Answered step by step

Verified Expert Solution

Question

1 Approved Answer

individual taxation university of VENDA topic: capital gain tax QUESTION 1 15 MARKS Prof Mbaula, a South African resident was recently appointed a Dean of

individual taxation university of VENDA topic: capital gain tax

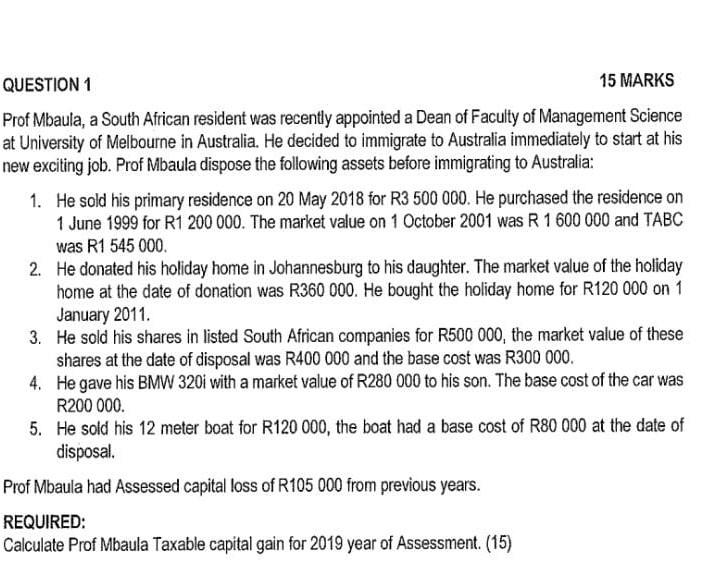

QUESTION 1 15 MARKS Prof Mbaula, a South African resident was recently appointed a Dean of Faculty of Management Science at University of Melbourne in Australia. He decided to immigrate to Australia immediately to start at his new exciting job. Prof Mbaula dispose the following assets before immigrating to Australia: 1. He sold his primary residence on 20 May 2018 for R3 500 000. He purchased the residence on 1 June 1999 for R1 200 000. The market value on 1 October 2001 was R 1 600 000 and TABC was R1 545 000 2. He donated his holiday home in Johannesburg to his daughter. The market value of the holiday home at the date of donation was R360 000. He bought the holiday home for R120 000 on 1 January 2011 3. He sold his shares in listed South African companies for R500 000, the market value of these shares at the date of disposal was R400 000 and the base cost was R300 000. 4. He gave his BMW 320i with a market value of R280 000 to his son. The base cost of the car was R200 000 5. He sold his 12 meter boat for R120 000, the boat had a base cost of R80 000 at the date of disposal. Prof Mbaula had Assessed capital loss of R105 000 from previous years. REQUIRED: Calculate Prof Mbaula Taxable capital gain for 2019 year of Assessment. (15) QUESTION 1 15 MARKS Prof Mbaula, a South African resident was recently appointed a Dean of Faculty of Management Science at University of Melbourne in Australia. He decided to immigrate to Australia immediately to start at his new exciting job. Prof Mbaula dispose the following assets before immigrating to Australia: 1. He sold his primary residence on 20 May 2018 for R3 500 000. He purchased the residence on 1 June 1999 for R1 200 000. The market value on 1 October 2001 was R 1 600 000 and TABC was R1 545 000 2. He donated his holiday home in Johannesburg to his daughter. The market value of the holiday home at the date of donation was R360 000. He bought the holiday home for R120 000 on 1 January 2011 3. He sold his shares in listed South African companies for R500 000, the market value of these shares at the date of disposal was R400 000 and the base cost was R300 000. 4. He gave his BMW 320i with a market value of R280 000 to his son. The base cost of the car was R200 000 5. He sold his 12 meter boat for R120 000, the boat had a base cost of R80 000 at the date of disposal. Prof Mbaula had Assessed capital loss of R105 000 from previous years. REQUIRED: Calculate Prof Mbaula Taxable capital gain for 2019 year of Assessment. (15)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started