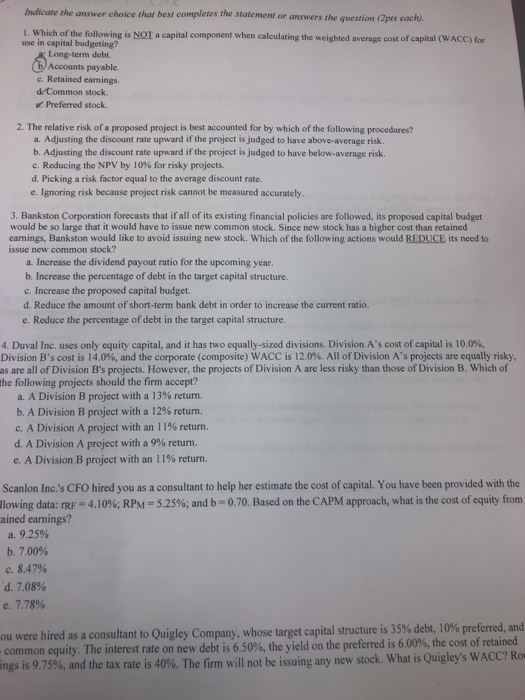

Indicate the answer choice that best completes the statement or answers the question (2pts each) 1. Which of the foll use in capital budgeting? lowing is NOT a capital component when calculating the weighted average cost of capital (WACC) for Long-term debt. Accounts payable c. Retained earnings deCommon stock. Preferred stock. 2. The relative risk of a proposed project is best accounted for by which of the following procedures? a. Adjusting the discount rate upward if the project is judged to have above-average risk. b. Adjusting the discount rate upward if the project is judged to have below-average risk. c. Reducing the NPV by 10% for risky projects. d. Picking a risk factor equal to the average discount rate. e. Ignoring risk because project risk cannot be measured accurately. 3. Bankston Corporation forecasts that if all of its existing financial policies are followed, its proposed capital budget would be so large that it would have to issue new common stock. Since new stock has a higher cost than retained carnings, Bankston would like to avoid issuing new stock. Which of the following actions would REDUCE its need to issue new common stock? a. Increase the dividend payout ratio for the upcoming year b. Increase the percentage of debt in the target capital structure. c. Increase the proposed capital budget. d. Reduce the amount of short-term bank debt in order to increase the current ratio. e. Reduce the percentage of debt in the target capital structure. 4. Duval Inc. uses only equity capital, and it has two equally-sized divisions Division A's cost ofcapital is 10.0%, Division B's cost is 14.0%, and the corporate (composite) WACC is 12.0%. All of Division A's projects are equally risky, as are all of Division B's projects. However, the projects of Division A are less risky than those of Division B. Which of the following projects should the firm accept? a. A Division B project with a 13% return. b, A Division B project with a 12% return. c. A Division A project with an 11% return. d, A Division A project with a 9% return. e. A Division B project with an 1 1% return. Scanlon Inc.'s CFO hired you as a consultant to help her estimate the cost of capital. You have been provided with the llowing data: rF-4.10%; RPM-5.25%; and b-070. Based on the CAPM approach, what is the cost of equity from ained earnings? a. 9.25% b. 7.00% C. 8.47% d. 7.08% e. 7.78% hired as a consultant to Quigley Company, whose target capital structure is 35% debt 10% preferred, and 's WACC? Ro common equity. The interest rate on new debt is 6.50%, the yield on the preferred is 6.00%, the cost of retained ings is 9.75% and the tax rate is 40%. The firm will not be issuing any new stock. What is Quigley