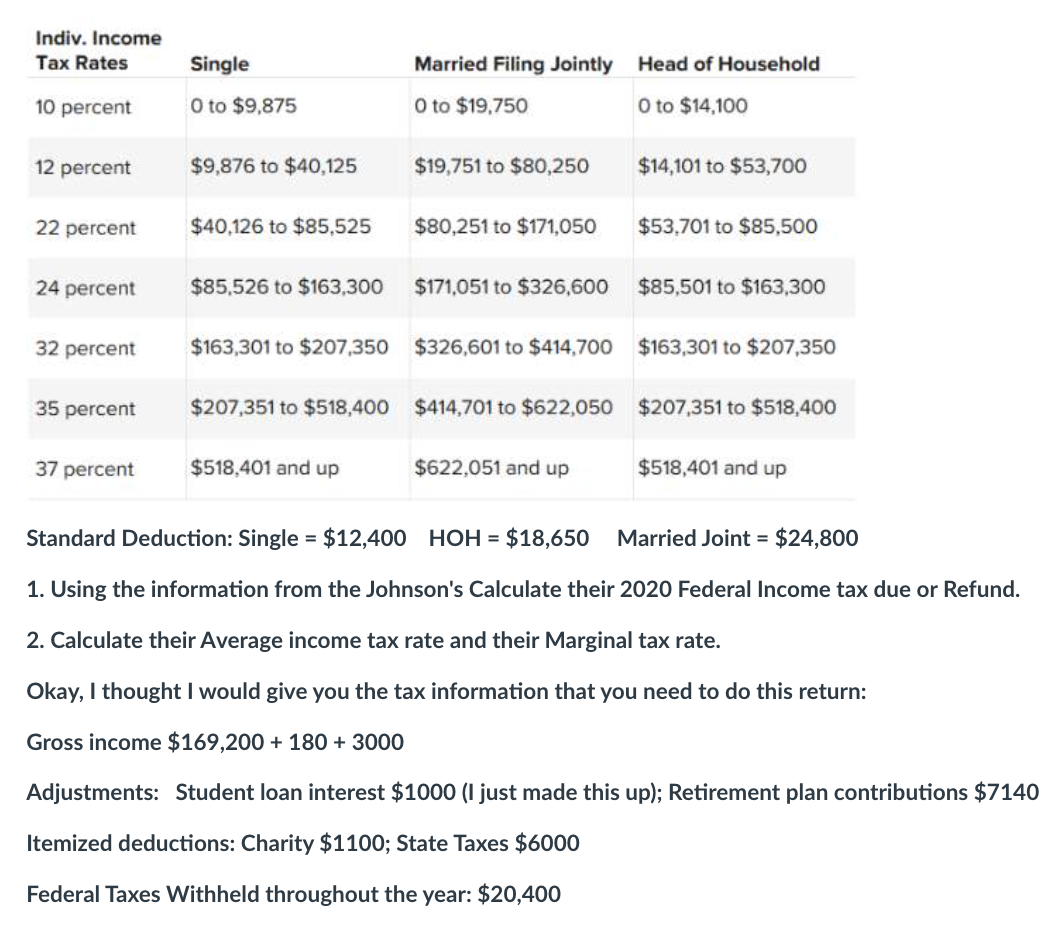

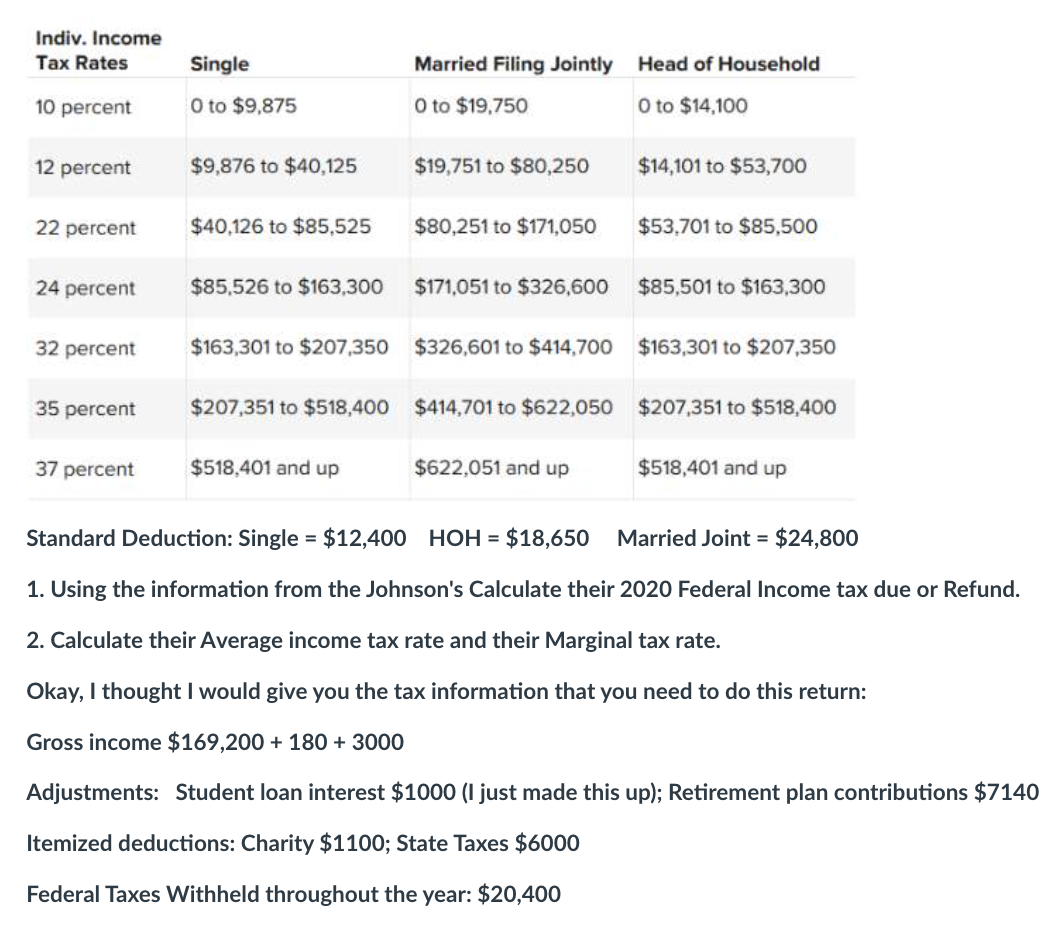

Indiv. Income Tax Rates Single Married Filing Jointly Head of Household 10 percent O to $9,875 O to $19,750 O to $14,100 12 percent $9,876 to $40,125 $19,751 to $80,250 $14,101 to $53,700 22 percent $40,126 to $85,525 $80,251 to $171,050 $53,701 to $85,500 24 percent $85,526 to $163,300 $171,051 to $326,600 $85,501 to $163,300 32 percent $163,301 to $207,350 $326,601 to $414,700 $163,301 to $207,350 35 percent $207,351 to $518,400 $414,701 to $622,050 $207,351 to $518,400 37 percent $518,401 and up $622,051 and up $518,401 and up Standard Deduction: Single = $12,400 HOH = $18,650 Married Joint = $24,800 1. Using the information from the Johnson's Calculate their 2020 Federal Income tax due or Refund. 2. Calculate their Average income tax rate and their Marginal tax rate. Okay, I thought I would give you the tax information that you need to do this return: Gross income $169,200 + 180 + 3000 Adjustments: Student loan interest $1000 (I just made this up); Retirement plan contributions $7140 Itemized deductions: Charity $1100; State Taxes $6000 Federal Taxes Withheld throughout the year: $20,400 Indiv. Income Tax Rates Single Married Filing Jointly Head of Household 10 percent O to $9,875 O to $19,750 O to $14,100 12 percent $9,876 to $40,125 $19,751 to $80,250 $14,101 to $53,700 22 percent $40,126 to $85,525 $80,251 to $171,050 $53,701 to $85,500 24 percent $85,526 to $163,300 $171,051 to $326,600 $85,501 to $163,300 32 percent $163,301 to $207,350 $326,601 to $414,700 $163,301 to $207,350 35 percent $207,351 to $518,400 $414,701 to $622,050 $207,351 to $518,400 37 percent $518,401 and up $622,051 and up $518,401 and up Standard Deduction: Single = $12,400 HOH = $18,650 Married Joint = $24,800 1. Using the information from the Johnson's Calculate their 2020 Federal Income tax due or Refund. 2. Calculate their Average income tax rate and their Marginal tax rate. Okay, I thought I would give you the tax information that you need to do this return: Gross income $169,200 + 180 + 3000 Adjustments: Student loan interest $1000 (I just made this up); Retirement plan contributions $7140 Itemized deductions: Charity $1100; State Taxes $6000 Federal Taxes Withheld throughout the year: $20,400