Answered step by step

Verified Expert Solution

Question

1 Approved Answer

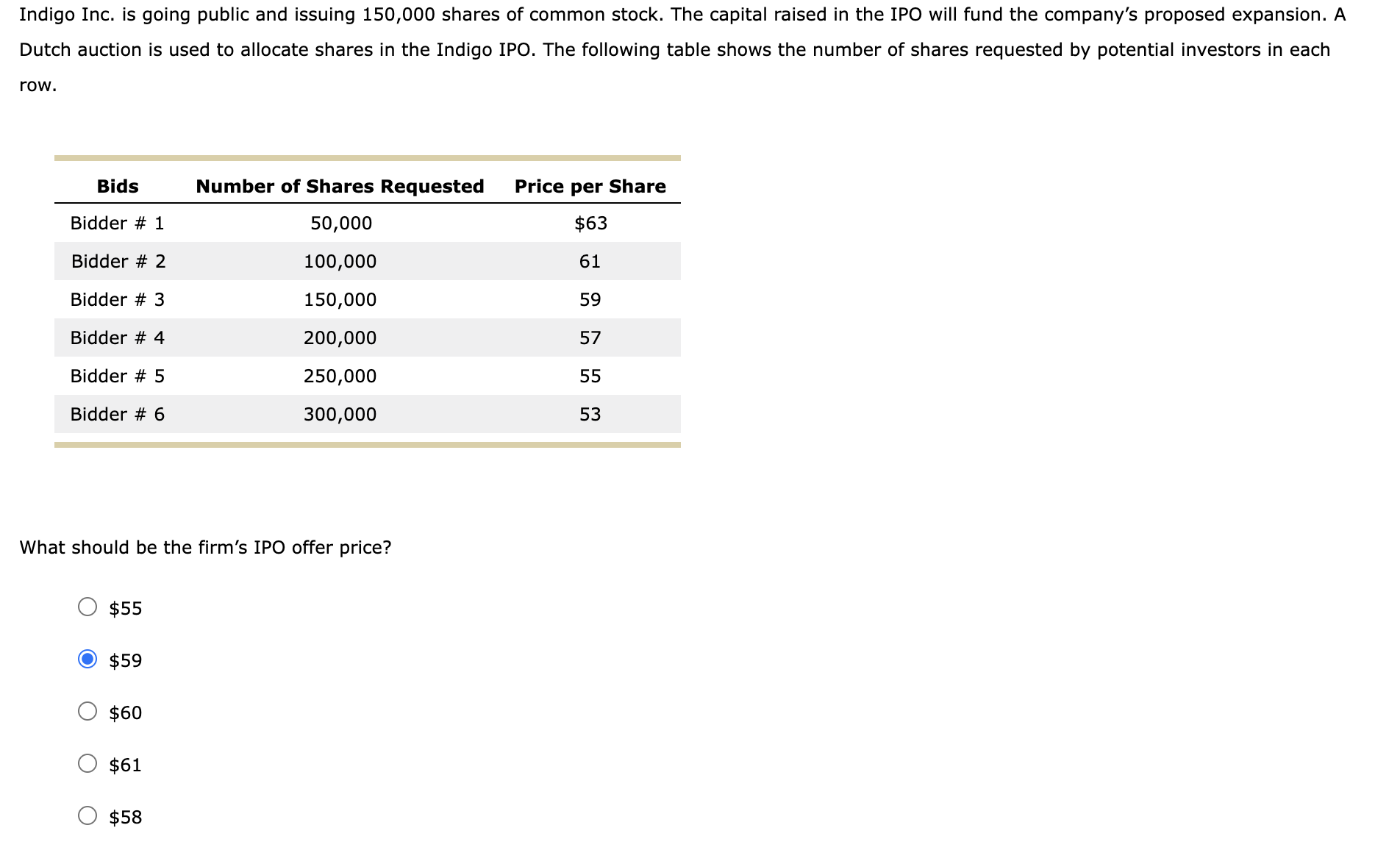

Indigo Inc. is going public and issuing 1 5 0 , 0 0 0 shares of common stock. The capital raised in the IPO will

Indigo Inc. is going public and issuing shares of common stock. The capital raised in the IPO will fund the company's proposed expansion. A

Dutch auction is used to allocate shares in the Indigo IPO. The following table shows the number of shares requested by potential investors in each

row.

What should be the firm's IPO offer price?

$

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started