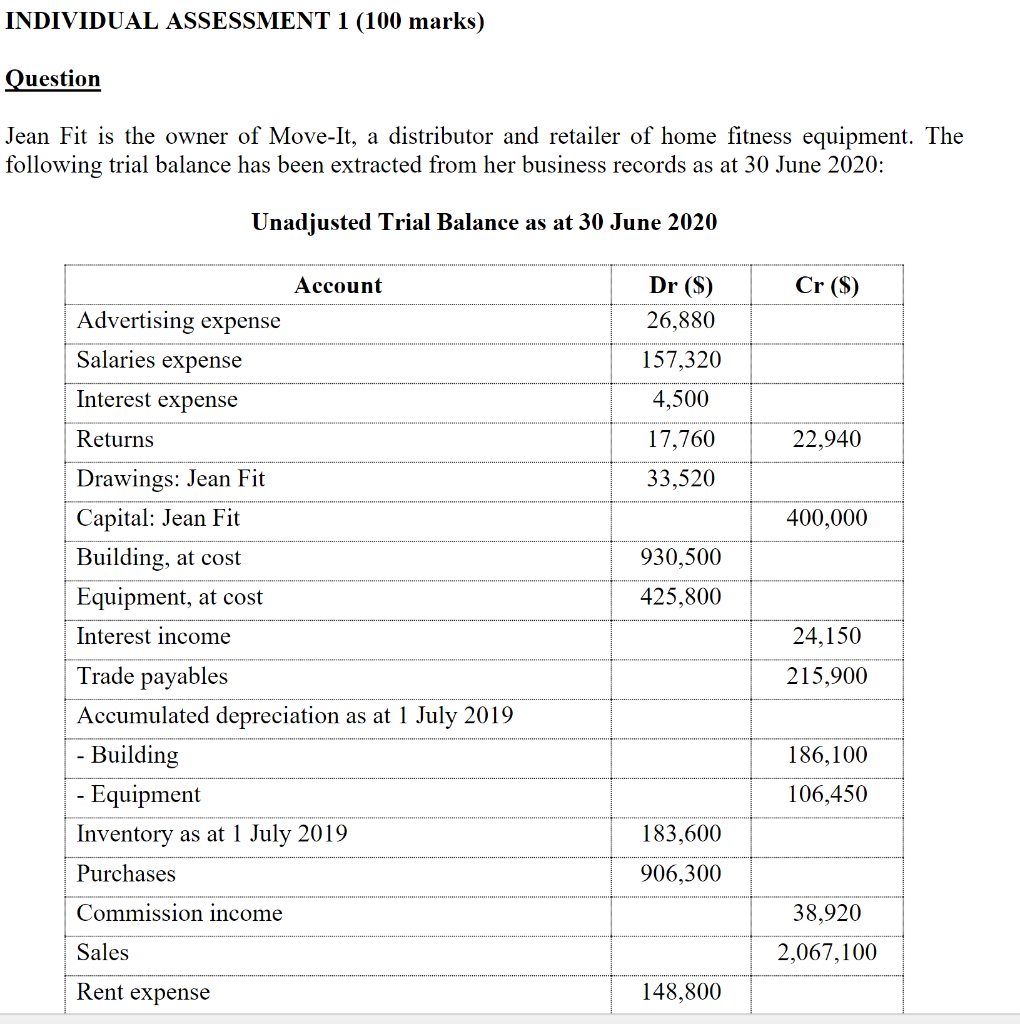

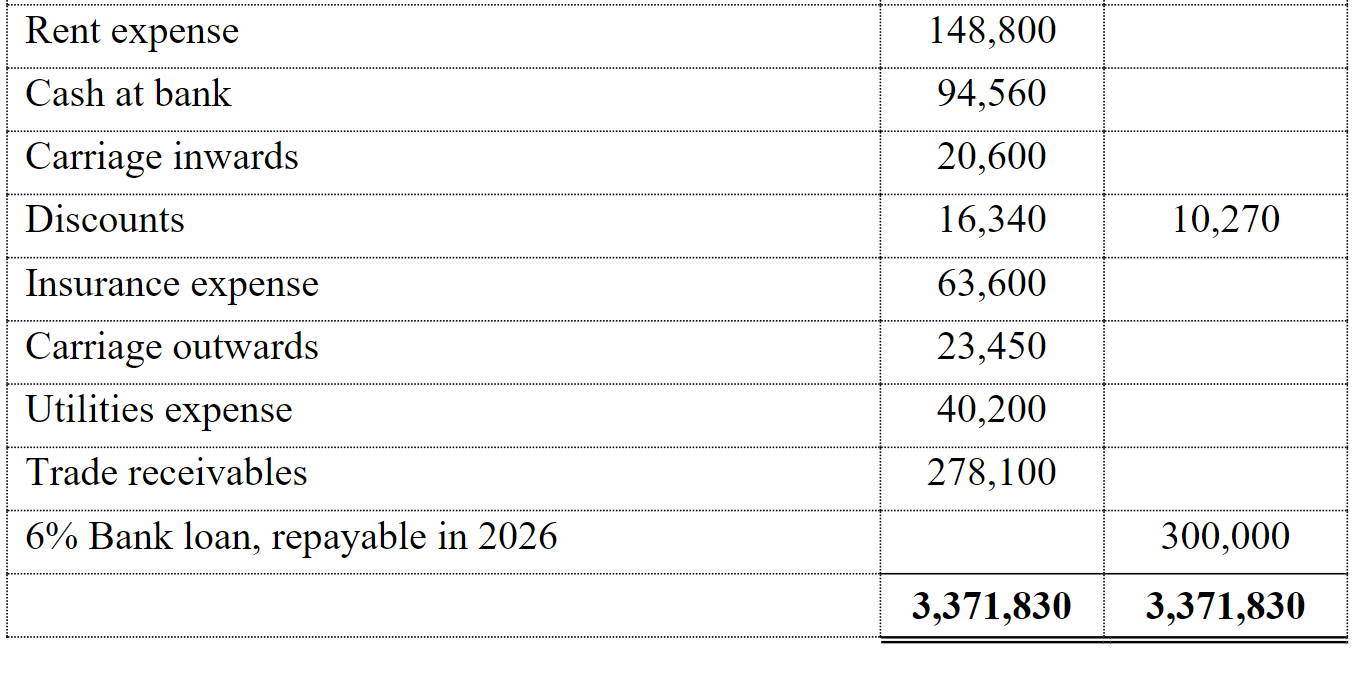

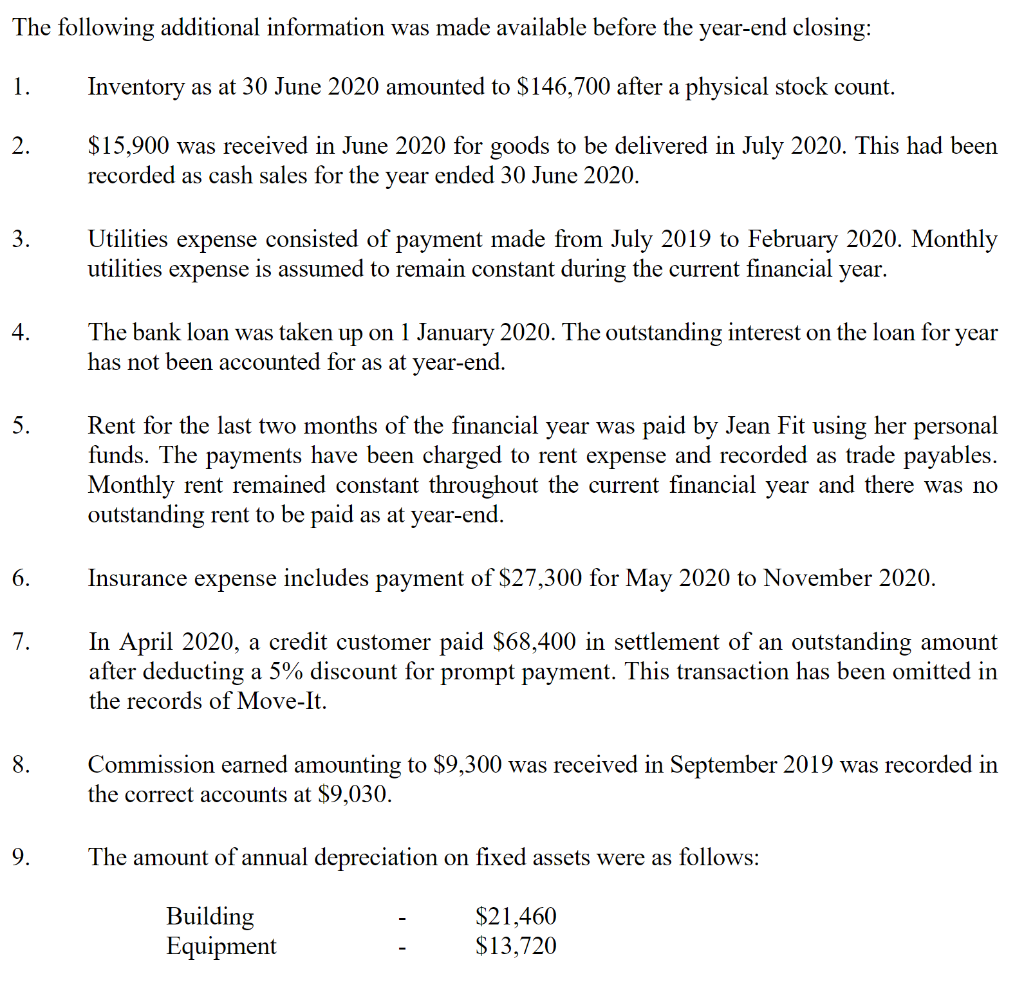

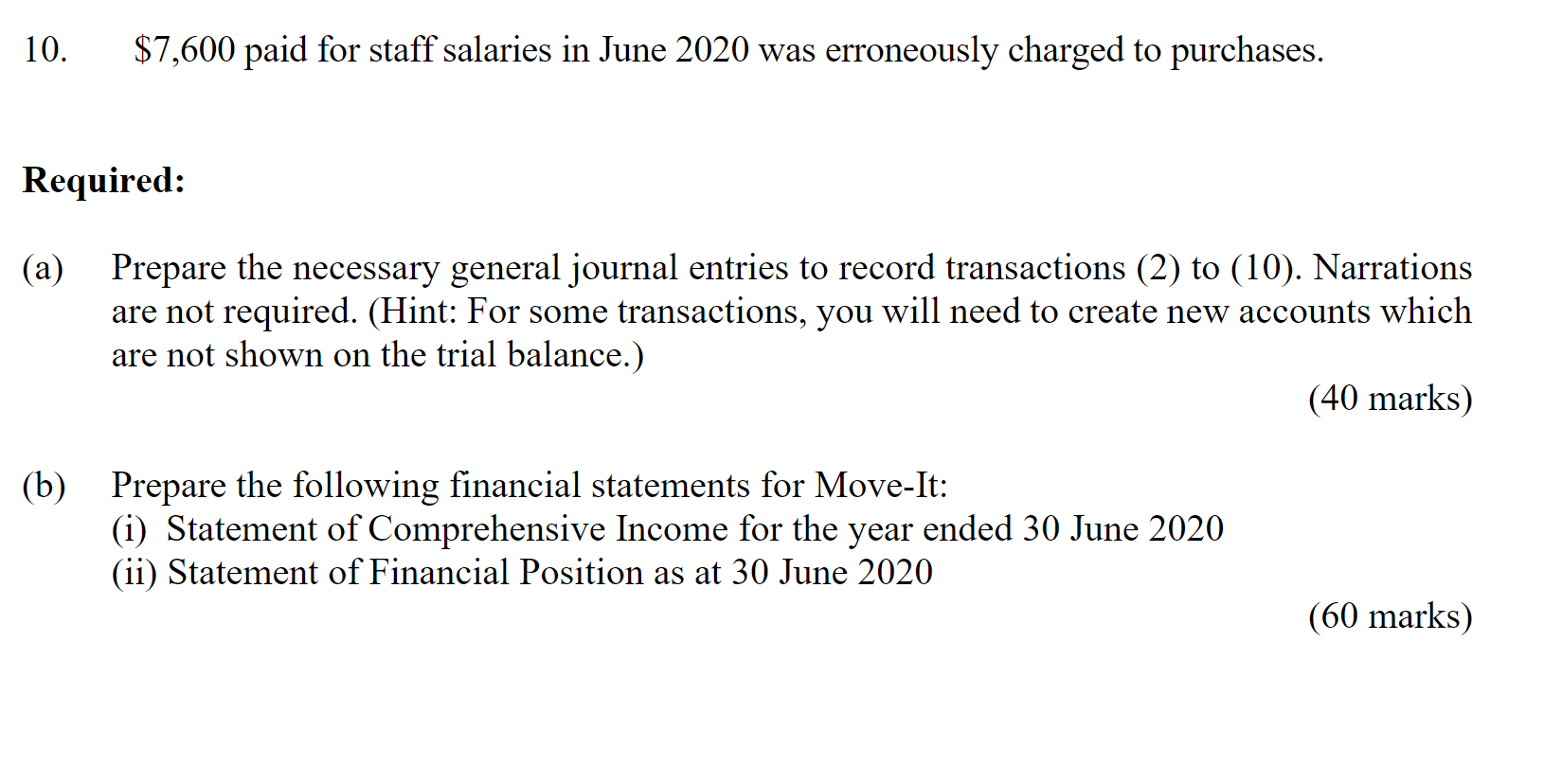

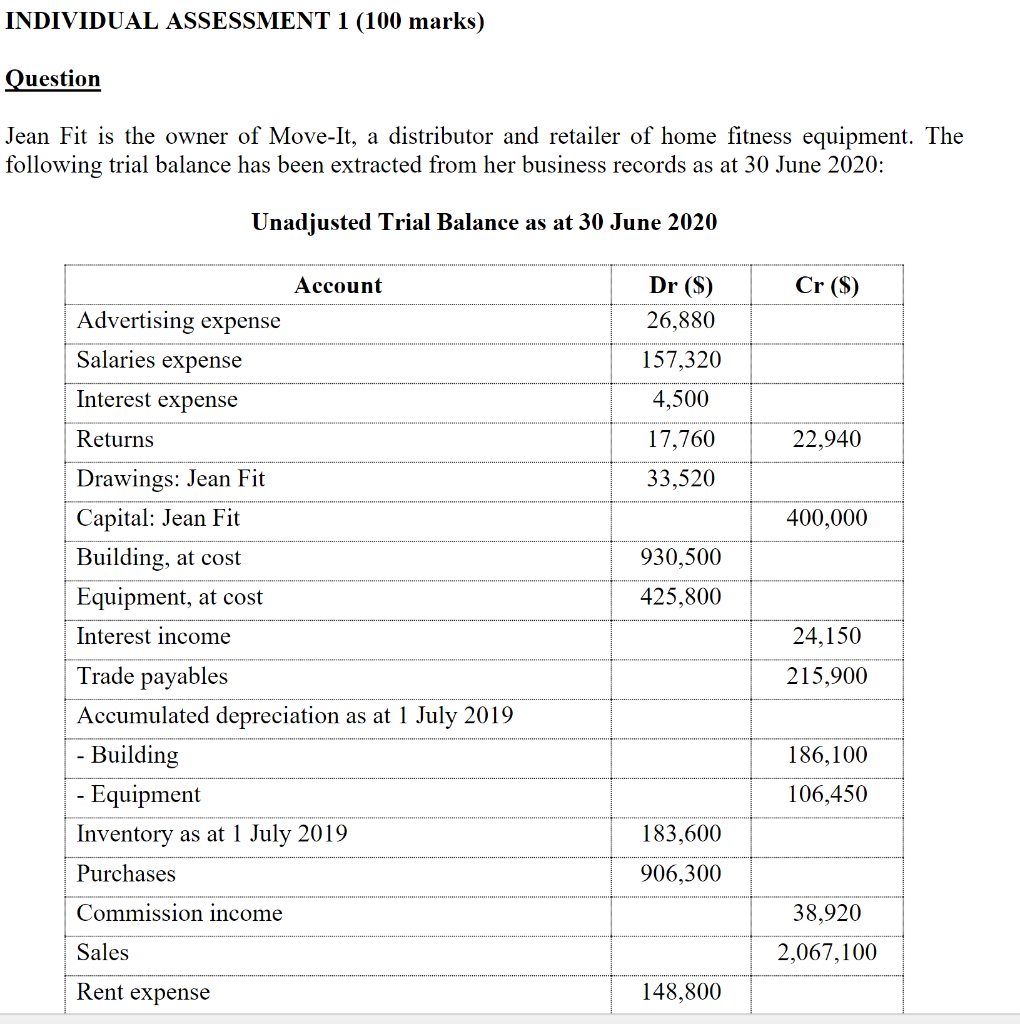

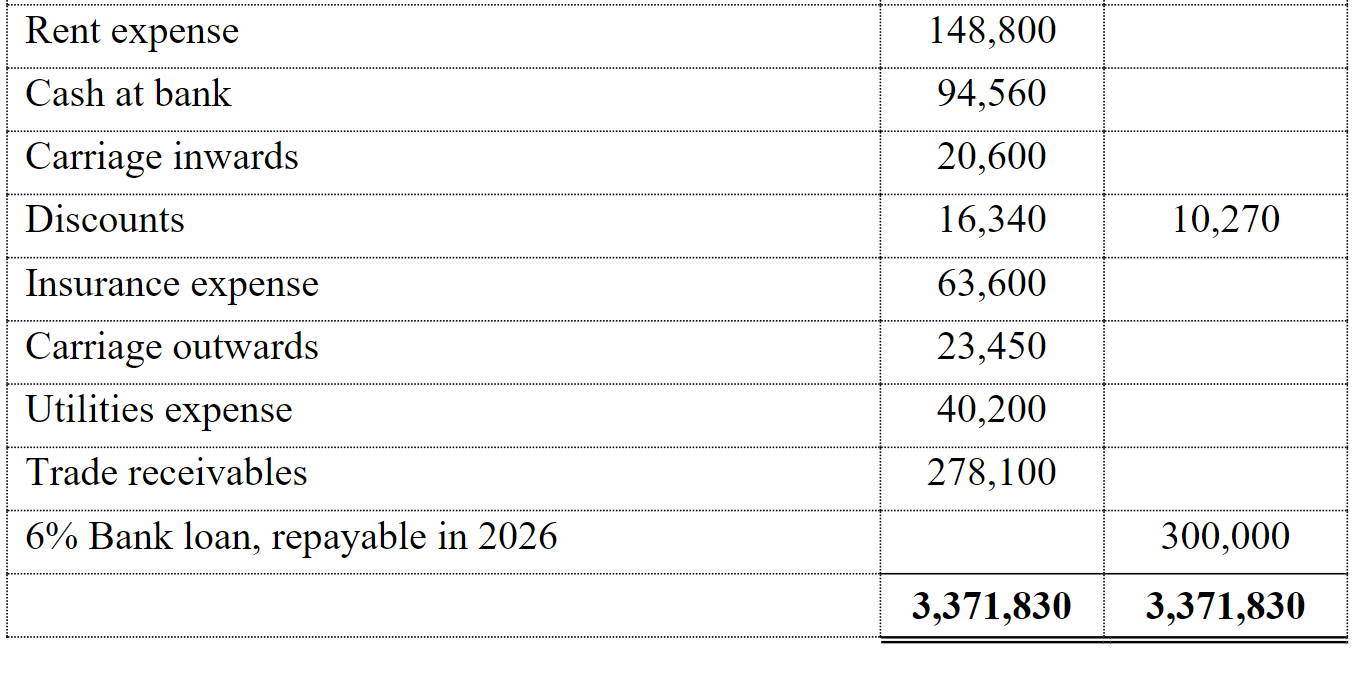

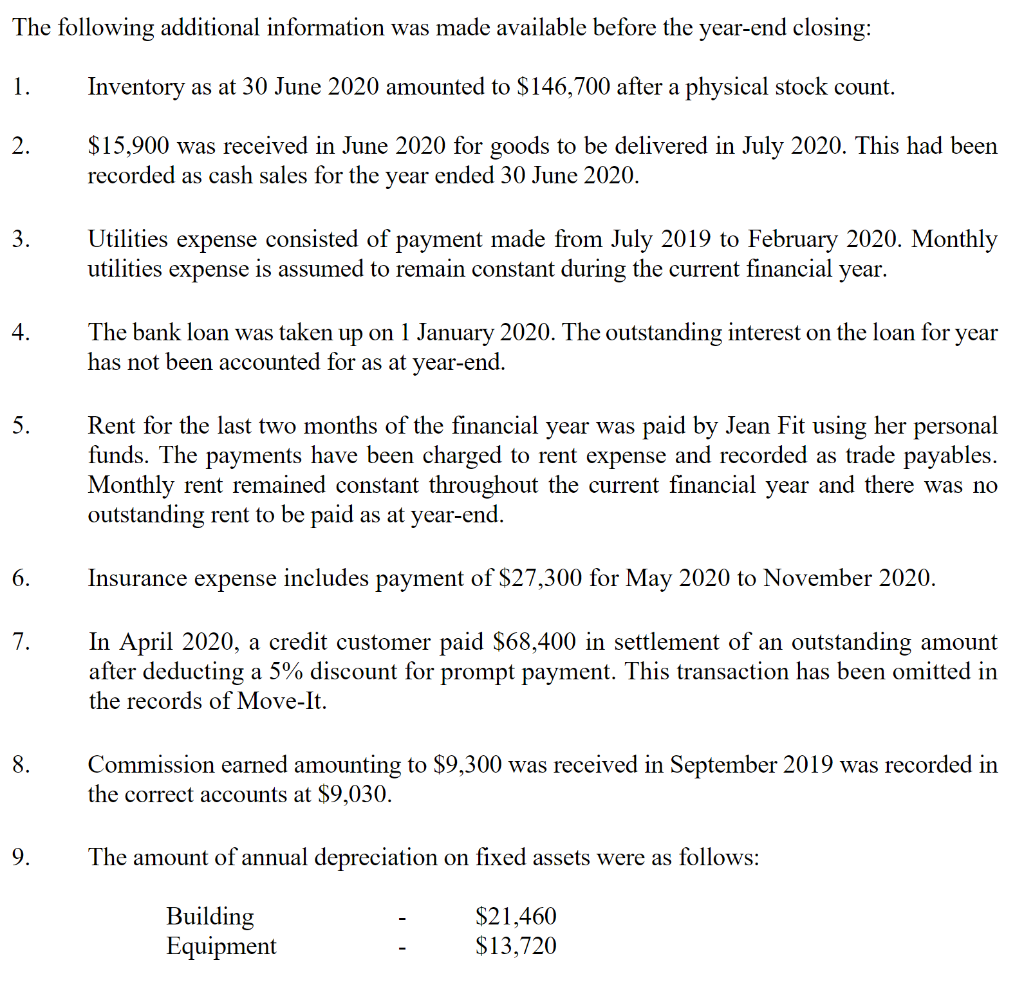

INDIVIDUAL ASSESSMENT 1 (100 marks) Question Jean Fit is the owner of Move-It, a distributor and retailer of home fitness equipment. The following trial balance has been extracted from her business records as at 30 June 2020: Unadjusted Trial Balance as at 30 June 2020 Dr ($) Cr ($) 26,880 157,320 4,500 17,760 22,940 33,520 400,000 Account Advertising expense Salaries expense Interest expense Returns Drawings: Jean Fit Capital: Jean Fit Building, at cost Equipment, at cost Interest income Trade payables Accumulated depreciation as at 1 July 2019 - Building - Equipment Inventory as at 1 July 2019 Purchases Commission income 930,500 425,800 24,150 215,900 186,100 106,450 183,600 906,300 38,920 2,067,100 Sales Rent expense 148,800 Rent expense 148.800 Cash at bank 94,560 Carriage inwards 20.600 Discounts 16,340 10,270 Insurance expense 63,600 23,450 Carriage outwards Utilities expense 40,200 Trade receivables 278,100 6% Bank loan, repayable in 2026 300,000 3,371,830 3,371,830 The following additional information was made available before the year-end closing: 1. Inventory as at 30 June 2020 amounted to $146,700 after a physical stock count. 2. $15,900 was received in June 2020 for goods to be delivered in July 2020. This had been recorded as cash sales for the year ended 30 June 2020. 3. Utilities expense consisted of payment made from July 2019 to February 2020. Monthly utilities expense is assumed to remain constant during the current financial year. 4. The bank loan was taken up on 1 January 2020. The outstanding interest on the loan for year has not been accounted for as at year-end. 5. Rent for the last two months of the financial year was paid by Jean Fit using her personal funds. The payments have been charged to rent expense and recorded as trade payables. Monthly rent remained constant throughout the current financial year and there was no outstanding rent to be paid as at year-end. 6. Insurance expense includes payment of $27,300 for May 2020 to November 2020. 7. In April 2020, a credit customer paid $68,400 in settlement of an outstanding amount after deducting a 5% discount for prompt payment. This transaction has been omitted in the records of Move-It. 8. Commission earned amounting to $9,300 was received in September 2019 was recorded in the correct accounts at $9,030. 9. The amount of annual depreciation on fixed assets were as follows: Building Equipment $21,460 $13,720 10. $7,600 paid for staff salaries in June 2020 was crroneously charged to purchases. Required: (a) Prepare the necessary general journal entries to record transactions (2) to (10). Narrations are not required. (Hint: For some transactions, you will need to create new accounts which are not shown on the trial balance.) (40 marks) (b) Prepare the following financial statements for Move-It: (i) Statement of Comprehensive Income for the year ended 30 June 2020 (ii) Statement of Financial Position as at 30 June 2020 (60 marks)