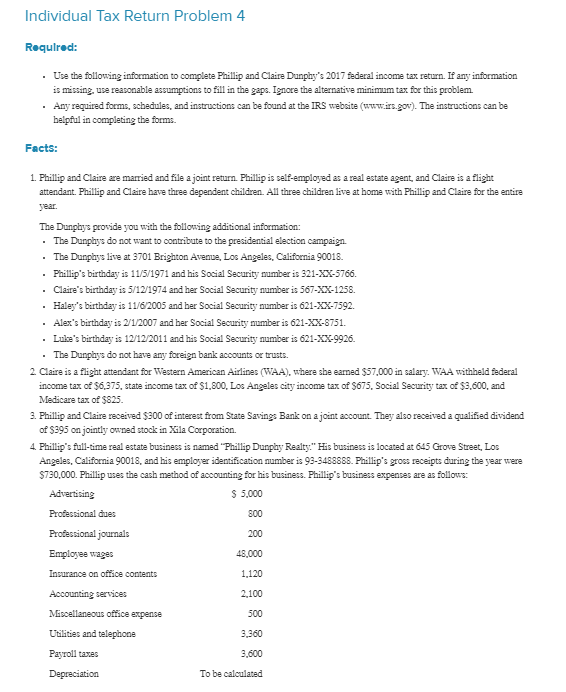

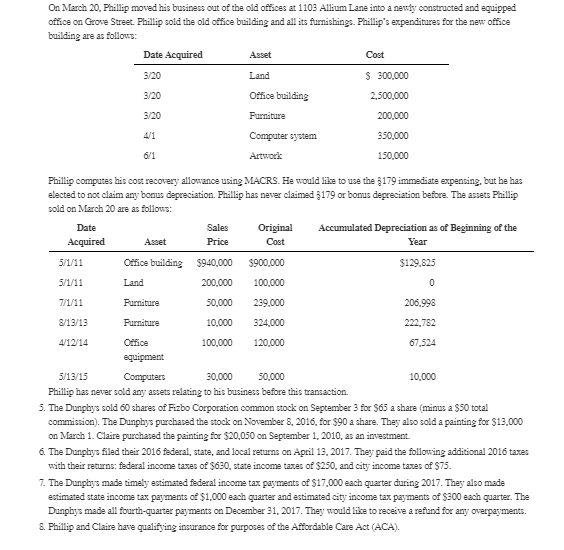

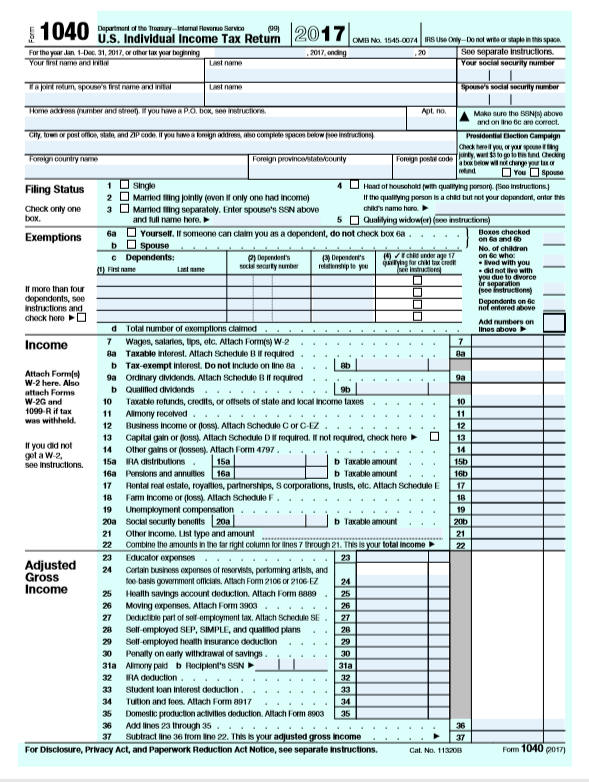

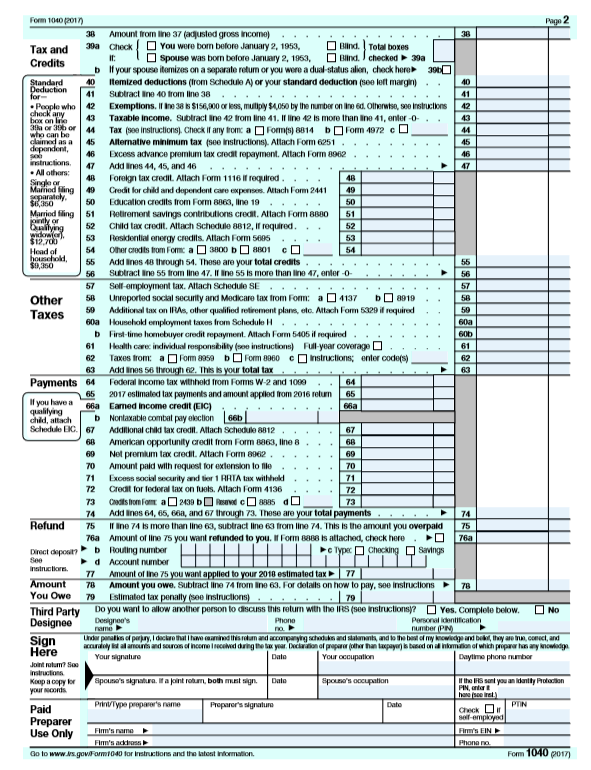

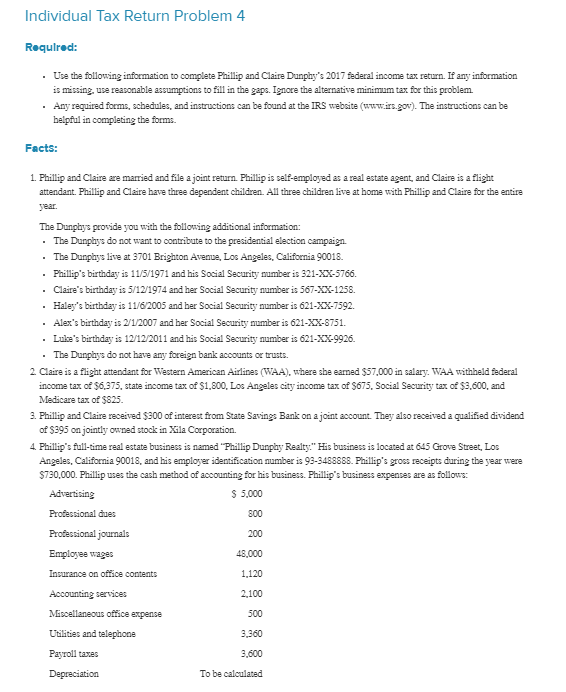

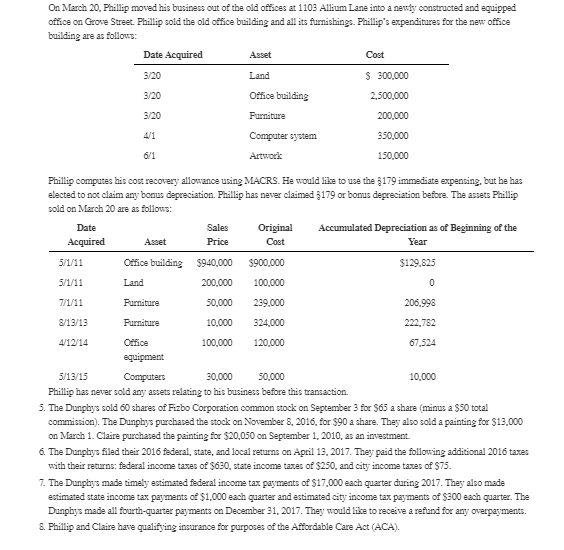

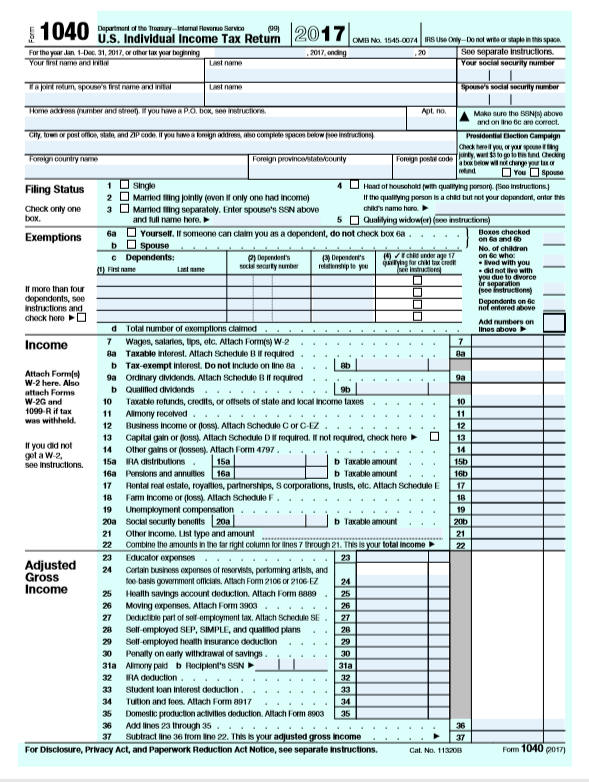

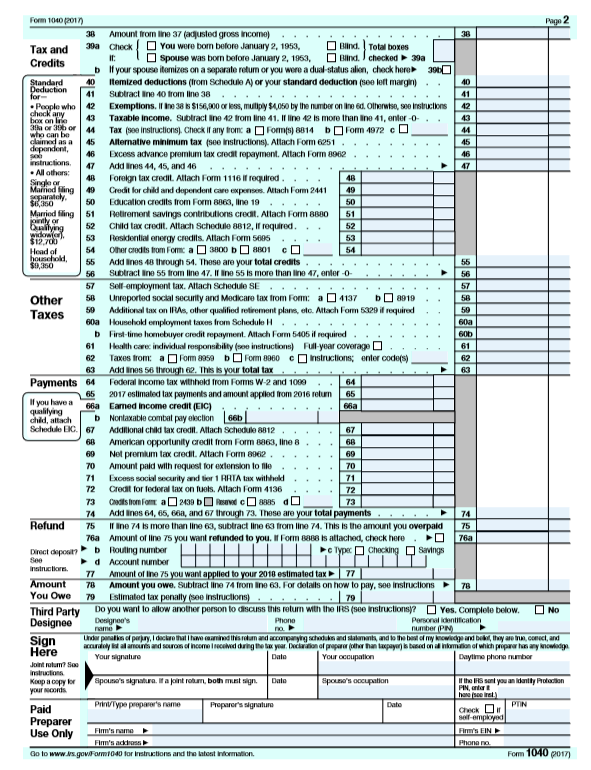

Individual Tax Return Problem 4 Requlred: .Use the following information to complete Phillip and Claire Dunphy's 2017 federal income tax return. If any information is missing, use reasonable assumptions to fill in the gaps. Ignore the alternative minimum tax for this problem. Any required forms, schedules, and instructions can be found at the IRS website (wwwirs.gov). The instructions can be belpful in completing the forms. Facts: 1 Phillip and Claire are married and file a joint return. Phillip is self-employed as a real estate agent, and Claire is a flight attendant. Phillip and Claire have three dependent children. All three children live at home with Phillip and Claire for the entire year. The Dunphys provide you with the following additional information: The Dunphys do not want to contribute to the presidential elaction campaign The Dunphys live at 3701 Brighton Avenuve, Los Angeles, California 90018. Phillip's birthday is 11/5/1971 and his Social Security umber is 321-XX-5766. Claire's birthday is 5/12/1974 and her Social Security number is 567-XX-1258. Haley's birthday is 11/6/2005 and her Social Security mumber is 621-XX-1592. . Alex's birthday is 21/2007 and her Social Security number is 621-XX-8751 Luke's birthday is 12/12/2011 and his Social Security umber is 621-X-9926. The Dunphys do not have any foreign bank accounts or trusts. 2 Claire is a flight attendant for Western American Airlines (WAA), where she eamed $57,000 in salary. WAA withheld federal income tax of $6,375, state income tax of $1,800, Los Angeles city income tax of $675, Social Security tax of $3,600, and Medicare tax of $825. 3. Phillip and Claire received $300 of interet from State Savings Bank on a joint account. They also received a qualifed dividend of $395 on jointly owned stock in Xila Corporation. 4 Phillip's full-time real estate business is named "Phillip Dunphy Realty." His business is located at 645 Grove Street, Los Angeles, California 90018, and his employer identifcation number is 93-3483888. Phillip's gross receipts during the year were $730,000. Phillip uses the cash method of accounting for his business. Phillip's business expenses are as follows Advertising Professional dues Professional journals Emploree wages Insuranca on office contents Accounting services Miscellaneous office expense Uilities and telephone Payroll taxes S 5,000 800 200 48,000 1,120 2,100 500 3,360 3,600 To be calculated On March 20, Phillip moved his business out of the old offices at 1103 Allium Lane into a newty constructed and equipped office on Grove Street. Phillip sold the old office building and all its furnishings. Phillip's expenditures for the new office building are as follows: Date Acquired 3/20 3/20 3/20 Cost S 300,000 Office building 200,000 Computer system 350,000 Phillip computes his cost recovery allowance using MACRS. He would ie to use the 179 immediate expensing, but he has elected to not claim any bonus depreciation. Phillip has neer claimed 8179 or bonus depreciation before. The assets Phillip sold on March 20 are as follows: Date Sales Price Origia Accumulated Depreciation as of Beginning of the Year Office building $940,000 $900,000 200,000 100,000 50,000 239.000 10,000 324,000 100,000 120,000 129.825 222,782 41214 equiponect Office 67,524 0,00050,000 10,000 Phillip has never sold any assets relating to his business before this transaction. 5. The Dunphys sold 60 shares of Fizbo Corporation common stock on September 3 for $65 a share (minus a S50 total commission). The Dunphys purchased the stock on November 8, 2016, for $90 a share. Thay also sold a painting for $13,000 on March 1. Claire purchased the painting for $20,050 on September 1, 2010, as an investment. 6. The Dunphys filed their 2016 faderal, state, and local returns on April 13, 2017. They paid the following additional 2016 taxes with their returns: faderal income taxes of $630, state income tates of $250, and city income taxes of $75. 7. The Dunphys made timely estimated faderal income tax payments of $17,000 each quarter during 2017. They also made estimated state income tax payments of $1,000 each quarter and estimated city income tax payments of $300 each quarter. Tba Dunphys made all fourth-quarter payments on December 31, 2017. They would lie to raceive a refund for any overpayments. &. Phillip and Claire have qualifying insurance for purposes of the Affordable Care Act (ACA). 1 040 us. Individual Income Tax Return 2017 OMB 1545 0074 Rsu seoay Doo na paco r the yar -lan 1-D 31,2017,c otr ta yor bigening See separa e Instructiors Lest nam Lest nam Rrneath.spunter and.m" you have a p a box, s'o "strict.rs. Apt no. Make sure the S8Npa) above Prosidential Dection Camplgn You spouse Filing Statusngl Check only one 3Maedng separately. Enter spouse's SSN above Mae ing Jonly teven Ii only one had income) I the qualryng porson is a child but not your dopantort, onfer ts name haro. and full name here. Exemptions b Spouse 6a Yourself. " someone can carn you as a dependent, do not diox box 6a Boxes checked c Dependents: Firt nane Dependents *Deed with you- If more than four dependents, see Instructions and chock hero entered iowe Add numbers on d Total number of exemptions claimed 7 Wages, salaries, tps, etc. tach Form(s) W-2 Income aa Taxable interest. Altach Schedule B if required da b Tax-exempt inlerest. Do not Include on line 8a Attach Forml 9a Ordinary divkdends. Altach Schedue BI required 9a W-2 here. Also attach Forms W-2G and 1099-R if tax was withhekd 10 Taxable refunds, credits, or offsets of state and local Income taxes 11 10 Almony receved 12 Business income or (lossi. Atach Schedile or C-EZ 12 13 14 Capital gain or Ossa Attach Sch die D " required. I' rol reqRed, dheck hef/> 1.3 If you did not get a w-2, see Instructions. other gins or (kssesa Attact,Form 4797 RA distributions 16a Pensions and annuties 16a 17 Rental reat oste,roas, partnerships, S corporaions, ss, olc. Altach schiectE 17 18 Farm income or (loss). Altach Schedule F 19 Unemployment compensation 20a Soctal security benellts 21 Other Income. List type and amount 22 Combine the amounts n the tar right column for ines z trough 21. ris your total Income22 23 Educator expenses 24 cartanbusiness experses ot esrvists, prkoming artss, and b Taxable amount b Taxablo amount 15a 18 axale amount 21 23 Adjusted Gross Income oe basis gowernment ofnicias. Ailach Fom 2106 or 2106 EZ24 25 Health savings account deduction. Altach For925 26 Moving expenses. Altach Fom 3903 7 Deductie part of sest-employment tax. Altach SchedseSE27 28 Sell-employed SEP, SIMPLE, and qualitied plans 28 29 Sell employed health insurance dedction 30 Penalty on earty withdrawal of savings 32 33 Sludent loan inlerest deduction 34 Tition and lees. Allach Form 8917 35 Domeslc production aciMtios deduction. Allach Form 8903 35 36 Ak nes 23 through 35 34 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate Iinstructions. Cat. No. 113208 Fom 0017) Form 1040 (201) 8 Amount from line 37 (adjusled gross income) Tax and 30a cYou were bom belore January 2,93, Bn.Total boxes Credits : spouse was born before January 2. 1 63, OBand, j checked 3ga "your spouse itemizes on a s parato return or you won a dual-status alien chock hen 30d 40 41 temized deductions (Irom Schedule Aj or your standard deduction (see lert margin Suoltract ine 40 trom line Pepple whoExemptions. I ine 38 $156,800 or less, muitipy $4050 by the number online 6d. Olferwtse, see Instructons42 at oor nbor who can be caimd as a45 Alternative minlmum tax (see insiructions. Aftach Form 6251 dpannt, Anothers 43 axable income. Subtract ine 42 trom line 41. I lin 42 s more than ine 41, enter-o- 43 44 Tax (see instructions). Chocx " amy trom: aromiti) 8814 bOForm 4972 c 46 Excess advance premium tax crecat repayment. Attach Form 8962 47 Add ines 44, 45, and 46 47 ar 48 Forekgn tax credit Altach Form 1116 Iif required ed fing 49 Credit for child and dependent care expenises. Altach Fom 24414 50 EQucation credits from Form 8863, line 19 Mamiod iing 51 etent savings contributions crean. Allach Form 88801 R53 Reskdential energy credits. Altach Form 5695 52 Child tax credit. Altach Schedule 8812, If required 53 55 Add ines 48 through 54. These are your total credits 56 Sotract ine 55 from ine 47. Il ine 55 is more than line 47, enter-o 57 Sell-employment tax. Altach Schedule S 56 57 Other 58 Unreported social secunity and Medicare tax trom Fom:8919 50 Additional tax on IRAs, other qualified retirement plans, etc.Atlach Fom 5329 if required 60a Household employment taxes from Schedule b First-time homebuyer credit repayment. Attach Form 5405 if required 61 Hoailth care individul responsibility (see instructions)Ful-year coverage 62 Taxes trom aFom 8Fom860 nstructo enter code(s) 63 Add irnes 56 through e2. This is your total tax 62 63 Payments 64 Federal income tax withhekd trom Fomms W-2 and 1000 64 65 2017 eslimated tax payments and amount appiled rom 2016 retun65 "66a Emed income credit (EIC) qualilying chid, attachb Nontaxable combat pay eection 66 Schedule EC 67 ddiional chilkd tax credit. Allach Schedule 8812. 67 68 American opportunity credit from Form 8363, ine8 69 Net premium tax credit. Altach Form 8962 0 Amount pald with request for extension to le 71 Excess social security and tior 1 RRTA tax withheld 70 71 72 73 72 Credit for lederal tax on fuels. Allach Fom 4136 Add ines 64, 65, 6ia, and 67 thwough 73. These are your total payments 75 76a 74 74 Refund I ine 74 is more than line 63, subtract line 63 trom line 74. This is the amount you overpald Anourt o' li 75you want refunded to ou."Form 8888 ls ara led Cheek hee 75 77 Amount of Ine 75 you want applied to your 2018 estimatedta 77 Amount 78 Amount you owe. Sublract line 74 rom ino 63. For delalils on now to pay, see inslrucions78 You Owe 79 Estimated tax penalty (see Instructions Third Party Do you want to alow another person to daiscuss this relurn with the IS (see inslructions?Yes. Complete belowNo Designee Sign Here Personal identilcation Your signauro Dalo Your cccupatlon Daytime phona umbar your ssconts Paid Preparer Use Only Fs rsame Go to www.ws.gowsForm1040 for Instructions and tho labost homation PTIN Proparor's signature Fom 1040 pP017) Individual Tax Return Problem 4 Requlred: .Use the following information to complete Phillip and Claire Dunphy's 2017 federal income tax return. If any information is missing, use reasonable assumptions to fill in the gaps. Ignore the alternative minimum tax for this problem. Any required forms, schedules, and instructions can be found at the IRS website (wwwirs.gov). The instructions can be belpful in completing the forms. Facts: 1 Phillip and Claire are married and file a joint return. Phillip is self-employed as a real estate agent, and Claire is a flight attendant. Phillip and Claire have three dependent children. All three children live at home with Phillip and Claire for the entire year. The Dunphys provide you with the following additional information: The Dunphys do not want to contribute to the presidential elaction campaign The Dunphys live at 3701 Brighton Avenuve, Los Angeles, California 90018. Phillip's birthday is 11/5/1971 and his Social Security umber is 321-XX-5766. Claire's birthday is 5/12/1974 and her Social Security number is 567-XX-1258. Haley's birthday is 11/6/2005 and her Social Security mumber is 621-XX-1592. . Alex's birthday is 21/2007 and her Social Security number is 621-XX-8751 Luke's birthday is 12/12/2011 and his Social Security umber is 621-X-9926. The Dunphys do not have any foreign bank accounts or trusts. 2 Claire is a flight attendant for Western American Airlines (WAA), where she eamed $57,000 in salary. WAA withheld federal income tax of $6,375, state income tax of $1,800, Los Angeles city income tax of $675, Social Security tax of $3,600, and Medicare tax of $825. 3. Phillip and Claire received $300 of interet from State Savings Bank on a joint account. They also received a qualifed dividend of $395 on jointly owned stock in Xila Corporation. 4 Phillip's full-time real estate business is named "Phillip Dunphy Realty." His business is located at 645 Grove Street, Los Angeles, California 90018, and his employer identifcation number is 93-3483888. Phillip's gross receipts during the year were $730,000. Phillip uses the cash method of accounting for his business. Phillip's business expenses are as follows Advertising Professional dues Professional journals Emploree wages Insuranca on office contents Accounting services Miscellaneous office expense Uilities and telephone Payroll taxes S 5,000 800 200 48,000 1,120 2,100 500 3,360 3,600 To be calculated On March 20, Phillip moved his business out of the old offices at 1103 Allium Lane into a newty constructed and equipped office on Grove Street. Phillip sold the old office building and all its furnishings. Phillip's expenditures for the new office building are as follows: Date Acquired 3/20 3/20 3/20 Cost S 300,000 Office building 200,000 Computer system 350,000 Phillip computes his cost recovery allowance using MACRS. He would ie to use the 179 immediate expensing, but he has elected to not claim any bonus depreciation. Phillip has neer claimed 8179 or bonus depreciation before. The assets Phillip sold on March 20 are as follows: Date Sales Price Origia Accumulated Depreciation as of Beginning of the Year Office building $940,000 $900,000 200,000 100,000 50,000 239.000 10,000 324,000 100,000 120,000 129.825 222,782 41214 equiponect Office 67,524 0,00050,000 10,000 Phillip has never sold any assets relating to his business before this transaction. 5. The Dunphys sold 60 shares of Fizbo Corporation common stock on September 3 for $65 a share (minus a S50 total commission). The Dunphys purchased the stock on November 8, 2016, for $90 a share. Thay also sold a painting for $13,000 on March 1. Claire purchased the painting for $20,050 on September 1, 2010, as an investment. 6. The Dunphys filed their 2016 faderal, state, and local returns on April 13, 2017. They paid the following additional 2016 taxes with their returns: faderal income taxes of $630, state income tates of $250, and city income taxes of $75. 7. The Dunphys made timely estimated faderal income tax payments of $17,000 each quarter during 2017. They also made estimated state income tax payments of $1,000 each quarter and estimated city income tax payments of $300 each quarter. Tba Dunphys made all fourth-quarter payments on December 31, 2017. They would lie to raceive a refund for any overpayments. &. Phillip and Claire have qualifying insurance for purposes of the Affordable Care Act (ACA). 1 040 us. Individual Income Tax Return 2017 OMB 1545 0074 Rsu seoay Doo na paco r the yar -lan 1-D 31,2017,c otr ta yor bigening See separa e Instructiors Lest nam Lest nam Rrneath.spunter and.m" you have a p a box, s'o "strict.rs. Apt no. Make sure the S8Npa) above Prosidential Dection Camplgn You spouse Filing Statusngl Check only one 3Maedng separately. Enter spouse's SSN above Mae ing Jonly teven Ii only one had income) I the qualryng porson is a child but not your dopantort, onfer ts name haro. and full name here. Exemptions b Spouse 6a Yourself. " someone can carn you as a dependent, do not diox box 6a Boxes checked c Dependents: Firt nane Dependents *Deed with you- If more than four dependents, see Instructions and chock hero entered iowe Add numbers on d Total number of exemptions claimed 7 Wages, salaries, tps, etc. tach Form(s) W-2 Income aa Taxable interest. Altach Schedule B if required da b Tax-exempt inlerest. Do not Include on line 8a Attach Forml 9a Ordinary divkdends. Altach Schedue BI required 9a W-2 here. Also attach Forms W-2G and 1099-R if tax was withhekd 10 Taxable refunds, credits, or offsets of state and local Income taxes 11 10 Almony receved 12 Business income or (lossi. Atach Schedile or C-EZ 12 13 14 Capital gain or Ossa Attach Sch die D " required. I' rol reqRed, dheck hef/> 1.3 If you did not get a w-2, see Instructions. other gins or (kssesa Attact,Form 4797 RA distributions 16a Pensions and annuties 16a 17 Rental reat oste,roas, partnerships, S corporaions, ss, olc. Altach schiectE 17 18 Farm income or (loss). Altach Schedule F 19 Unemployment compensation 20a Soctal security benellts 21 Other Income. List type and amount 22 Combine the amounts n the tar right column for ines z trough 21. ris your total Income22 23 Educator expenses 24 cartanbusiness experses ot esrvists, prkoming artss, and b Taxable amount b Taxablo amount 15a 18 axale amount 21 23 Adjusted Gross Income oe basis gowernment ofnicias. Ailach Fom 2106 or 2106 EZ24 25 Health savings account deduction. Altach For925 26 Moving expenses. Altach Fom 3903 7 Deductie part of sest-employment tax. Altach SchedseSE27 28 Sell-employed SEP, SIMPLE, and qualitied plans 28 29 Sell employed health insurance dedction 30 Penalty on earty withdrawal of savings 32 33 Sludent loan inlerest deduction 34 Tition and lees. Allach Form 8917 35 Domeslc production aciMtios deduction. Allach Form 8903 35 36 Ak nes 23 through 35 34 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate Iinstructions. Cat. No. 113208 Fom 0017) Form 1040 (201) 8 Amount from line 37 (adjusled gross income) Tax and 30a cYou were bom belore January 2,93, Bn.Total boxes Credits : spouse was born before January 2. 1 63, OBand, j checked 3ga "your spouse itemizes on a s parato return or you won a dual-status alien chock hen 30d 40 41 temized deductions (Irom Schedule Aj or your standard deduction (see lert margin Suoltract ine 40 trom line Pepple whoExemptions. I ine 38 $156,800 or less, muitipy $4050 by the number online 6d. Olferwtse, see Instructons42 at oor nbor who can be caimd as a45 Alternative minlmum tax (see insiructions. Aftach Form 6251 dpannt, Anothers 43 axable income. Subtract ine 42 trom line 41. I lin 42 s more than ine 41, enter-o- 43 44 Tax (see instructions). Chocx " amy trom: aromiti) 8814 bOForm 4972 c 46 Excess advance premium tax crecat repayment. Attach Form 8962 47 Add ines 44, 45, and 46 47 ar 48 Forekgn tax credit Altach Form 1116 Iif required ed fing 49 Credit for child and dependent care expenises. Altach Fom 24414 50 EQucation credits from Form 8863, line 19 Mamiod iing 51 etent savings contributions crean. Allach Form 88801 R53 Reskdential energy credits. Altach Form 5695 52 Child tax credit. Altach Schedule 8812, If required 53 55 Add ines 48 through 54. These are your total credits 56 Sotract ine 55 from ine 47. Il ine 55 is more than line 47, enter-o 57 Sell-employment tax. Altach Schedule S 56 57 Other 58 Unreported social secunity and Medicare tax trom Fom:8919 50 Additional tax on IRAs, other qualified retirement plans, etc.Atlach Fom 5329 if required 60a Household employment taxes from Schedule b First-time homebuyer credit repayment. Attach Form 5405 if required 61 Hoailth care individul responsibility (see instructions)Ful-year coverage 62 Taxes trom aFom 8Fom860 nstructo enter code(s) 63 Add irnes 56 through e2. This is your total tax 62 63 Payments 64 Federal income tax withhekd trom Fomms W-2 and 1000 64 65 2017 eslimated tax payments and amount appiled rom 2016 retun65 "66a Emed income credit (EIC) qualilying chid, attachb Nontaxable combat pay eection 66 Schedule EC 67 ddiional chilkd tax credit. Allach Schedule 8812. 67 68 American opportunity credit from Form 8363, ine8 69 Net premium tax credit. Altach Form 8962 0 Amount pald with request for extension to le 71 Excess social security and tior 1 RRTA tax withheld 70 71 72 73 72 Credit for lederal tax on fuels. Allach Fom 4136 Add ines 64, 65, 6ia, and 67 thwough 73. These are your total payments 75 76a 74 74 Refund I ine 74 is more than line 63, subtract line 63 trom line 74. This is the amount you overpald Anourt o' li 75you want refunded to ou."Form 8888 ls ara led Cheek hee 75 77 Amount of Ine 75 you want applied to your 2018 estimatedta 77 Amount 78 Amount you owe. Sublract line 74 rom ino 63. For delalils on now to pay, see inslrucions78 You Owe 79 Estimated tax penalty (see Instructions Third Party Do you want to alow another person to daiscuss this relurn with the IS (see inslructions?Yes. Complete belowNo Designee Sign Here Personal identilcation Your signauro Dalo Your cccupatlon Daytime phona umbar your ssconts Paid Preparer Use Only Fs rsame Go to www.ws.gowsForm1040 for Instructions and tho labost homation PTIN Proparor's signature Fom 1040 pP017)