Question

Individual Rehabilitation Services (IRS) is a not-for-profit organization that assists individuals returning to society following a substance abuse conviction. IRS has been greatly successful in

Individual Rehabilitation Services (IRS) is a not-for-profit organization that assists individuals returning to society following a substance abuse conviction. IRS has been greatly successful in its urban efforts. Thus, more resources are needed. Late last year IRS began a restaurant operation, The Golden Kettle, that specializes in soups. Last years operation was a break-even effort. At the beginning of the year, The Golden Kettle relocated to a newer facility. It has been clearly established by the district director of the Internal Revenue Service (the other IRS) that income generated by The Golden Kettle will be unrelated business income.

Cash receipts: $160,900 (sales of $156,100 plus $4,800 donated to IRS by Golden Kettle customers)

Other Information

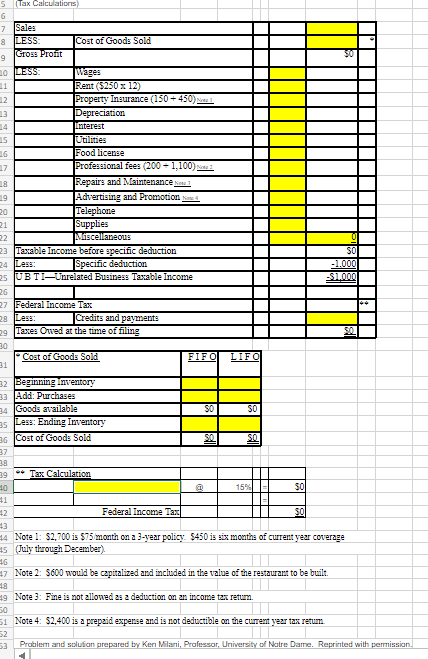

1. IRS is an accrual-basis, calendar-year taxpayer.

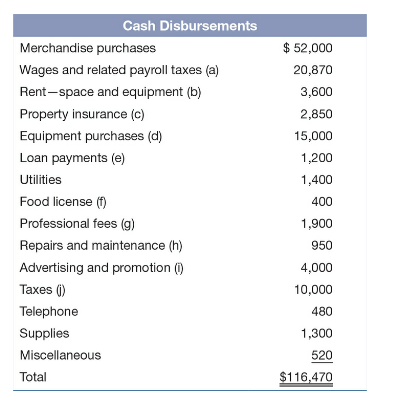

Explanation of notes: Includes employers share of Federal Insurance Contributions Act (FICA) tax, which funds the Social Security and Medicare system.

Rent is $250 per month. A $350 security deposit was made and the final months rent was paid in advance on an 18-month lease.

Two assets are insured: inventory$150 (a floating figure based on monthly inventory levels); tangible personal property$2,700 (a 3-year policy that was acquired on July 1 of the current year).

Additional equipment not provided by the owner of the facility is required and acquired. Information pertaining to this equipment is shown below:

$100 a month is paid to Buckner Bank on a $3,000 loan used to purchase the equipment in (d). Interest expense is $450.

$200 is paid on January 1 and July 1 to the city controller, who issues a 6-month license at those dates.

Breakdown of this expense indicates:

$200Preparation of prior years tax return.

$600Payment to an architect for her plans, which will be used to build another restaurant in the near future.

$1,100Attorney fee in settling a claim brought by a customer who claimed that she was served undercooked food, which led to her illness.

The previous customer claim brought about an extensive inspection by the Health Department, which ordered several changes (costing $650) in the operation and fined IRS $300. The $300 is included in the $950 repairs and maintenance figure. (Note that fines are not deductible on a federal income tax return.)

Includes $1,600 of newspaper advertising plus $2,400 paid for an internet site ad that will begin in March of next year.

Estimated federal income tax payments during the year.

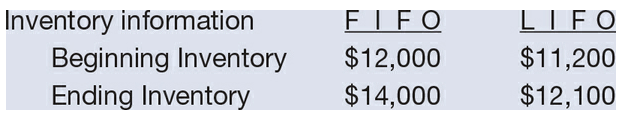

\begin{tabular}{|l|r|r|} \hline Cost of Goods Sold & FIF & L I F \\ \hline Beginninglnventory & & \\ \hline Add: Purchases & & \\ \hline Goods available & & \\ \hline Less: Ending Inventory & So & So \\ \hline Cost of Goods Sold & SO & \\ \hline \end{tabular} Tax Calculation Note 1: $2,700 is $75 month on a 3-year policy. $450 is six months of current year coverage (July through December). Note 2: $600 would be capitalized and included in the value of the restaurast to be built. Note 3: Fine is not allowed as a deduction on an income tax return. Note 4: $2,400 is a prepaid experse and is not deductible on the current year tax retum. Problem and solufian prepared by Ken Mlani, Professor, University of Natre Dame. Reprinted with permissian. \begin{tabular}{lr} \multicolumn{2}{c}{ Cash Disbursements } \\ Merchandise purchases & $52,000 \\ Wages and related payroll taxes (a) & 20,870 \\ Rent - space and equipment (b) & 3,600 \\ Property insurance (c) & 2,850 \\ Equipment purchases (d) & 15,000 \\ Loan payments (e) & 1,200 \\ Utilities & 1,400 \\ Food license (f) & 400 \\ Professional fees (g) & 1,900 \\ Repairs and maintenance (h) & 950 \\ Advertising and promotion (i) & 4,000 \\ Taxes (j) & 10,000 \\ Telephone & 480 \\ Supplies & 1,300 \\ Miscellaneous & 520 \\ Total & $116,470 \\ \hline \end{tabular} \begin{tabular}{llll} & Class Life & Cost & Current Year Depreciation \\ \hline Description & & & \\ \hline Cash register & 5 -year & $5,000 & $1,000(20%$5,000) \\ Broaster & 7-year & $10,000 & $1,430(14.3%$10,000) \end{tabular} \begin{tabular}{|l|r|r|} \hline Cost of Goods Sold & FIF & L I F \\ \hline Beginninglnventory & & \\ \hline Add: Purchases & & \\ \hline Goods available & & \\ \hline Less: Ending Inventory & So & So \\ \hline Cost of Goods Sold & SO & \\ \hline \end{tabular} Tax Calculation Note 1: $2,700 is $75 month on a 3-year policy. $450 is six months of current year coverage (July through December). Note 2: $600 would be capitalized and included in the value of the restaurast to be built. Note 3: Fine is not allowed as a deduction on an income tax return. Note 4: $2,400 is a prepaid experse and is not deductible on the current year tax retum. Problem and solufian prepared by Ken Mlani, Professor, University of Natre Dame. Reprinted with permissian. \begin{tabular}{lr} \multicolumn{2}{c}{ Cash Disbursements } \\ Merchandise purchases & $52,000 \\ Wages and related payroll taxes (a) & 20,870 \\ Rent - space and equipment (b) & 3,600 \\ Property insurance (c) & 2,850 \\ Equipment purchases (d) & 15,000 \\ Loan payments (e) & 1,200 \\ Utilities & 1,400 \\ Food license (f) & 400 \\ Professional fees (g) & 1,900 \\ Repairs and maintenance (h) & 950 \\ Advertising and promotion (i) & 4,000 \\ Taxes (j) & 10,000 \\ Telephone & 480 \\ Supplies & 1,300 \\ Miscellaneous & 520 \\ Total & $116,470 \\ \hline \end{tabular} \begin{tabular}{llll} & Class Life & Cost & Current Year Depreciation \\ \hline Description & & & \\ \hline Cash register & 5 -year & $5,000 & $1,000(20%$5,000) \\ Broaster & 7-year & $10,000 & $1,430(14.3%$10,000) \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started