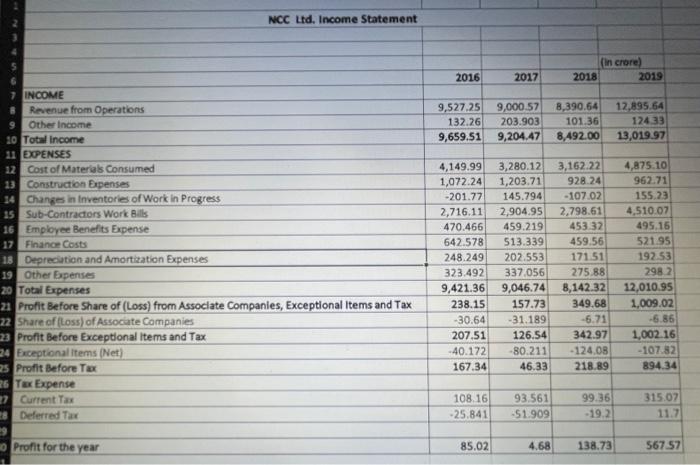

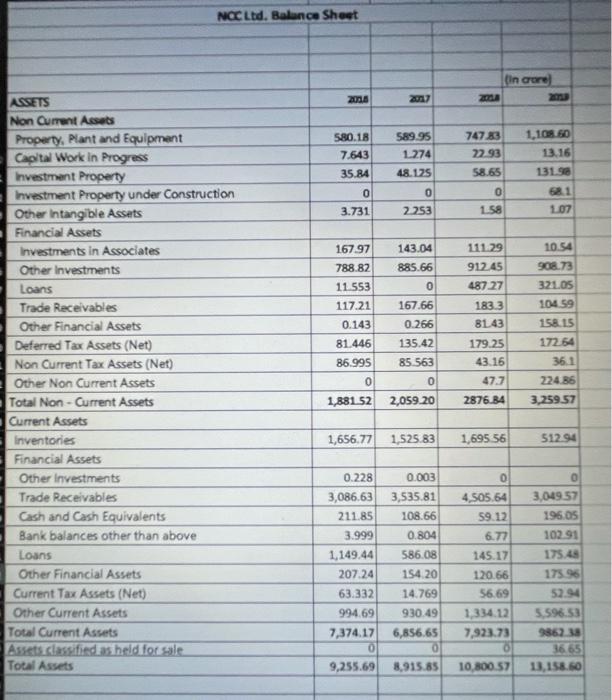

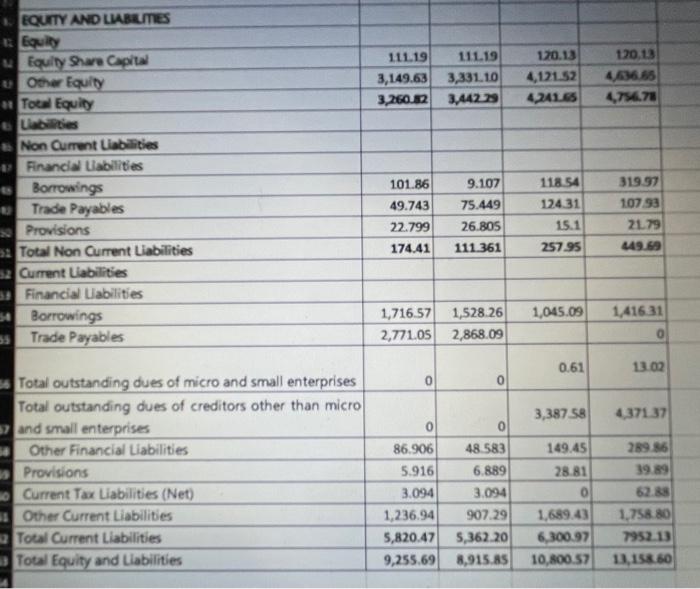

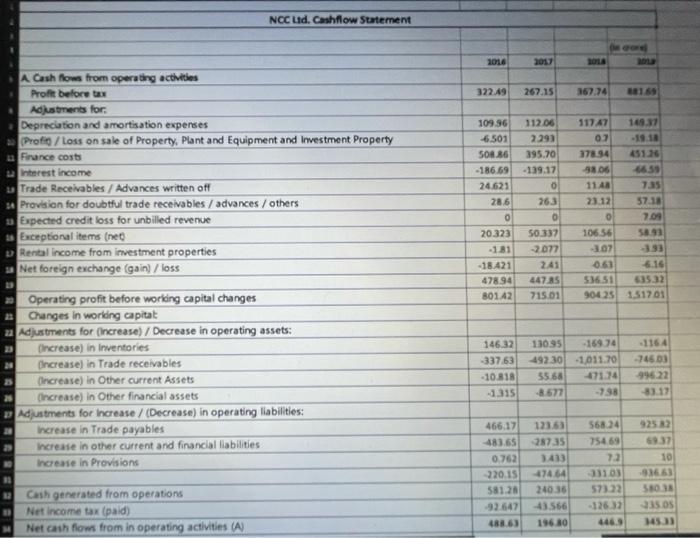

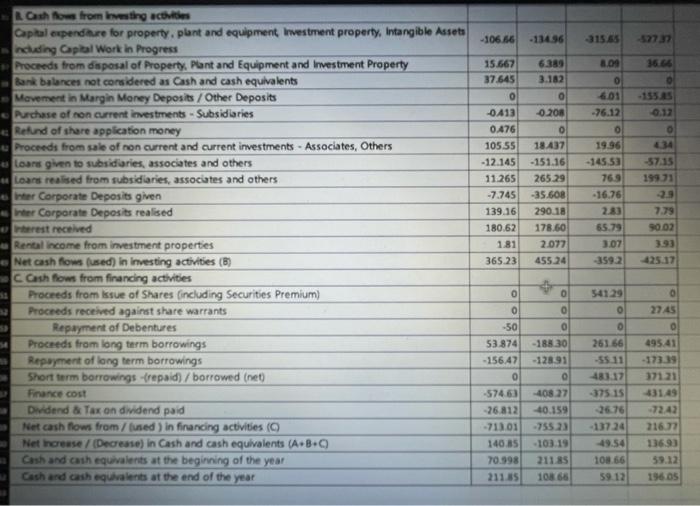

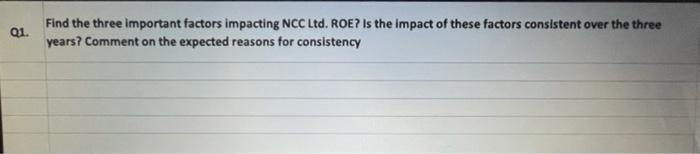

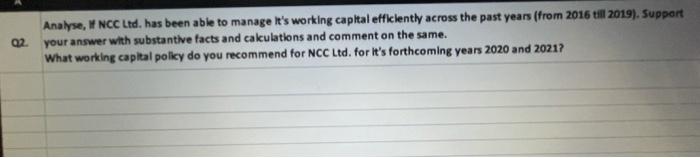

Indla Construction Industry fackground to the company de corridays an important growth of India's economy is wrw of the Interlinduntries in India. It has been dort and lacturing and Industrial growth over past few years. The correction industry and et correcta majorly provide the trust to the ring India's coretruction industry. Majoretructions which out for powth pr., Newton, and years and export and import orga. Around 21% contribution is from cargo x from wwwyorstand and Powerton Gets such as making 100 anties, world des ways and sping infrastructure, housing and understand the French papers and from government budgets. As permeny 2017-1 India will require USD 45 trillion by 2040 for the development of infrastructure. The housing and town are the USD 0 2017 For the current care of infrastructure is inadequate to sustain the urban population, government han development mission and the utan local bodies and for players are further expected to boost the growth of india contruction industry in the coming years. Ase, 100Fonction pretende ind pris lowed through automatic route Further forecensies werd hands with India for infrastructure development through finances and technology such as Irde-lapen for development of North sites and Sweden for de arteries. These projects tend to provide he opportunities to the private players by taking up the project contracts and tender, few watch slayers are LAT, God Properties Shapoor Pilot Tata Projects, Escar Group, Hindistan Construction Company, laypee Group and others Frete Gation industry Thendan sonry is on arising phased growth in the infrastructure and constructions industry, it has seen to have grown in 2018 as well as in 2019 with a sin. The tiedost similar rates in the period 2020-2023 due to the government's efforts and spending on development of housing, roadports, wortel to be built under the Pradhan Mantel Gram Sadak Yojana (PMGSY) by the government in the rural and backward areas in India in the formato mo. All the 15 show a dear powth in this industry as far as our economy is concerned Cedit to building infrastructure of good standard Infrastructure that is a constant reminder of the Company's host construction, which is the of rendesition and her dedication. Today, NC Ld play a sible role on the rational Infrastructure stage, leaving its fure mark of quality in alles who NCC Ltd. Income Statement (in crore) 2018 2019 2016 2017 9,527.25 132.26 9,659.51 9,000.57 203.903 9,204.47 8,390.64 101.36 8,492.00 12,895,64 12433 13,019.97 7 INCOME Revenue from Operations 9 Other Income 20 Total income 1 EXPENSES 12 Cost of Materials Consumed 13 Construction Bipenses 14 Changes in Inventories of Work in Progress 15 Sub-Contractors Work Bills 16 Employee Benefits Expense 17 Finance Costs 18 Depreciation and Amortization Expenses 19 Other Expenses 20 Total Expenses zi Profit Before Share of (Loss) from Associate Companies, Exceptional Items and Tax 22 Share of (Loss) of Associate Companies 23 Profit Before Exceptional Items and Tax 24 Exceptional items (Net) 25 Profit Before Tax R6 Tax Expense 17 Current Tax 8 Deferred Tax 4,149.99 1,072.24 -201.77 2,716.11 470.466 642.578 248.249 323.492 9,421.36 238.15 -30.64 207.51 -40.172 167.34 3,280.12 1,203.71 145.794 2,904.95 459.219 513.339 202.553 337.056 9,046.74 157.73 -31.189 126.54 -80.211 46.33 3,162.22 928.24 -107.02 2,798.61 45332 459.56 171.51 275.88 8,142.32 349.68 -6.71 342.97 -124.08 218.89 4,875.10 962.71 155.23 4,510.07 495.16 521.95 192.53 2982 12,010.95 1,009.02 -6.86 1,002.16 -107.82 894.34 108.16 -25.841 93.561 -51.909 99.36 -19.2 315.07 11.7 Profit for the year 85.02 4.68 138.73 567.57 NOC Ltd. Balance Sheet anger 2000 1,108 50 13.16 580.18 7.643 35.84 0 589.95 1274 48.125 0 2253 747.83 22.93 58.65 0 158 131.98 3.731 107 143.04 111.29 91245 885.66 0 ASSETS Non Current Assets Property, Plant and Equipment Capital Work in Progress Investment Property Investment Property under Construction Other Intangible Assets Financial Assets Investments in Associates Other Investments Loans Trade Receivables Other Financial Assets Deferred Tax Assets (Net) Non Current Tax Assets (Net) Other Non Current Assets Total Non-Current Assets Current Assets Inventories Financial Assets Other investments Trade Receivables Cash and Cash Equivalents Bank balances other than above Loans Other Financial Assets Current Tax Assets (Net) Other Current Assets Total Current Assets Assets classified as held for sale Total Assets 16797 788.82 11.553 117.21 0.143 81.446 86.995 0 1,881.52 167.66 0.266 135.42 85.563 0 10.54 908.73 321.05 104.59 15815 172.54 36.1 48727 183.3 8143 179.25 43.16 47.7 2876 B4 224 86 2,059.20 3,259.57 1,656.77 1,525.83 1,695 56 512.94 0.228 0.003 3,086,63 3,535.81 21185 108.66 3.999 0.804 1,149.44 586.08 207.24 154.20 63.332 14.769 994.69 930.49 7,374.17 6,856.65 0 0 9,255,69 8,915.85 0 4,505.64 59.12 6.77 145.17 120.66 56.69 1.334.12 7,923.73 O 10,800.57 3,049.57 196.05 102.91 175.45 175.96 52.94 5.596.53 9862 33 3665 13,158.50 11119 111.19 3,149.63 3,331.10 3,260.32 3,44229 120.13 4,121.52 4,241.65 120.13 4036.65 47.78 EQUITY AND LIABILMES Eu foultry Share Capita Other Equity Toel Equity Labdies Non Current Liabilities Financial abilities Borrowings Trade Payables Provisions 5 Total Non Current Liabilities 52 Current Liabilities 5 Financial abilities Borrowings ss Trade Payables 101.86 49.743 22.799 174.41 9.107 75.449 26.BOS 111.361 118.54 124.31 15.1 257.95 319.37 107.93 2179 449.69 1,045.09 1,41631 1,716.57 1,528.26 2,771.05 2,868.09 0.61 13.02 0 0 3,387.58 437137 0 Total outstanding dues of micro and small enterprises Total outstanding dues of creditors other than micro and small enterprises Other Financial Liabilities Provisions Current Tax Liabilities (Net) 5 Other Current Liabilities Total Current Liabilities Total Equity and Llabilities 149.45 28.81 86.906 5.916 3.094 1,236.94 5,820.47 9,255.69 48 583 6.889 3.094 907.29 5,362.20 8,915.85 289 86 39.89 62.88 1.758.80 7952.13 13,156 60 1.689.43 6,300.97 10,800.57 NCC Lid. Cashflow Statement 2016 2017 322.49 267.15 167.74 11747 03 149.37 -18.10 A Cash flows from operating activities Profit before tax Adjustments for Depreciation and amortisation expenses Profi / Loss on sale of Property, Plant and Equipment and Investment Property Finance costs interest income Trade Receivables / Advances written off 24 Provision for doubtful trade receivables / advances / others Expected credit loss for unbilled revenue Exceptional items (net - Rental income from investment properties Net foreign exchange (gain) / loss 109.96 6.501 SO8.86 -186.69 24.623 286 0 20.323 1.81 -18.421 47894 801.42 112.00 2.293 395.70 - 139.17 0 26.3 0 50337 2077 7:35 37.10 709 378.94 38.06 1143 23.12 0 106.56 3.07 061 536.51 90425 44785 715.01 6.16 63532 151701 13095 492.30 Operating profit before working capital changes 2 Changes in working capitat 2 Adjustments for increase) / Decrease in operating assets: increase) in Inventories increase) in Trade receivables increase) in Other current Assets Cincrease) in Other financial assets Adjustments for increase / (Decrease) in operating liabilities: increase in Trade payables Increase in other current and financial liabilities Increase in Provisions 146.32 337.63 10.818 -1.315 -169.74 -1011.70 471.14 -1164 -74603 996.22 -8312 55.68 -8.577 568.34 754 69 466.17 483.65 0.762 220.15 581.28 92.647 123.53 287.35 3433 474 64 24036 -43.566 196.80 69.31 10 -93653 580 335 14533 33103 57322 12637 4463 Cash generated from operations Net Income tax (paid) Net cash flows from in operating activities (A) -106.66 - 13496 315.65 8.00 35. 3.182 o 601 -76.12 0 0.208 -15523 Cashows from Investing acties Capital expenditure for property, plant and equipment Investment property, Intangible Assets neding Capibal Work in Progress Proceeds from disposal of Property, plant and Equipment and Investment Property Bank balances not considered as Cash and cash equivalents Movement in Margin Money Deposits / Other Deposits Purchase of non current investments - Subsidiaries Refund of share application money Proceeds from sale of non current and current investments - Associates, Others loans given to subsidiaries, associates and others Loans realised from subsidiaries, associates and others Inter Corporate Deposits given her Corporate Deposits realised erest received Rental income from investment properties Net cash flows used in investing activities (B) Cash flows from financing activities Proceeds from issue of Shares (including Securities Premium) Proceeds received against share warrants Repayment of Debentures Proceeds from long term borrowings Repayment of long term borrowings Short term borrowings -repaid) / borrowed (net Finance cost Dividend & Tax on dividend paid Net cash flows from/used ) in financing activities ( Net horase / Decrease) in Cash and cash equivalents (A.B.0 Cash and cath equivalents at the beginning of the year Cash and cash equivalents at the end of the year 15.667 37.645 0 0413 0.476 105.55 -12.145 11.265 -7.745 139.16 180.62 181 365.23 18437 -151.16 265.29 -35,608 290.18 178,60 2.077 455.24 19.96 -145.53 769 -16.76 2.83 65.79 3.07 34 -57.15 199.71 29 7.79 0.02 393 425.17 0 54129 0 0 2745 0 -18.30 - 128.91 261.66 -55 11 -50 53.874 -156.47 0 -574 63 -26.812 -713.01 140.85 70.998 211.35 -408 27 40.159 -75523 -103.19 211.85 108 66 -375 15 26.76 13724 49.54 495.41 - 173.39 371.21 $31.49 72.42 216.77 136.93 59.12 196 05 108 66 59.12 Q1. Find the three important factors impacting NCC Ltd. ROE? Is the impact of these factors consistent over the three years? Comment on the expected reasons for consistency Q2 Analyse, NCC Ltd. has been able to manage It's working capital efficiently across the past years (from 2016 till 2019). Support your answer with substantive facts and cakulations and comment on the same. What working capital polky do you recommend for NCC Ltd. for it's forthcoming years 2020 and 2021? Looking into the past performance of NCC itd., what sales growth percentage do you recommend for the forthcoming years 2020 and 2021. Dustify your choice of using the sales growth for forecasting for years 2020 and 2021 with valid subjective arguments as well) Does NCC tid. require ATN for the years 2020 and 2021, yes, then plug in the value with the appropriate source of financing wested by yow (20 MARES) for NCC Ltd. Create Racing Plan for NCC Ltd, and utify your choice of financing suggested for the firm, Indla Construction Industry fackground to the company de corridays an important growth of India's economy is wrw of the Interlinduntries in India. It has been dort and lacturing and Industrial growth over past few years. The correction industry and et correcta majorly provide the trust to the ring India's coretruction industry. Majoretructions which out for powth pr., Newton, and years and export and import orga. Around 21% contribution is from cargo x from wwwyorstand and Powerton Gets such as making 100 anties, world des ways and sping infrastructure, housing and understand the French papers and from government budgets. As permeny 2017-1 India will require USD 45 trillion by 2040 for the development of infrastructure. The housing and town are the USD 0 2017 For the current care of infrastructure is inadequate to sustain the urban population, government han development mission and the utan local bodies and for players are further expected to boost the growth of india contruction industry in the coming years. Ase, 100Fonction pretende ind pris lowed through automatic route Further forecensies werd hands with India for infrastructure development through finances and technology such as Irde-lapen for development of North sites and Sweden for de arteries. These projects tend to provide he opportunities to the private players by taking up the project contracts and tender, few watch slayers are LAT, God Properties Shapoor Pilot Tata Projects, Escar Group, Hindistan Construction Company, laypee Group and others Frete Gation industry Thendan sonry is on arising phased growth in the infrastructure and constructions industry, it has seen to have grown in 2018 as well as in 2019 with a sin. The tiedost similar rates in the period 2020-2023 due to the government's efforts and spending on development of housing, roadports, wortel to be built under the Pradhan Mantel Gram Sadak Yojana (PMGSY) by the government in the rural and backward areas in India in the formato mo. All the 15 show a dear powth in this industry as far as our economy is concerned Cedit to building infrastructure of good standard Infrastructure that is a constant reminder of the Company's host construction, which is the of rendesition and her dedication. Today, NC Ld play a sible role on the rational Infrastructure stage, leaving its fure mark of quality in alles who Indla Construction Industry (Back ground fo the company) india construction Industry is an important growth driver of indu's economy, it one of the integral Industries in India. In general has been growing an enger ncrease in domestic and international manufacturing activities and Industrial growth over a past few years. The construction Industry contributo around X the ins The government construction projects are majorly providing the thrust to the rising India's construction industry. Major construction activities which account for growth we projects, highway construction, and away expansion and export and import cargo. Around 21% contribution is from cargo, 9.8% from highway construction and expansion on power generation Government inatives such as making 100 smart cities, world-class highways and shipping Infrastructure, housing and urban development has the through Foreign Direct Investment private players and from government budgets As per economic survey 2017-18, Indu will require USD 45 trillion by 2040 for the development of infrastructure. The housing and township development sector has reched USB 24 2017 through for route. The current scenario of infrastructure inadequate to sustain the urban population, government urban development mkton and the partnerships urban local bodies and foreign players we further expected to boost the growth of india construction Industry in the coming years. Abo, 100% FDI in construction development project developing industrul partes allowed through automate route Further,vans for economies have joined hands with India fornfrastructure development through finances and technology such as India Japan for development of the North East and India Sweden for developing smart cities. These projects tend to provide huge opportunities to the private players by taking up the project contracts and tenders, few such major players LAT.Godrej Properties, Shapoorji Poji Tata Projects, Escar Group, Hindustan Construction Company, Jaypee Group and others Future Prospects of the Construction Industry The Indian economy on a sing phase of growth in the infrastructure and constructions industry. It has seen to have grown in 2018 as well as in 2019 with a drastic increase in output. The industry is peded to powtimerrates in the period 2020-2023 due to the government's efforts and spending on development of housing road, ports, water supply airport al. Aho, numerous roads are to be built under the Pradhan Mantri Gram Sadak Yojana (PMGSY) by the government in the rural and backward areas in India in the format of a PPP model Athese attributes show dear growth in the industry as far as our economy is concerned. NCC Limited NCC und has dedicated tell to buking infrastructure of good standards Infrastructure that a constant reminder of the Company's holistic construction expertise, which in turn the rest of en innovation and sheer dedication. Today, NCC Lid plays a visible role on the national infrastructure stage, leaving its signature mark of quality in several growth areas Indla Construction Industry fackground to the company de corridays an important growth of India's economy is wrw of the Interlinduntries in India. It has been dort and lacturing and Industrial growth over past few years. The correction industry and et correcta majorly provide the trust to the ring India's coretruction industry. Majoretructions which out for powth pr., Newton, and years and export and import orga. Around 21% contribution is from cargo x from wwwyorstand and Powerton Gets such as making 100 anties, world des ways and sping infrastructure, housing and understand the French papers and from government budgets. As permeny 2017-1 India will require USD 45 trillion by 2040 for the development of infrastructure. The housing and town are the USD 0 2017 For the current care of infrastructure is inadequate to sustain the urban population, government han development mission and the utan local bodies and for players are further expected to boost the growth of india contruction industry in the coming years. Ase, 100Fonction pretende ind pris lowed through automatic route Further forecensies werd hands with India for infrastructure development through finances and technology such as Irde-lapen for development of North sites and Sweden for de arteries. These projects tend to provide he opportunities to the private players by taking up the project contracts and tender, few watch slayers are LAT, God Properties Shapoor Pilot Tata Projects, Escar Group, Hindistan Construction Company, laypee Group and others Frete Gation industry Thendan sonry is on arising phased growth in the infrastructure and constructions industry, it has seen to have grown in 2018 as well as in 2019 with a sin. The tiedost similar rates in the period 2020-2023 due to the government's efforts and spending on development of housing, roadports, wortel to be built under the Pradhan Mantel Gram Sadak Yojana (PMGSY) by the government in the rural and backward areas in India in the formato mo. All the 15 show a dear powth in this industry as far as our economy is concerned Cedit to building infrastructure of good standard Infrastructure that is a constant reminder of the Company's host construction, which is the of rendesition and her dedication. Today, NC Ld play a sible role on the rational Infrastructure stage, leaving its fure mark of quality in alles who NCC Ltd. Income Statement (in crore) 2018 2019 2016 2017 9,527.25 132.26 9,659.51 9,000.57 203.903 9,204.47 8,390.64 101.36 8,492.00 12,895,64 12433 13,019.97 7 INCOME Revenue from Operations 9 Other Income 20 Total income 1 EXPENSES 12 Cost of Materials Consumed 13 Construction Bipenses 14 Changes in Inventories of Work in Progress 15 Sub-Contractors Work Bills 16 Employee Benefits Expense 17 Finance Costs 18 Depreciation and Amortization Expenses 19 Other Expenses 20 Total Expenses zi Profit Before Share of (Loss) from Associate Companies, Exceptional Items and Tax 22 Share of (Loss) of Associate Companies 23 Profit Before Exceptional Items and Tax 24 Exceptional items (Net) 25 Profit Before Tax R6 Tax Expense 17 Current Tax 8 Deferred Tax 4,149.99 1,072.24 -201.77 2,716.11 470.466 642.578 248.249 323.492 9,421.36 238.15 -30.64 207.51 -40.172 167.34 3,280.12 1,203.71 145.794 2,904.95 459.219 513.339 202.553 337.056 9,046.74 157.73 -31.189 126.54 -80.211 46.33 3,162.22 928.24 -107.02 2,798.61 45332 459.56 171.51 275.88 8,142.32 349.68 -6.71 342.97 -124.08 218.89 4,875.10 962.71 155.23 4,510.07 495.16 521.95 192.53 2982 12,010.95 1,009.02 -6.86 1,002.16 -107.82 894.34 108.16 -25.841 93.561 -51.909 99.36 -19.2 315.07 11.7 Profit for the year 85.02 4.68 138.73 567.57 NOC Ltd. Balance Sheet anger 2000 1,108 50 13.16 580.18 7.643 35.84 0 589.95 1274 48.125 0 2253 747.83 22.93 58.65 0 158 131.98 3.731 107 143.04 111.29 91245 885.66 0 ASSETS Non Current Assets Property, Plant and Equipment Capital Work in Progress Investment Property Investment Property under Construction Other Intangible Assets Financial Assets Investments in Associates Other Investments Loans Trade Receivables Other Financial Assets Deferred Tax Assets (Net) Non Current Tax Assets (Net) Other Non Current Assets Total Non-Current Assets Current Assets Inventories Financial Assets Other investments Trade Receivables Cash and Cash Equivalents Bank balances other than above Loans Other Financial Assets Current Tax Assets (Net) Other Current Assets Total Current Assets Assets classified as held for sale Total Assets 16797 788.82 11.553 117.21 0.143 81.446 86.995 0 1,881.52 167.66 0.266 135.42 85.563 0 10.54 908.73 321.05 104.59 15815 172.54 36.1 48727 183.3 8143 179.25 43.16 47.7 2876 B4 224 86 2,059.20 3,259.57 1,656.77 1,525.83 1,695 56 512.94 0.228 0.003 3,086,63 3,535.81 21185 108.66 3.999 0.804 1,149.44 586.08 207.24 154.20 63.332 14.769 994.69 930.49 7,374.17 6,856.65 0 0 9,255,69 8,915.85 0 4,505.64 59.12 6.77 145.17 120.66 56.69 1.334.12 7,923.73 O 10,800.57 3,049.57 196.05 102.91 175.45 175.96 52.94 5.596.53 9862 33 3665 13,158.50 11119 111.19 3,149.63 3,331.10 3,260.32 3,44229 120.13 4,121.52 4,241.65 120.13 4036.65 47.78 EQUITY AND LIABILMES Eu foultry Share Capita Other Equity Toel Equity Labdies Non Current Liabilities Financial abilities Borrowings Trade Payables Provisions 5 Total Non Current Liabilities 52 Current Liabilities 5 Financial abilities Borrowings ss Trade Payables 101.86 49.743 22.799 174.41 9.107 75.449 26.BOS 111.361 118.54 124.31 15.1 257.95 319.37 107.93 2179 449.69 1,045.09 1,41631 1,716.57 1,528.26 2,771.05 2,868.09 0.61 13.02 0 0 3,387.58 437137 0 Total outstanding dues of micro and small enterprises Total outstanding dues of creditors other than micro and small enterprises Other Financial Liabilities Provisions Current Tax Liabilities (Net) 5 Other Current Liabilities Total Current Liabilities Total Equity and Llabilities 149.45 28.81 86.906 5.916 3.094 1,236.94 5,820.47 9,255.69 48 583 6.889 3.094 907.29 5,362.20 8,915.85 289 86 39.89 62.88 1.758.80 7952.13 13,156 60 1.689.43 6,300.97 10,800.57 NCC Lid. Cashflow Statement 2016 2017 322.49 267.15 167.74 11747 03 149.37 -18.10 A Cash flows from operating activities Profit before tax Adjustments for Depreciation and amortisation expenses Profi / Loss on sale of Property, Plant and Equipment and Investment Property Finance costs interest income Trade Receivables / Advances written off 24 Provision for doubtful trade receivables / advances / others Expected credit loss for unbilled revenue Exceptional items (net - Rental income from investment properties Net foreign exchange (gain) / loss 109.96 6.501 SO8.86 -186.69 24.623 286 0 20.323 1.81 -18.421 47894 801.42 112.00 2.293 395.70 - 139.17 0 26.3 0 50337 2077 7:35 37.10 709 378.94 38.06 1143 23.12 0 106.56 3.07 061 536.51 90425 44785 715.01 6.16 63532 151701 13095 492.30 Operating profit before working capital changes 2 Changes in working capitat 2 Adjustments for increase) / Decrease in operating assets: increase) in Inventories increase) in Trade receivables increase) in Other current Assets Cincrease) in Other financial assets Adjustments for increase / (Decrease) in operating liabilities: increase in Trade payables Increase in other current and financial liabilities Increase in Provisions 146.32 337.63 10.818 -1.315 -169.74 -1011.70 471.14 -1164 -74603 996.22 -8312 55.68 -8.577 568.34 754 69 466.17 483.65 0.762 220.15 581.28 92.647 123.53 287.35 3433 474 64 24036 -43.566 196.80 69.31 10 -93653 580 335 14533 33103 57322 12637 4463 Cash generated from operations Net Income tax (paid) Net cash flows from in operating activities (A) -106.66 - 13496 315.65 8.00 35. 3.182 o 601 -76.12 0 0.208 -15523 Cashows from Investing acties Capital expenditure for property, plant and equipment Investment property, Intangible Assets neding Capibal Work in Progress Proceeds from disposal of Property, plant and Equipment and Investment Property Bank balances not considered as Cash and cash equivalents Movement in Margin Money Deposits / Other Deposits Purchase of non current investments - Subsidiaries Refund of share application money Proceeds from sale of non current and current investments - Associates, Others loans given to subsidiaries, associates and others Loans realised from subsidiaries, associates and others Inter Corporate Deposits given her Corporate Deposits realised erest received Rental income from investment properties Net cash flows used in investing activities (B) Cash flows from financing activities Proceeds from issue of Shares (including Securities Premium) Proceeds received against share warrants Repayment of Debentures Proceeds from long term borrowings Repayment of long term borrowings Short term borrowings -repaid) / borrowed (net Finance cost Dividend & Tax on dividend paid Net cash flows from/used ) in financing activities ( Net horase / Decrease) in Cash and cash equivalents (A.B.0 Cash and cath equivalents at the beginning of the year Cash and cash equivalents at the end of the year 15.667 37.645 0 0413 0.476 105.55 -12.145 11.265 -7.745 139.16 180.62 181 365.23 18437 -151.16 265.29 -35,608 290.18 178,60 2.077 455.24 19.96 -145.53 769 -16.76 2.83 65.79 3.07 34 -57.15 199.71 29 7.79 0.02 393 425.17 0 54129 0 0 2745 0 -18.30 - 128.91 261.66 -55 11 -50 53.874 -156.47 0 -574 63 -26.812 -713.01 140.85 70.998 211.35 -408 27 40.159 -75523 -103.19 211.85 108 66 -375 15 26.76 13724 49.54 495.41 - 173.39 371.21 $31.49 72.42 216.77 136.93 59.12 196 05 108 66 59.12 Q1. Find the three important factors impacting NCC Ltd. ROE? Is the impact of these factors consistent over the three years? Comment on the expected reasons for consistency Q2 Analyse, NCC Ltd. has been able to manage It's working capital efficiently across the past years (from 2016 till 2019). Support your answer with substantive facts and cakulations and comment on the same. What working capital polky do you recommend for NCC Ltd. for it's forthcoming years 2020 and 2021? Looking into the past performance of NCC itd., what sales growth percentage do you recommend for the forthcoming years 2020 and 2021. Dustify your choice of using the sales growth for forecasting for years 2020 and 2021 with valid subjective arguments as well) Does NCC tid. require ATN for the years 2020 and 2021, yes, then plug in the value with the appropriate source of financing wested by yow (20 MARES) for NCC Ltd. Create Racing Plan for NCC Ltd, and utify your choice of financing suggested for the firm, Indla Construction Industry fackground to the company de corridays an important growth of India's economy is wrw of the Interlinduntries in India. It has been dort and lacturing and Industrial growth over past few years. The correction industry and et correcta majorly provide the trust to the ring India's coretruction industry. Majoretructions which out for powth pr., Newton, and years and export and import orga. Around 21% contribution is from cargo x from wwwyorstand and Powerton Gets such as making 100 anties, world des ways and sping infrastructure, housing and understand the French papers and from government budgets. As permeny 2017-1 India will require USD 45 trillion by 2040 for the development of infrastructure. The housing and town are the USD 0 2017 For the current care of infrastructure is inadequate to sustain the urban population, government han development mission and the utan local bodies and for players are further expected to boost the growth of india contruction industry in the coming years. Ase, 100Fonction pretende ind pris lowed through automatic route Further forecensies werd hands with India for infrastructure development through finances and technology such as Irde-lapen for development of North sites and Sweden for de arteries. These projects tend to provide he opportunities to the private players by taking up the project contracts and tender, few watch slayers are LAT, God Properties Shapoor Pilot Tata Projects, Escar Group, Hindistan Construction Company, laypee Group and others Frete Gation industry Thendan sonry is on arising phased growth in the infrastructure and constructions industry, it has seen to have grown in 2018 as well as in 2019 with a sin. The tiedost similar rates in the period 2020-2023 due to the government's efforts and spending on development of housing, roadports, wortel to be built under the Pradhan Mantel Gram Sadak Yojana (PMGSY) by the government in the rural and backward areas in India in the formato mo. All the 15 show a dear powth in this industry as far as our economy is concerned Cedit to building infrastructure of good standard Infrastructure that is a constant reminder of the Company's host construction, which is the of rendesition and her dedication. Today, NC Ld play a sible role on the rational Infrastructure stage, leaving its fure mark of quality in alles who Indla Construction Industry (Back ground fo the company) india construction Industry is an important growth driver of indu's economy, it one of the integral Industries in India. In general has been growing an enger ncrease in domestic and international manufacturing activities and Industrial growth over a past few years. The construction Industry contributo around X the ins The government construction projects are majorly providing the thrust to the rising India's construction industry. Major construction activities which account for growth we projects, highway construction, and away expansion and export and import cargo. Around 21% contribution is from cargo, 9.8% from highway construction and expansion on power generation Government inatives such as making 100 smart cities, world-class highways and shipping Infrastructure, housing and urban development has the through Foreign Direct Investment private players and from government budgets As per economic survey 2017-18, Indu will require USD 45 trillion by 2040 for the development of infrastructure. The housing and township development sector has reched USB 24 2017 through for route. The current scenario of infrastructure inadequate to sustain the urban population, government urban development mkton and the partnerships urban local bodies and foreign players we further expected to boost the growth of india construction Industry in the coming years. Abo, 100% FDI in construction development project developing industrul partes allowed through automate route Further,vans for economies have joined hands with India fornfrastructure development through finances and technology such as India Japan for development of the North East and India Sweden for developing smart cities. These projects tend to provide huge opportunities to the private players by taking up the project contracts and tenders, few such major players LAT.Godrej Properties, Shapoorji Poji Tata Projects, Escar Group, Hindustan Construction Company, Jaypee Group and others Future Prospects of the Construction Industry The Indian economy on a sing phase of growth in the infrastructure and constructions industry. It has seen to have grown in 2018 as well as in 2019 with a drastic increase in output. The industry is peded to powtimerrates in the period 2020-2023 due to the government's efforts and spending on development of housing road, ports, water supply airport al. Aho, numerous roads are to be built under the Pradhan Mantri Gram Sadak Yojana (PMGSY) by the government in the rural and backward areas in India in the format of a PPP model Athese attributes show dear growth in the industry as far as our economy is concerned. NCC Limited NCC und has dedicated tell to buking infrastructure of good standards Infrastructure that a constant reminder of the Company's holistic construction expertise, which in turn the rest of en innovation and sheer dedication. Today, NCC Lid plays a visible role on the national infrastructure stage, leaving its signature mark of quality in several growth areas