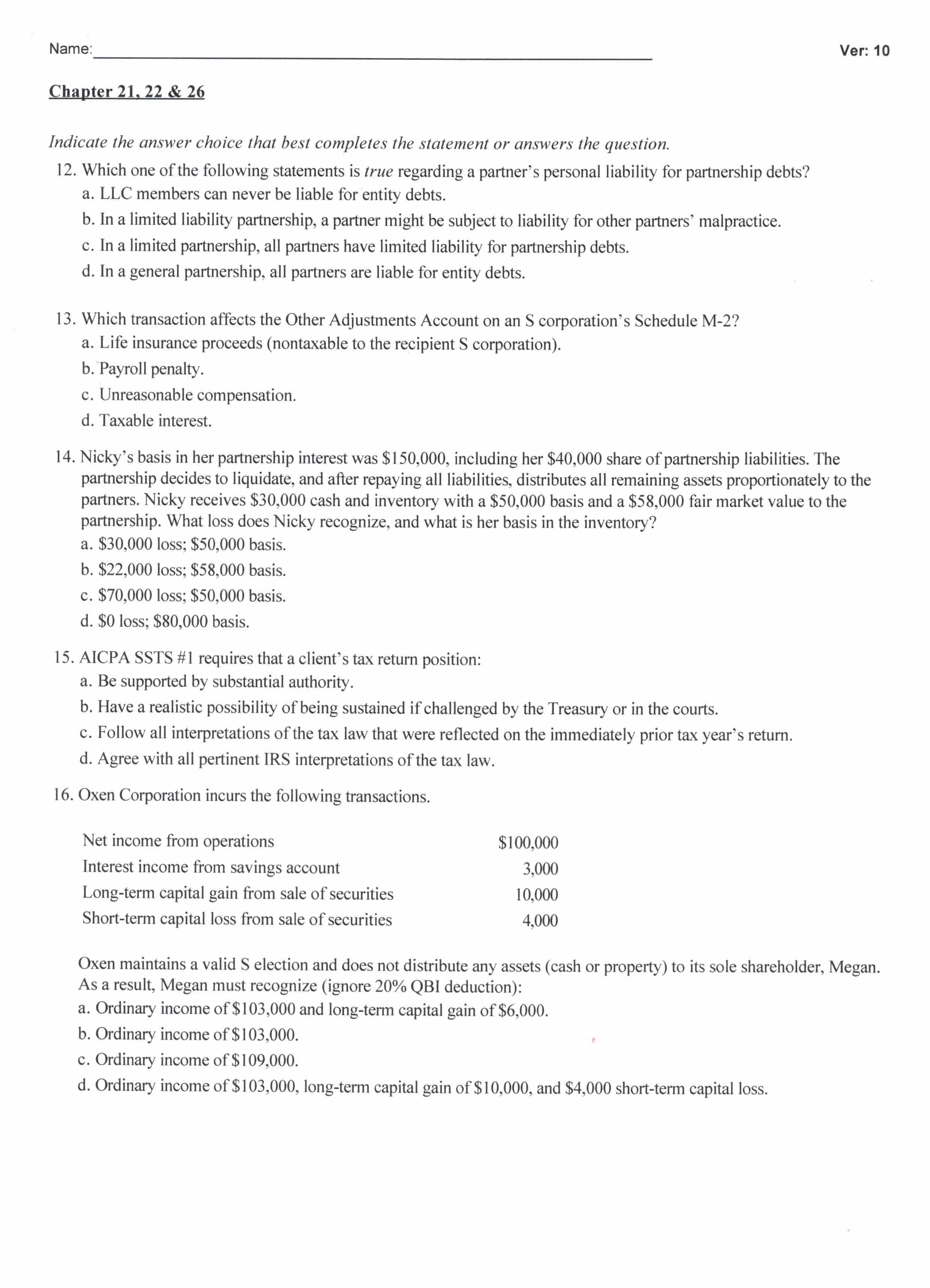

Indicate the answer choice that best completes the statement or answers the question. 12. Which one of the following statements is true regarding a partner's personal liability for partnership debts? a. LLC members can never be liable for entity debts. b. In a limited liability partnership, a partner might be subject to liability for other partners' malpractice. c. In a limited partnership, all partners have limited liability for partnership debts. d. In a general partnership, all partners are liable for entity debts. 13. Which transaction affects the Other Adjustments Account on an S corporation's Schedule M-2? a. Life insurance proceeds (nontaxable to the recipient S corporation). b. Payroll penalty. c. Unreasonable compensation. d. Taxable interest. 14. Nicky's basis in her partnership interest was $150,000, including her $40,000 share of partnership liabilities. The partnership decides to liquidate, and after repaying all liabilities, distributes all remaining assets proportionately to the partners. Nicky receives $30,000 cash and inventory with a $50,000 basis and a $58,000 fair market value to the partnership. What loss does Nicky recognize, and what is her basis in the inventory? a. $30,000 loss; $50,000 basis. b. $22,000 loss; $58,000 basis. c. $70,000 loss; $50,000 basis. d. $0 loss; $80,000 basis. 15. AICPA SSTS \#1 requires that a client's tax return position: a. Be supported by substantial authority. b. Have a realistic possibility of being sustained if challenged by the Treasury or in the courts. c. Follow all interpretations of the tax law that were reflected on the immediately prior tax year's return. d. Agree with all pertinent IRS interpretations of the tax law. 16. Oxen Corporation incurs the following transactions. Oxen maintains a valid S election and does not distribute any assets (cash or property) to its sole shareholder, Megan. As a result, Megan must recognize (ignore 20% QBI deduction): a. Ordinary income of $103,000 and long-term capital gain of $6,000. b. Ordinary income of $103,000. c. Ordinary income of $109,000. d. Ordinary income of $103,000, long-term capital gain of $10,000, and $4,000 short-term capital loss

Indicate the answer choice that best completes the statement or answers the question. 12. Which one of the following statements is true regarding a partner's personal liability for partnership debts? a. LLC members can never be liable for entity debts. b. In a limited liability partnership, a partner might be subject to liability for other partners' malpractice. c. In a limited partnership, all partners have limited liability for partnership debts. d. In a general partnership, all partners are liable for entity debts. 13. Which transaction affects the Other Adjustments Account on an S corporation's Schedule M-2? a. Life insurance proceeds (nontaxable to the recipient S corporation). b. Payroll penalty. c. Unreasonable compensation. d. Taxable interest. 14. Nicky's basis in her partnership interest was $150,000, including her $40,000 share of partnership liabilities. The partnership decides to liquidate, and after repaying all liabilities, distributes all remaining assets proportionately to the partners. Nicky receives $30,000 cash and inventory with a $50,000 basis and a $58,000 fair market value to the partnership. What loss does Nicky recognize, and what is her basis in the inventory? a. $30,000 loss; $50,000 basis. b. $22,000 loss; $58,000 basis. c. $70,000 loss; $50,000 basis. d. $0 loss; $80,000 basis. 15. AICPA SSTS \#1 requires that a client's tax return position: a. Be supported by substantial authority. b. Have a realistic possibility of being sustained if challenged by the Treasury or in the courts. c. Follow all interpretations of the tax law that were reflected on the immediately prior tax year's return. d. Agree with all pertinent IRS interpretations of the tax law. 16. Oxen Corporation incurs the following transactions. Oxen maintains a valid S election and does not distribute any assets (cash or property) to its sole shareholder, Megan. As a result, Megan must recognize (ignore 20% QBI deduction): a. Ordinary income of $103,000 and long-term capital gain of $6,000. b. Ordinary income of $103,000. c. Ordinary income of $109,000. d. Ordinary income of $103,000, long-term capital gain of $10,000, and $4,000 short-term capital loss Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started