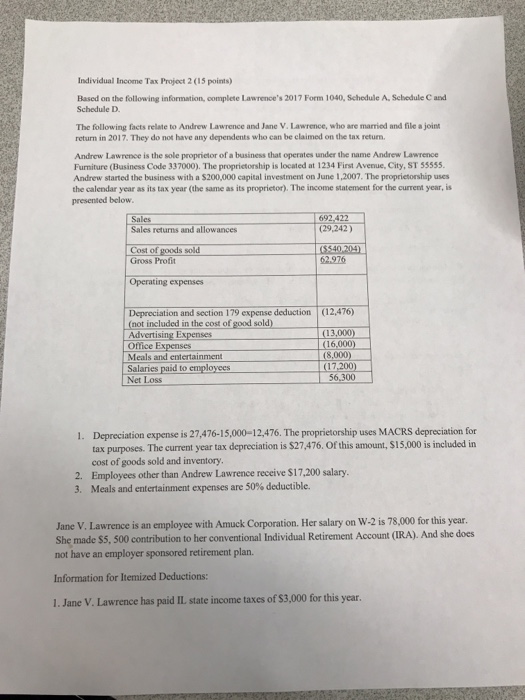

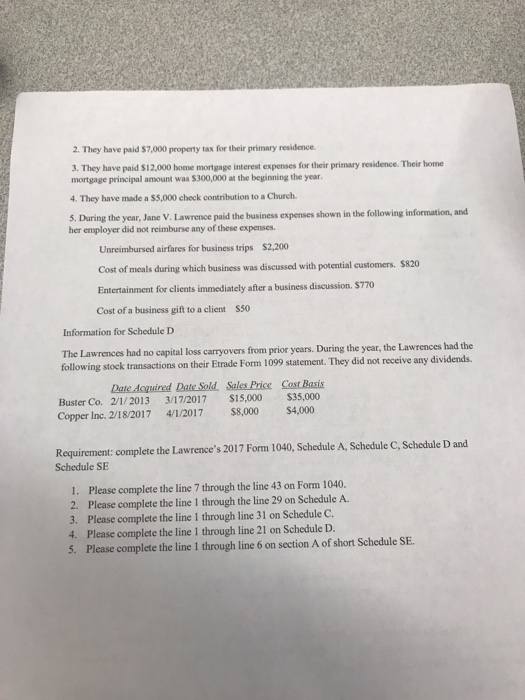

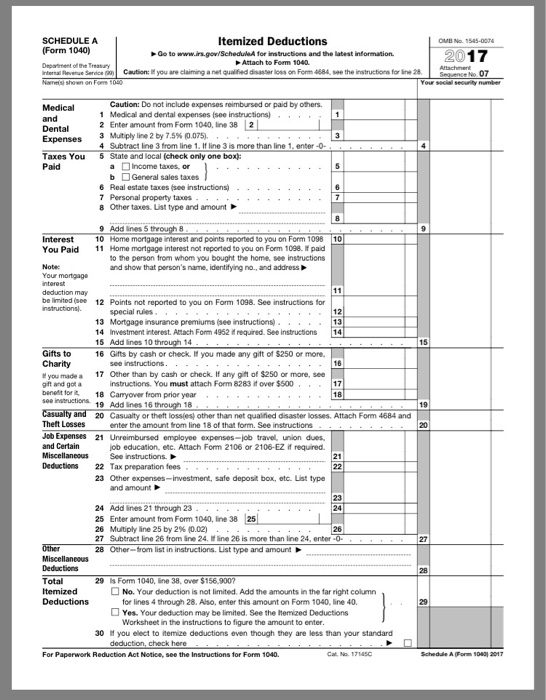

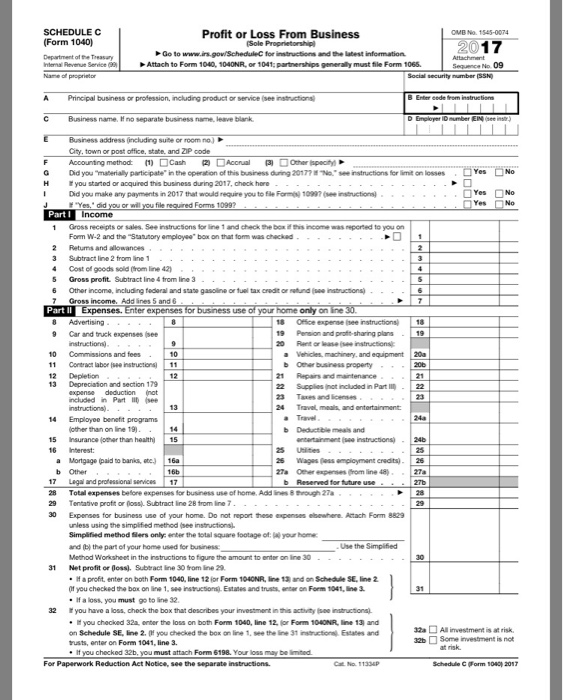

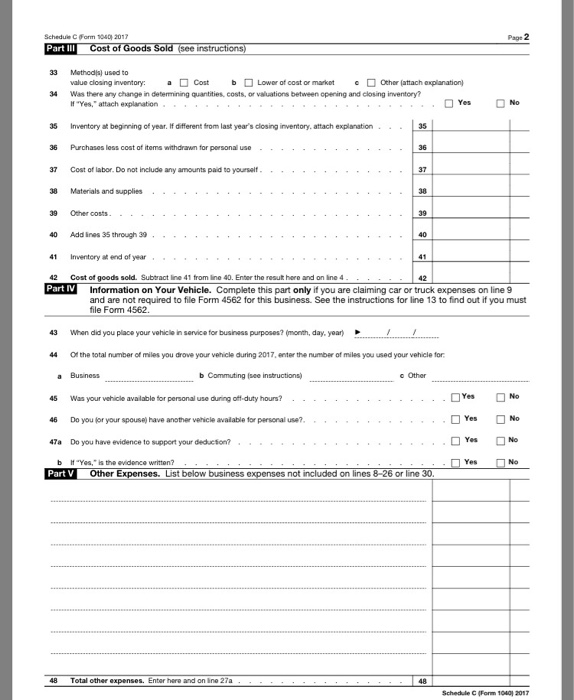

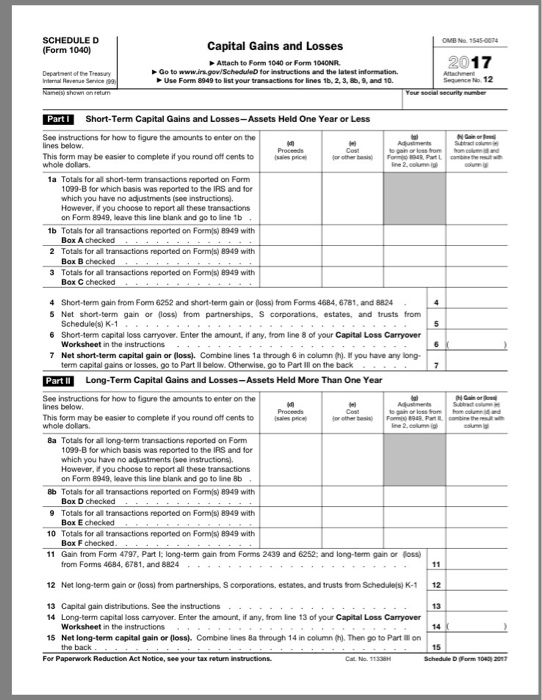

Individual Income Tax Project 2 (15 points) Based on the following information, complete Lawrence's 2017 Form 1040, Schedule A. Schedule C and Schedule D. The following facts relate to Andrew Lawrence and Jane V. Lawrence, who are married and file a joint return in 2017. They do not have any dependents who can be claimed on the tax return. Andrew Lawrence is the sole proprietor of a business that operates under the name Andrew Lawrence Furniture (Business Code 337000). The proprietorship is located at 1234 First Avenue, City, ST 55555. Andrew started the business with a S200,000 capital investment on June 1 .2007The proprietorship uses the calendar year as its tax year (the same as its proprietor). The income statement for the current year, is presented below Sales Sales returns and allowances 29,242) Cost of goods sold Gross Profit 62.976 Operating expenses Depreciation and section 179 expense deduction (not included in the cost of good sold) Advertising Expenses Office Expenses Meals and entertainment Salaries paid to employees Net Loss (12,476) 16,000 (8,000 1. Depreciation expense is 27,476-15,000-12,476. The proprietorship uses MACRS depreciation for tax purposes. The current year tax depreciation is $27,476. of this amount, $15,000 is included in cost of goods sold and inventory. Employees other than Andrew Lawrence receive $17.200 salary. Meals and entertainment expenses are 50% deductible. 2. 3, Jane V. Lawrence is an employee with Amuck Corporation. Her salary on W-2 is 78,000 for this year. She made $5, 500 contribution to her conventional Individual Retirement Account (RA). And she does not have an employer sponsored retirement plan. Information for Itemized Deductions: 1. Jane V. Lawrence has paid ILI state income taxes of $3,000 for this year Individual Income Tax Project 2 (15 points) Based on the following information, complete Lawrence's 2017 Form 1040, Schedule A. Schedule C and Schedule D. The following facts relate to Andrew Lawrence and Jane V. Lawrence, who are married and file a joint return in 2017. They do not have any dependents who can be claimed on the tax return. Andrew Lawrence is the sole proprietor of a business that operates under the name Andrew Lawrence Furniture (Business Code 337000). The proprietorship is located at 1234 First Avenue, City, ST 55555. Andrew started the business with a S200,000 capital investment on June 1 .2007The proprietorship uses the calendar year as its tax year (the same as its proprietor). The income statement for the current year, is presented below Sales Sales returns and allowances 29,242) Cost of goods sold Gross Profit 62.976 Operating expenses Depreciation and section 179 expense deduction (not included in the cost of good sold) Advertising Expenses Office Expenses Meals and entertainment Salaries paid to employees Net Loss (12,476) 16,000 (8,000 1. Depreciation expense is 27,476-15,000-12,476. The proprietorship uses MACRS depreciation for tax purposes. The current year tax depreciation is $27,476. of this amount, $15,000 is included in cost of goods sold and inventory. Employees other than Andrew Lawrence receive $17.200 salary. Meals and entertainment expenses are 50% deductible. 2. 3, Jane V. Lawrence is an employee with Amuck Corporation. Her salary on W-2 is 78,000 for this year. She made $5, 500 contribution to her conventional Individual Retirement Account (RA). And she does not have an employer sponsored retirement plan. Information for Itemized Deductions: 1. Jane V. Lawrence has paid ILI state income taxes of $3,000 for this year