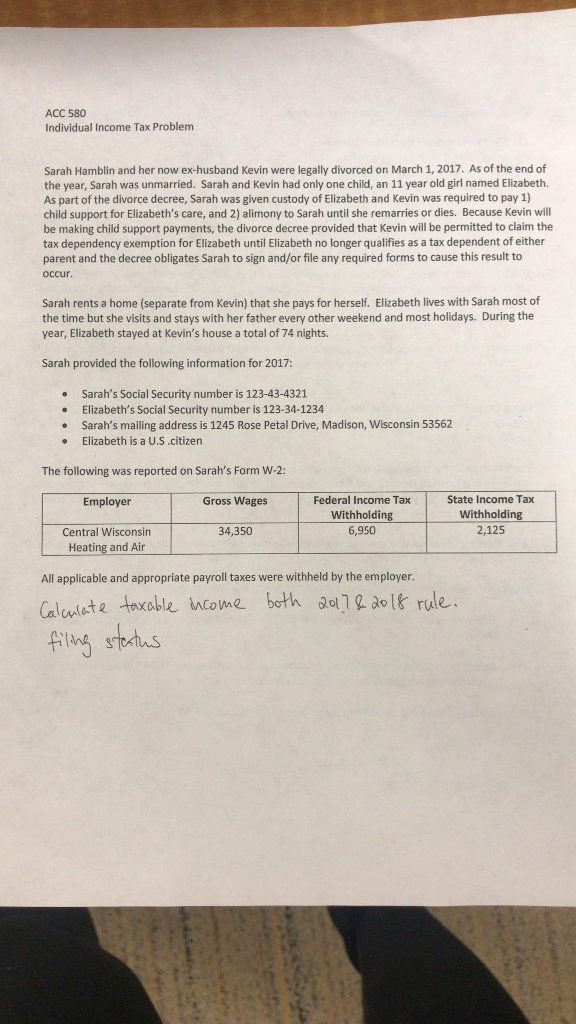

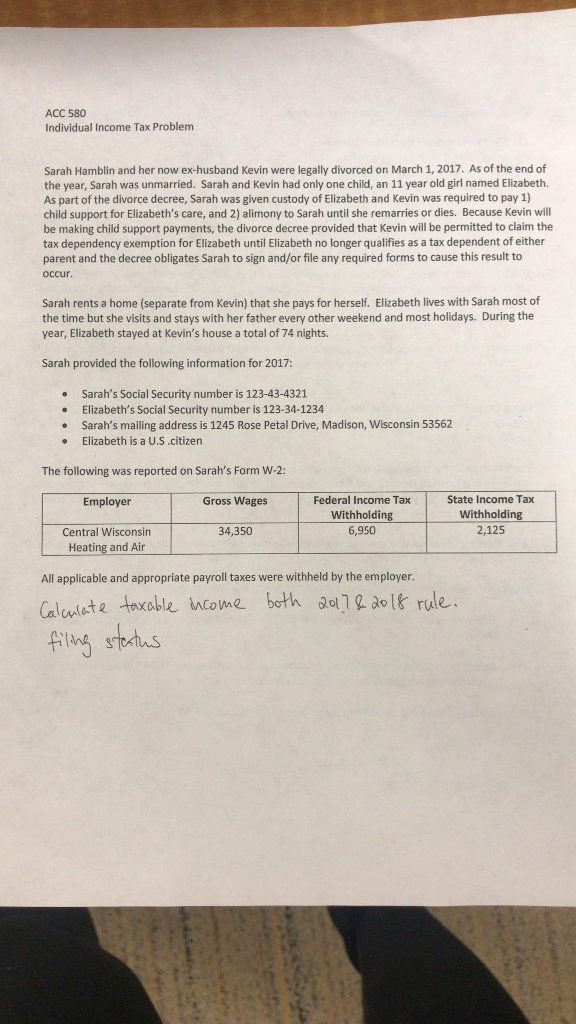

Individual Income Tax Problem

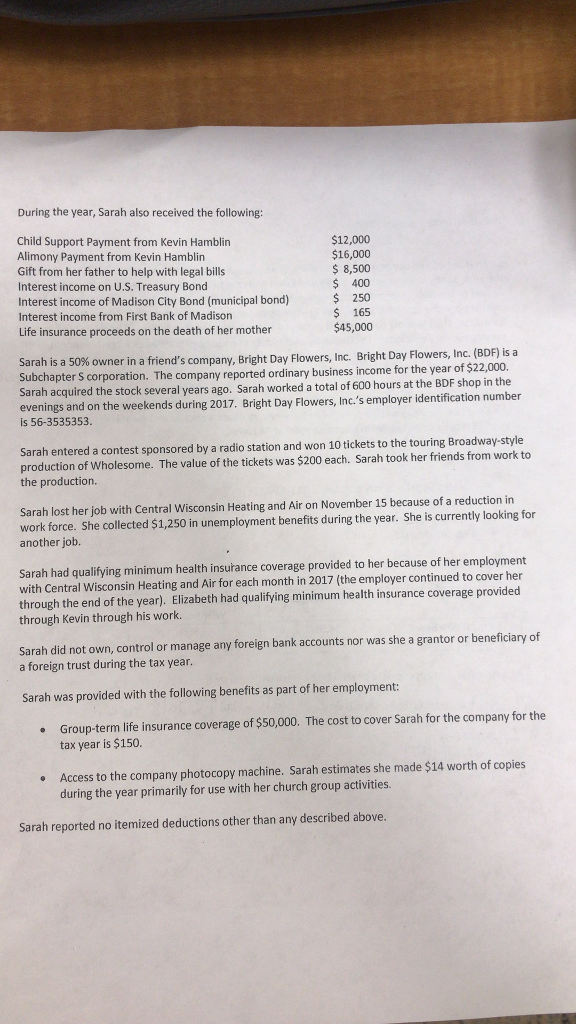

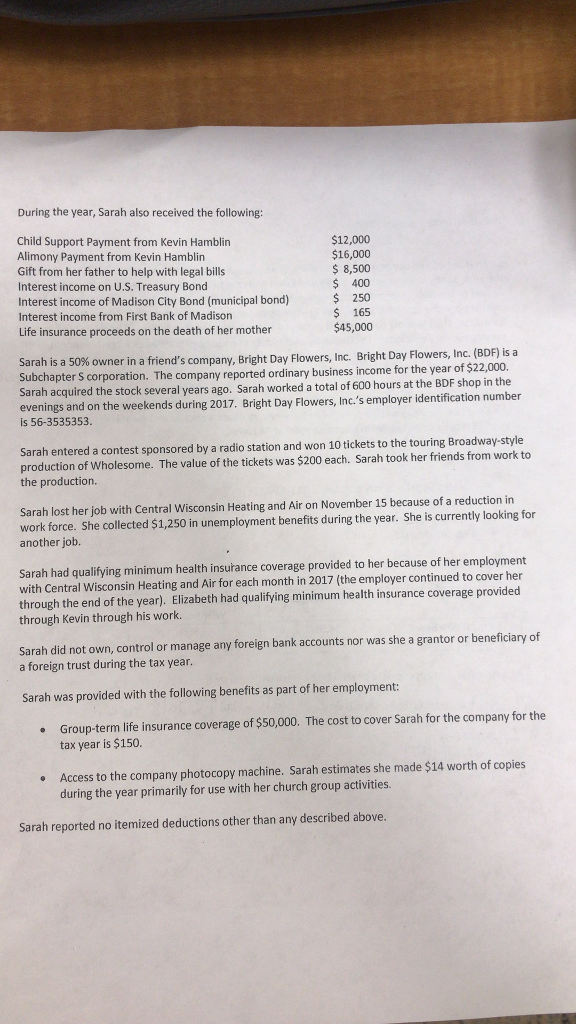

During the year, Sarah also received the following: Child Support Payment from Kevin Hamblin Alimony Payment from Kevin Hamblin Gift from her father to help with legal bills Interest income on U.S. Treasury Bond nterest income of Madison City Bond (municipal bond) Interest income from First Bank of Madison Life insurance proceeds on the death of her mother $12,000 $16,000 8,500 $ 400 $250 S 165 $45,000 Sarah is a 50% owner in a friend's company, Bright Day Flowers, Inc. Subchapter S corporation. Th Bright Day Flowers, Inc. (B DF) is a e company reported ordinary business income for the year of $22,000. arah acquired the stock several years ago. Sarah worked a total of 600 hours at the BDF shop in the evenings and on the weekends during 2017. Bright Day Flowers, inc.'s employer ietifiction numbie is 56-3535353. Sarah entered a contest sponsored by a radio station and won 10 tickets to the touring Broadway-style production of Wholesome. The value of the tickets was $200 each. Sarah took her friends from work to the production. Sarah lost her job with Central Wisconsin Heating and Air on November 15 because of a reduction in work force. She collected $1,250 in unemployment benefits during the year. She is currently looking for another job. Sarah had qualifying minimum health insurance coverage provided to her because of her employment with Central Wisconsin Heating and Air for each month in 2017 (the employer continued to cover her through the end of the year). Elizabeth had qualifying minimum health insurance coverage provided through Kevin through his work. Sarah did not own, control or manage any foreign bank accounts nor was she a grantor or beneficiary of a foreign trust during the tax yearn Sarah was provided with the following benefits as part of her employment: Group-term life insurance coverage of $50,000. The cost to cover Sarah for the company for the tax year is $150. Access to the company photocopy machine. Sarah estimates she made $14 worth of copies during the year primarily for use with her church group activities. Sarah reported no itemized deductions other than any described above. During the year, Sarah also received the following: Child Support Payment from Kevin Hamblin Alimony Payment from Kevin Hamblin Gift from her father to help with legal bills Interest income on U.S. Treasury Bond nterest income of Madison City Bond (municipal bond) Interest income from First Bank of Madison Life insurance proceeds on the death of her mother $12,000 $16,000 8,500 $ 400 $250 S 165 $45,000 Sarah is a 50% owner in a friend's company, Bright Day Flowers, Inc. Subchapter S corporation. Th Bright Day Flowers, Inc. (B DF) is a e company reported ordinary business income for the year of $22,000. arah acquired the stock several years ago. Sarah worked a total of 600 hours at the BDF shop in the evenings and on the weekends during 2017. Bright Day Flowers, inc.'s employer ietifiction numbie is 56-3535353. Sarah entered a contest sponsored by a radio station and won 10 tickets to the touring Broadway-style production of Wholesome. The value of the tickets was $200 each. Sarah took her friends from work to the production. Sarah lost her job with Central Wisconsin Heating and Air on November 15 because of a reduction in work force. She collected $1,250 in unemployment benefits during the year. She is currently looking for another job. Sarah had qualifying minimum health insurance coverage provided to her because of her employment with Central Wisconsin Heating and Air for each month in 2017 (the employer continued to cover her through the end of the year). Elizabeth had qualifying minimum health insurance coverage provided through Kevin through his work. Sarah did not own, control or manage any foreign bank accounts nor was she a grantor or beneficiary of a foreign trust during the tax yearn Sarah was provided with the following benefits as part of her employment: Group-term life insurance coverage of $50,000. The cost to cover Sarah for the company for the tax year is $150. Access to the company photocopy machine. Sarah estimates she made $14 worth of copies during the year primarily for use with her church group activities. Sarah reported no itemized deductions other than any described above