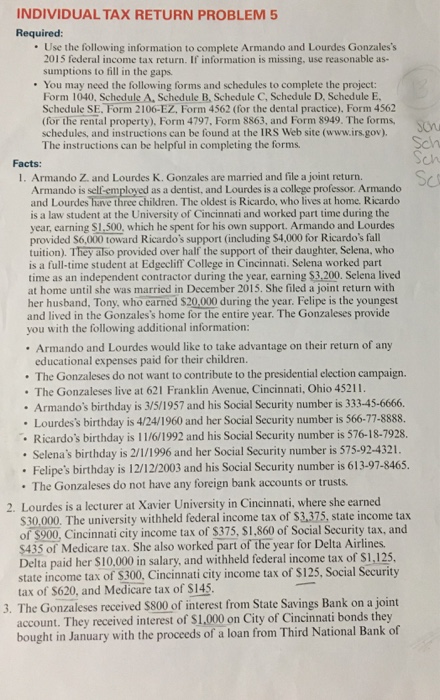

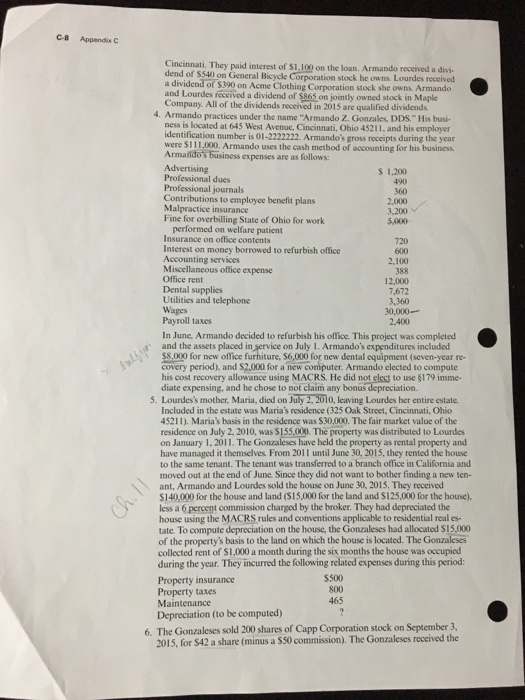

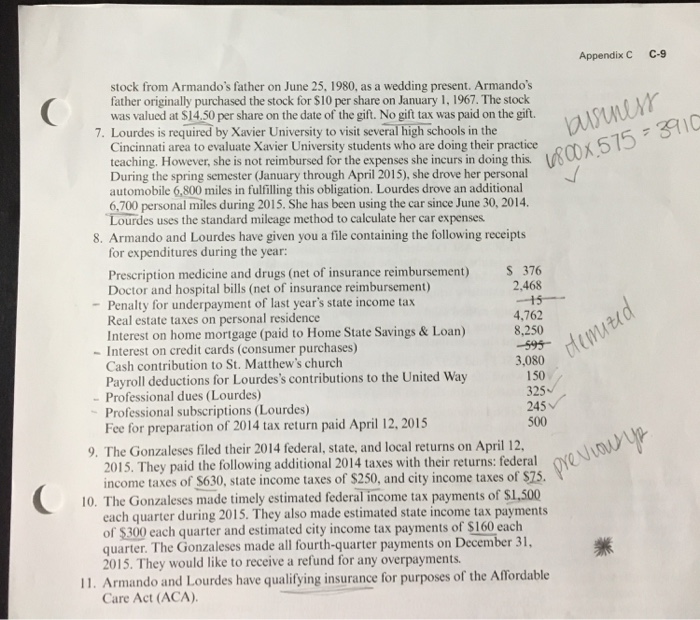

INDIVIDUAL TAX RETURN PROBLEM 5 Required Use the following information to complete Armando and Lourdes Gonzales's 2015 federal income tax return. If information is missing, use reasonable as- sumptions to fill in the gaps. You may need the following forms and schedules to complete the project: Form 1040, Schedule A. Schedule B, Schedule C, Schedule D, Schedule E Schedule SE Form 2106-EZ. Form 4562 (for the de ental practice). Form 4562 (for the rental property), Form 4797, Form 8 and Form 8949. The forms, schedules, and instructions can be found at the IRS Web site (www.irs.gov). completing the forms. The instructions can be helpful Facts: 1. Armando and Lourdes K.Gonzales are married and file a joint return. Armando is self-employed as a dentist, and Lourdes is a college professor Armando and Lourdes harve three children. The oldest is Ricardo, who lives at home. Ricardo s a law student at the University of Cincinnati and worked part time during the year, earning SI 500, which he spent for his own support. Armando and Lourdes provided S6,000 toward Ricardo's support (including S4.000 for Ricardo's fal on). They also provided over half the support of their daughter. Selena, who full-time student at Edgecliff College in Cincinnati. Selena worked part time as an independent contractor during the year, earning $3.200. Selena lived she was married in December 2015. She filed a joint return with at home unt her husband, Tony, who earned S20000 during the year. Felipe is the youngest and lived in the Gonzales's home for the entire year. The Gonzaleses provide you with the following additional information Armando and Lourdes would like to take advantage on their return of any educational expenses paid for their children The Gonzaleses do not want to contribute to the presidential election campaign. The Gonzaleses live at 621 Franklin Avenue, Cincinnati, Ohio 4521I Armando's birthday is 3/5/1957 and his Social Security number is 333-45-6666 Lourdes's birthday is 4/24/1960 and her Social Security number is 566-77-8888 Ricardo's birthday is 11/6/1992 and his Social Security number is 576-18-7928 Selena's birthday is 2/1/1996 and her Social Security number is 575-92-4321 Felipe's birthday is 12122003 and his Social Security number is 61397-8465 The Gonzaleses do not have any foreign bank accounts or trusts. Lourdes is a lecturer at Xavier University in Cincinnati, where she earned 2. 30.000. The university withheld federal income tax of S3,375, state income tax of $900, Cincinnati city income tax of S375, Sl.860 of Social Security tax, and Medicare tax. She also worked part of the year for Delta Airlines Delta paid her in salary, and withheld federal income tax tax of 00, Cincinnati city income tax of Social Securit tax of S620, and Medicare tax of S145 The Gonzaleses received S800 of interest from State Savings Bank on a joint 3. They received interest of Sl,000 on City of Cincinnati bonds they bought in January with the proceeds of a loan from Third National Bank of INDIVIDUAL TAX RETURN PROBLEM 5 Required Use the following information to complete Armando and Lourdes Gonzales's 2015 federal income tax return. If information is missing, use reasonable as- sumptions to fill in the gaps. You may need the following forms and schedules to complete the project: Form 1040, Schedule A. Schedule B, Schedule C, Schedule D, Schedule E Schedule SE Form 2106-EZ. Form 4562 (for the de ental practice). Form 4562 (for the rental property), Form 4797, Form 8 and Form 8949. The forms, schedules, and instructions can be found at the IRS Web site (www.irs.gov). completing the forms. The instructions can be helpful Facts: 1. Armando and Lourdes K.Gonzales are married and file a joint return. Armando is self-employed as a dentist, and Lourdes is a college professor Armando and Lourdes harve three children. The oldest is Ricardo, who lives at home. Ricardo s a law student at the University of Cincinnati and worked part time during the year, earning SI 500, which he spent for his own support. Armando and Lourdes provided S6,000 toward Ricardo's support (including S4.000 for Ricardo's fal on). They also provided over half the support of their daughter. Selena, who full-time student at Edgecliff College in Cincinnati. Selena worked part time as an independent contractor during the year, earning $3.200. Selena lived she was married in December 2015. She filed a joint return with at home unt her husband, Tony, who earned S20000 during the year. Felipe is the youngest and lived in the Gonzales's home for the entire year. The Gonzaleses provide you with the following additional information Armando and Lourdes would like to take advantage on their return of any educational expenses paid for their children The Gonzaleses do not want to contribute to the presidential election campaign. The Gonzaleses live at 621 Franklin Avenue, Cincinnati, Ohio 4521I Armando's birthday is 3/5/1957 and his Social Security number is 333-45-6666 Lourdes's birthday is 4/24/1960 and her Social Security number is 566-77-8888 Ricardo's birthday is 11/6/1992 and his Social Security number is 576-18-7928 Selena's birthday is 2/1/1996 and her Social Security number is 575-92-4321 Felipe's birthday is 12122003 and his Social Security number is 61397-8465 The Gonzaleses do not have any foreign bank accounts or trusts. Lourdes is a lecturer at Xavier University in Cincinnati, where she earned 2. 30.000. The university withheld federal income tax of S3,375, state income tax of $900, Cincinnati city income tax of S375, Sl.860 of Social Security tax, and Medicare tax. She also worked part of the year for Delta Airlines Delta paid her in salary, and withheld federal income tax tax of 00, Cincinnati city income tax of Social Securit tax of S620, and Medicare tax of S145 The Gonzaleses received S800 of interest from State Savings Bank on a joint 3. They received interest of Sl,000 on City of Cincinnati bonds they bought in January with the proceeds of a loan from Third National Bank of