Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A change to a 17% flat tax could cause a considerable increase in many taxpayers' taxes and a considerable decrease in the case of

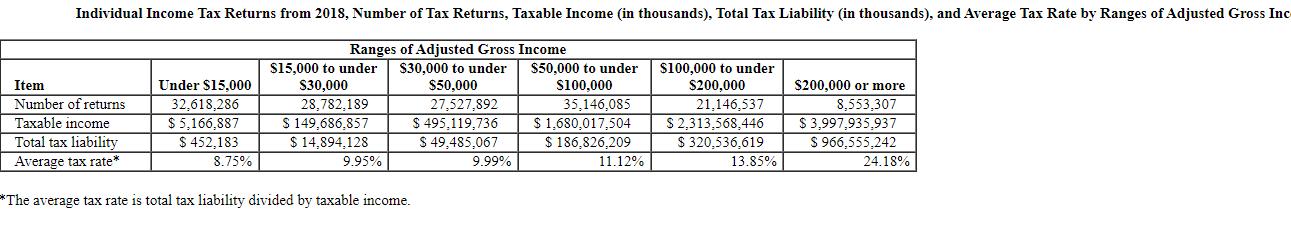

A change to a 17% flat tax could cause a considerable increase in many taxpayers' taxes and a considerable decrease in the case of others. Explain this statement in light of the statistics in Table Individual Income Tax Returns from 2018, Number of Tax Returns, Taxable Income (in thousands), Total Tax Liability (in thousands), and Average Tax Rate by Ranges of Adjusted Gross Inc Ranges of Adjusted Gross Income S15,000 to under S30,000 28,782,189 S 149,686,857 $ 14,894,128 $30,000 to under $50,000 $50,000 to under s100,000 s100,000 to under S200,000 $200,000 or more 8,553,307 $ 3,997,935,937 S 966,555,242 24.18% Item Number of returns Taxable income Total tax liability Average tax rate* Under S15,000 32,618,286 $ 5,166,887 $ 452,183 8.75% 27,527,892 $ 495,119,736 $ 49,485,067 9.99% 35,146,085 $ 1,680,017,504 $ 186,826,209 21.146.537 $ 2,313,568,446 $ 320,536,619 9.95% 11.12% 13.85% *The average tax rate is total tax liability divided by taxable income.

Step by Step Solution

★★★★★

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Solution Based on table 13 one can see that average tax rate for each slab payer is different The sm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started