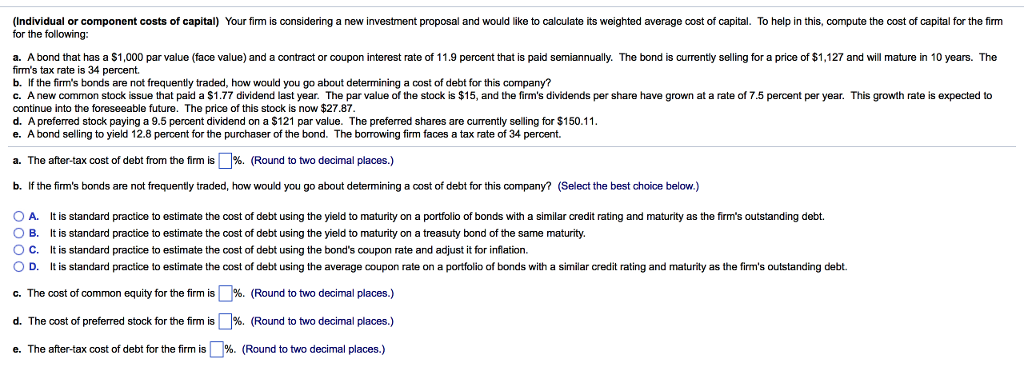

(Individual or component costs of capital) Your firm is considering a new investment proposal and would like to calculate its weighted average cost of capital. To help in this, compute the cost of capital for the firm for the following: a. A bond that has a $1,000 par value (face value) and a contract or coupon interest rate of 11.9 percent that is paid semiannualty. The bond is currently selling for a price of $1,127 and will mature in 10 years. The firm's tax rate is 34 percent. b. If the firm's bonds are not frequently traded, how would you go about determining a cost of debt for this company? c. A new com mon stock issue that paid a S 1 77 dividend ast year. The par value o the stock s $15, and the rm's d vidends pers are have gro na arateof?5 e ent per ear. This ro th ate se pected to continue into the foreseeable future. The price of this stock is now $27.87. d. A preferred stock paying a 9.5 percent dividend on a $121 par value. The preferred shares are currently selling for $150.11 e. A bond selling to yield 12.8 percent for the purchaser of the bond. The borrowing firm faces a tax rate of 34 percent. a. The after-tax cost of debt from the firm is %. (Round to two decimal places.) b. If the firm's bonds are not frequently traded, how would you go about determining a cost of debt for this company? (Select the best choice below.) OA. It is standard practice to estimate the cost of debt using the yield to maturity on a portfolio of bonds with a similar credit rating and maturity as the firm's outstanding debt O B. It is standard practice to estimate the cost of debt using the yield to maturity on a treasuty bond of the same maturity. O C. It is standard practice to estimate the cost of debt using the bond's coupon rate and adjust it for inflation. O D. It is standard practice to estimate the cost of debt using the average coupon rate on a portfolio of bonds with a similar credit rating and maturity as the firm's outstanding debt. c. The cost of common equity for the firm isD%. (Round to two decimal places.) d. The cost of preferred stock for the firm iO%. (Round to two decimal places.) e. The after-tax cost of debt for the firm is L %. (Round to two decimal places.)