Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Indicate whether each statement is true or false: IFRS and the CPA Canada Handbook, Part II , have equal status in Canada for financial reporting.

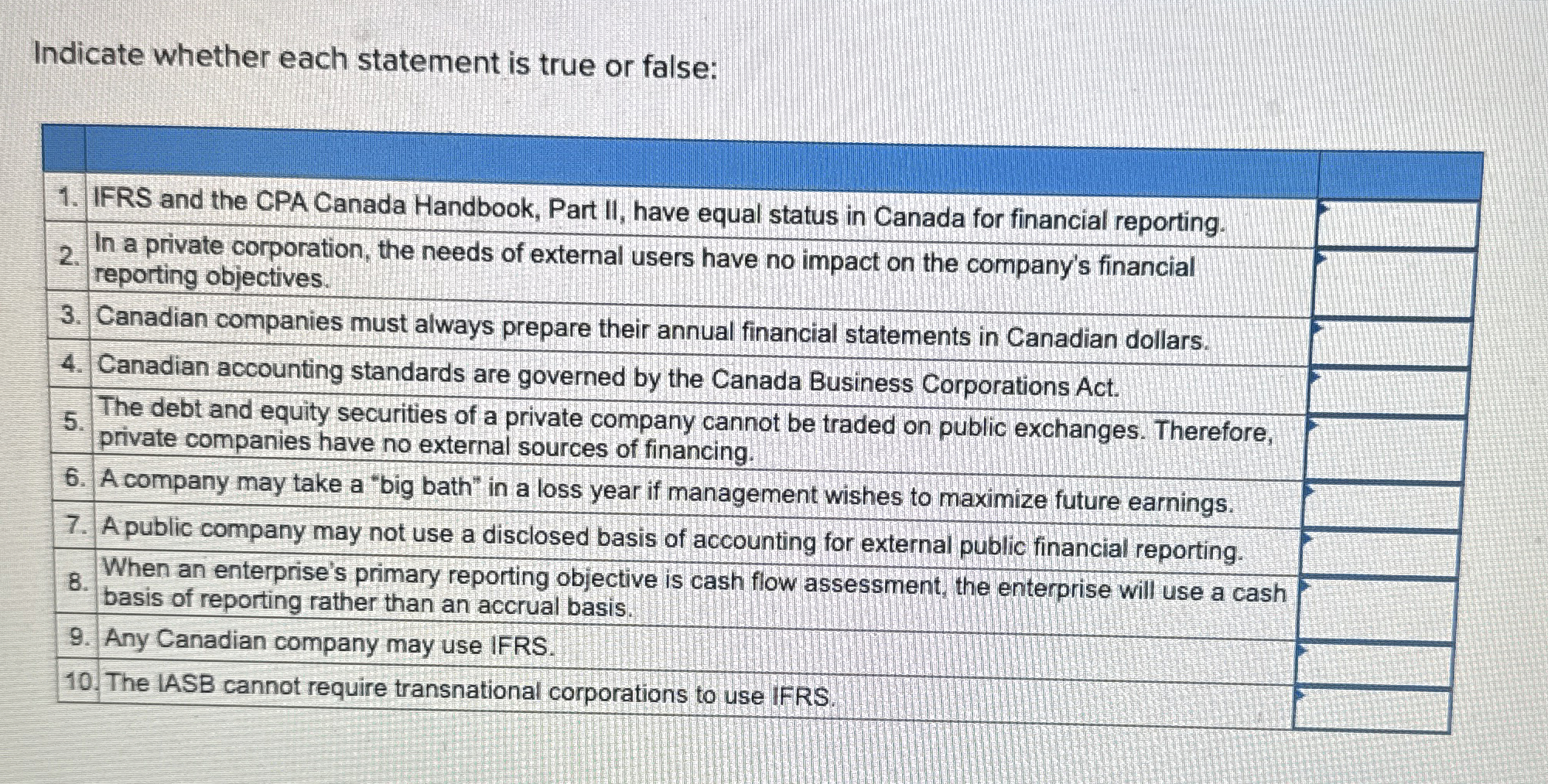

Indicate whether each statement is true or false:

IFRS and the CPA Canada Handbook, Part II have equal status in Canada for financial reporting.

In a private corporation, the needs of external users have no impact on the company's financial

reporting objectives.

Canadian companies must always prepare their annual financial statements in Canadian dollars.

Canadian accounting standards are governed by the Canada Business Corporations Act.

The debt and equity securities of a private company cannot be traded on public exchanges. Therefore,

private companies have no external sources of financing.

A company may take a "big bath" in a loss year if management wishes to maximize future earnings.

A public company may not use a disclosed basis of accounting for external public financial reporting.

When an enterprise's primary reporting objective is cash flow assessment, the enterprise will use a cash

basis of reporting rather than an accrual basis.

Any Canadian company may use IFRS.

The IASB cannot require transnational corporations to use IFRS.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started