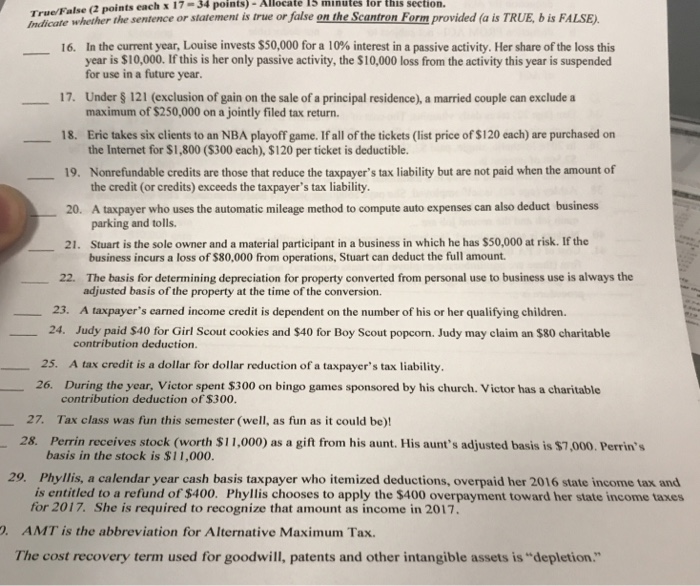

Indicate whether the sentence or statement is true or false on the Scantron Form provided (a is TRUE, bis FALSE) In the current year, Louise invests $50,000 for a 10% interest in a passive activity. Her share of the loss this year is $10,000. If this is her only passive activity, the $10,000 loss from the activity this year is suspended for use in a future year. Under section 121 (exclusion of gain on the sale of a principal residence), a married couple can exclude a maximum of $250,000 on a jointly filed tax return. Eric takes six clients to an NBA playoff game. If all of the tickets (list price of $120 each) are purchased on the Internet for $1, 800 ($300 each) $120 per ticket is deductible. Nonrefundable credits are those that reduce the taxpayer's tax liability but are not paid when the amount of the credit (or credits) exceeds the taxpayer's tax liability. A taxpayer who uses the automatic mileage method to compute auto expenses can also deduct business parking and tolls. Stuart is the sole owner and a material participant in a business in which he has $50,000 at risk. If the business incurs a loss of $80,000 from operations, Stuart can deduct the full amount. The basis for determining depreciation for property converted from personal use to business use is always the adjusted basis of the property at the time of the conversion. A taxpayer's earned income credit is dependent on the number of his or her qualifying children. Judy paid $40 for Girl Scout cookies and $40 for Boy Scout popcorn. Judy may claim an $80 charitable contribution deduction. A tax credit is a dollar for dollar reduction of a taxpayer's tax liability. During the year, Victor spent $300 on bingo games sponsored by his church. Victor has a charitable contribution deduction of $300. Tax class was fun this semester (well, as fun as it could be)! Perrin receives stock (worth $11,000) as a gift from his aunt. His aunt's adjusted basis is $7,000. Perrin's basis in the stock is $11,000. Phyllis, a calendar year cash basis taxpayer who itemized deductions, overpaid her 2016 state income tax and is entitled to a refund of $400. Phyllis chooses to apply the $400 overpayment toward her state income taxes 2017. She is required to recognize that amount as income in 2017 AMT is the abbreviation for Alternative Maximum Tax The cost recovery term used for goodwill, patents and other intangible assets is "depletion