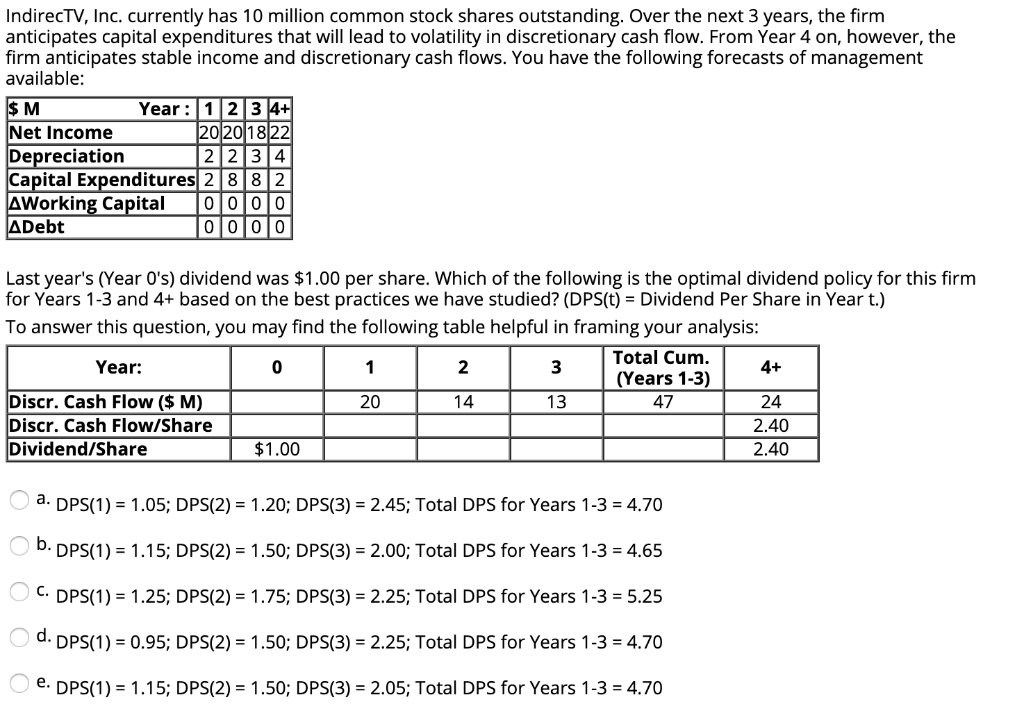

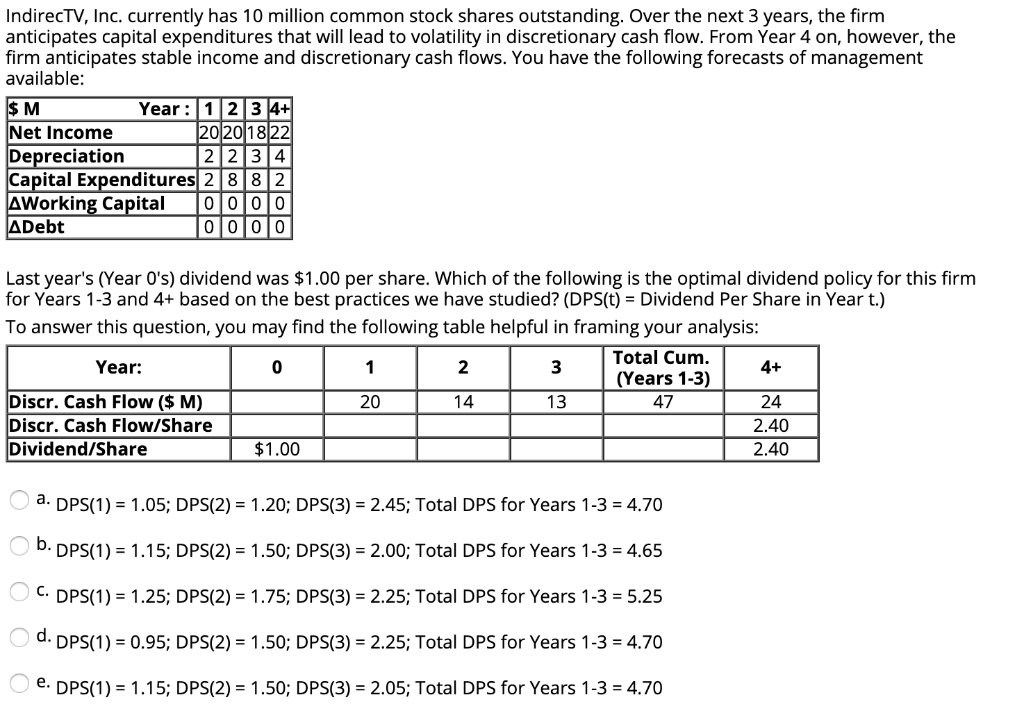

IndirecTV, Inc. currently has 10 million common stock shares outstanding. Over the next 3 years, the firm anticipates capital expenditures that will lead to volatility in discretionary cash flow. From Year 4 on, however, the firm anticipates stable income and discretionary cash flows. You have the following forecasts of management available: $ M Net Income Depreciation Capital Expenditures 2 8 8 2 Year: 12 3 202018 AWorking CapitalC ADebt Last year's (Year 0's) dividend was $1.00 per share. Which of the following is the optimal dividend policy for this firm for Years 1-3 and 4+ based on the best practices we have studied? (DPS(t)Dividend Per Share in Year t.) To answer this question, you may find the following table helpful in framing your analysis Total Cum. (Years 1-3) 47 Year. 2 3 Discr. Cash Flow ($ M) Discr. Cash Flow/Share Dividend/Share 24 2.40 2.40 20 13 $1.00 a. DPS(1) 1.05; DPS(2) -1.20; DPS(3) 2.45; Total DPS for Years 1-3 4.70 b. DPS(1)-1.15; DPS(2)-1.50; DPS(3)-2.00; Total DPS for Years 1-3-4.65 C. DPS(1) 1.25; DPS(2) 1.75; DPS(3) -2.25; Total DPS for Years 1-3 5.25 d. DPS(1) 0.95; DPS(2) 1.50; DPS(3) 2.25; Total DPS for Years 1-3 4.70 e DPS(1)- 1.15; DPS(2) 1.50; DPS(3) 2.05; Total DPS for Years 1-3 -4.70 IndirecTV, Inc. currently has 10 million common stock shares outstanding. Over the next 3 years, the firm anticipates capital expenditures that will lead to volatility in discretionary cash flow. From Year 4 on, however, the firm anticipates stable income and discretionary cash flows. You have the following forecasts of management available: $ M Net Income Depreciation Capital Expenditures 2 8 8 2 Year: 12 3 202018 AWorking CapitalC ADebt Last year's (Year 0's) dividend was $1.00 per share. Which of the following is the optimal dividend policy for this firm for Years 1-3 and 4+ based on the best practices we have studied? (DPS(t)Dividend Per Share in Year t.) To answer this question, you may find the following table helpful in framing your analysis Total Cum. (Years 1-3) 47 Year. 2 3 Discr. Cash Flow ($ M) Discr. Cash Flow/Share Dividend/Share 24 2.40 2.40 20 13 $1.00 a. DPS(1) 1.05; DPS(2) -1.20; DPS(3) 2.45; Total DPS for Years 1-3 4.70 b. DPS(1)-1.15; DPS(2)-1.50; DPS(3)-2.00; Total DPS for Years 1-3-4.65 C. DPS(1) 1.25; DPS(2) 1.75; DPS(3) -2.25; Total DPS for Years 1-3 5.25 d. DPS(1) 0.95; DPS(2) 1.50; DPS(3) 2.25; Total DPS for Years 1-3 4.70 e DPS(1)- 1.15; DPS(2) 1.50; DPS(3) 2.05; Total DPS for Years 1-3 -4.70