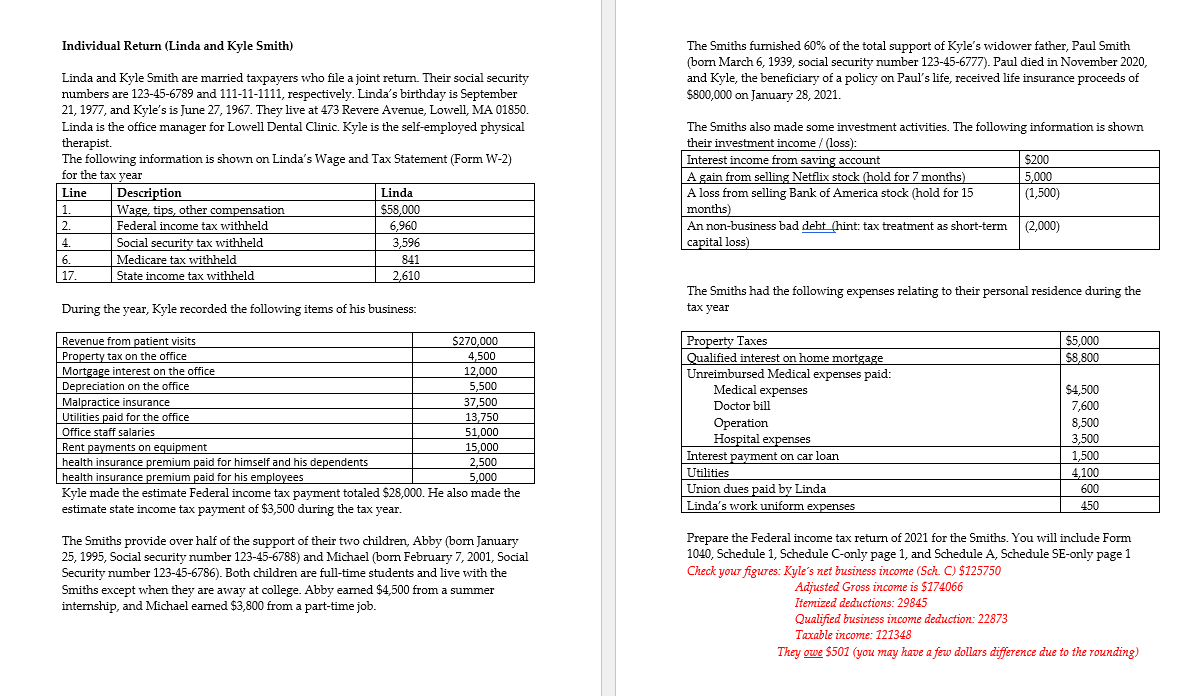

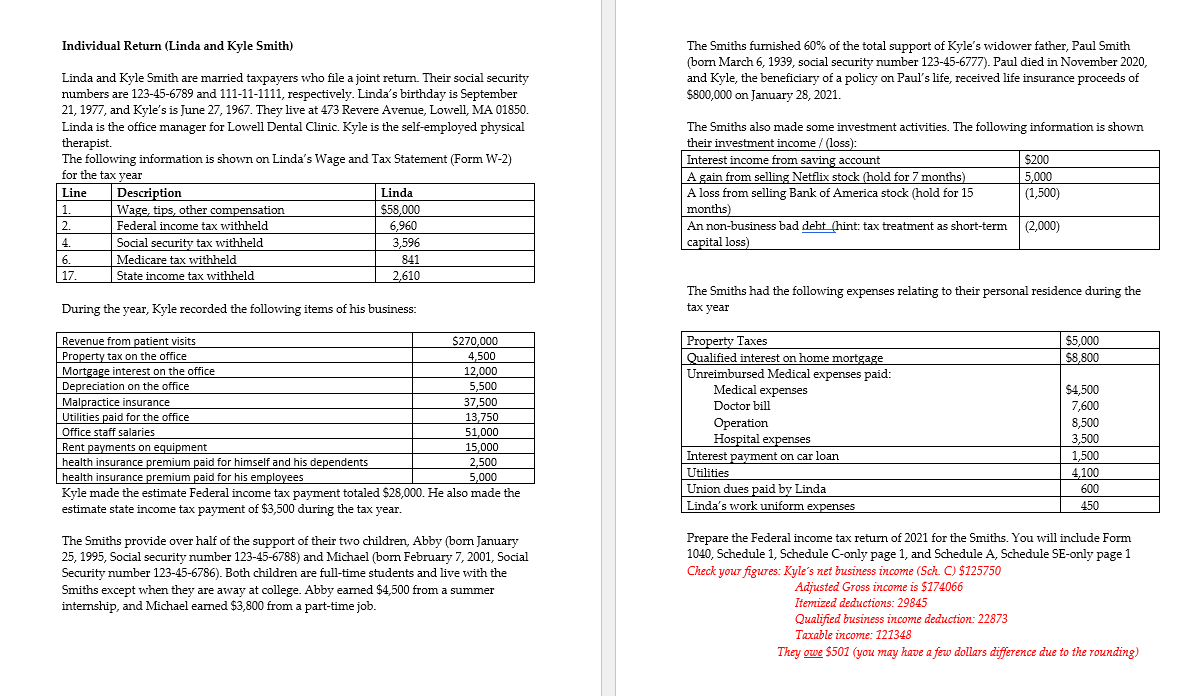

Individual Return (Linda and Kyle Smith) The Smiths furnished 60% of the total support of Kyle's widower father, Paul Smith Linda and Kyle Smith are married taxpayers who file a joint return. Their social security (born March 6, 1939, social security number 123-45-6777). Paul died in November 2020, numbers are 123-45-6789 and 111-11-1111, respectively. Linda's birthday is September $800,000 on January 28,2021. 21, 1977, and Kyle's is June 27, 1967. They live at 473 Revere Avenue, Lowell, MA 01850. Linda is the office manager for Lowell Dental Clinic. Kyle is the self-employed physical Linda is th The following information is shown on Linda's Wage and Tax Statement (Form W-2) The Smiths also made some investment activities. The following information is shown for the tax vear During the year, Kyle recorded the following items of his business: The Smiths had the following expenses relating to their personal residence during the tax year Kyle made the estmate rederal income tax payment totaled 8,000. He also made the estimate state income tax payment of $3,500 during the tax year. The Smiths provide over half of the support of their two children, Abby (born January 25,1995 , Social security number 123456788 ) and Michael (born February 7,2001 , Soci Security number 123456786 ). Both children are full-time students and live with the Smiths except when they are away at college. Abby earned $4,500 from a summer internship, and Michael earned $3,800 from a part-time job. Prepare the Federal income tax return of 2021 for the Smiths. You will include Form 1040, Schedule 1, Schedule C-only page 1, and Schedule A, Schedule SE-only page 1 Check your figures: Kyle's net business income (Sch. C) \$125750 internship, and Michael earned $3,800 from a part-time job. Adjusted Gross income is $174066 Itemized deductions: 29845 Qualified business income deduction: 22873 Taxable income: 121348 Individual Return (Linda and Kyle Smith) The Smiths furnished 60% of the total support of Kyle's widower father, Paul Smith Linda and Kyle Smith are married taxpayers who file a joint return. Their social security (born March 6, 1939, social security number 123-45-6777). Paul died in November 2020, numbers are 123-45-6789 and 111-11-1111, respectively. Linda's birthday is September $800,000 on January 28,2021. 21, 1977, and Kyle's is June 27, 1967. They live at 473 Revere Avenue, Lowell, MA 01850. Linda is the office manager for Lowell Dental Clinic. Kyle is the self-employed physical Linda is th The following information is shown on Linda's Wage and Tax Statement (Form W-2) The Smiths also made some investment activities. The following information is shown for the tax vear During the year, Kyle recorded the following items of his business: The Smiths had the following expenses relating to their personal residence during the tax year Kyle made the estmate rederal income tax payment totaled 8,000. He also made the estimate state income tax payment of $3,500 during the tax year. The Smiths provide over half of the support of their two children, Abby (born January 25,1995 , Social security number 123456788 ) and Michael (born February 7,2001 , Soci Security number 123456786 ). Both children are full-time students and live with the Smiths except when they are away at college. Abby earned $4,500 from a summer internship, and Michael earned $3,800 from a part-time job. Prepare the Federal income tax return of 2021 for the Smiths. You will include Form 1040, Schedule 1, Schedule C-only page 1, and Schedule A, Schedule SE-only page 1 Check your figures: Kyle's net business income (Sch. C) \$125750 internship, and Michael earned $3,800 from a part-time job. Adjusted Gross income is $174066 Itemized deductions: 29845 Qualified business income deduction: 22873 Taxable income: 121348