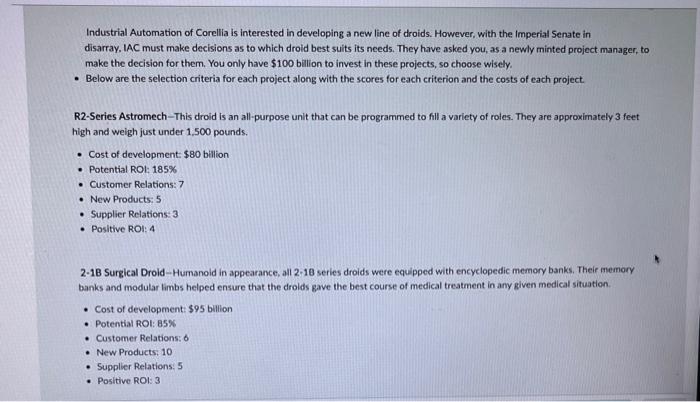

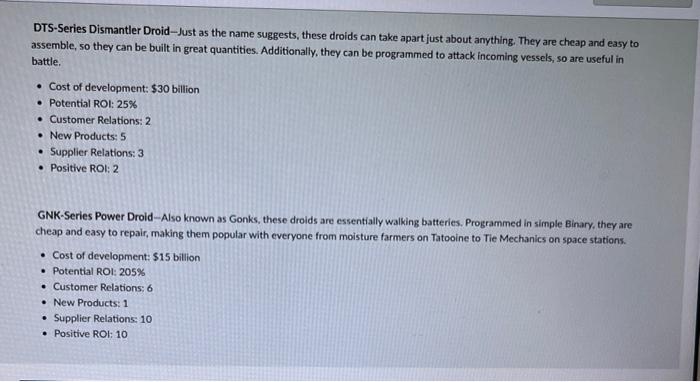

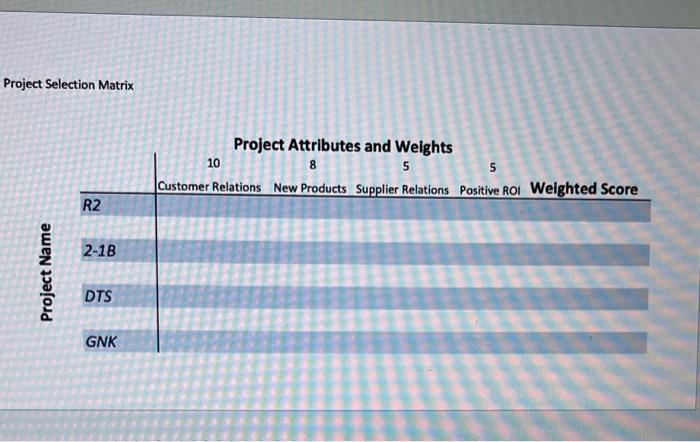

Industrial Automation of Corellia is interested in developing a new line of droids. However, with the Imperial Senate in disarray. IAC must make decisions as to which droid best suits its needs. They have asked you, as a newly minted project manager, to make the decision for them. You only have $100 billion to invest in these projects, so choose wisely. - Below are the selection criteria for each project along with the scores for each criterion and the costs of each project. R2-Series Astromech-This droid is an all-purpose unit that can be programmed to fill a variety of roles. They are approximately 3 feet high and weigh just under 1,500 pounds. - Cost of development $80 bilition - Potential ROL 185% - Customer Relations: 7 - New Products: 5 - Supplier Relations: 3 - Positive ROI: 4 2-18 Surgical Droid-Humanoid in appearance, all 2-18 series droids were equipped with encyclopedic memory banks. Their memory banks and modular limbs helped ensure that the drolds gave the best course of medical treatment in any given medical situation. - Cost of development $95 billion - Potential ROI: 85\% - Customer Relations: 6 - New Products: 10 - Supplier Relations: 5 - Positive ROI: 3 DTS-Series Dismantler Droid-Just as the name suggests, these droids can take apart just about anything. They are cheap and easy to assemble, so they can be built in great quantities. Additionally, they can be programmed to attack incoming vessels, so are useful in battle. - Cost of development: $30 billion - Potential ROI: 25% - Customer Relations: 2 - New Products: 5 - Supplier Relations: 3 - Positive ROI: 2 GNK-Series Power Droid-Also known as Gonks, these droids are essentially walking batteries. Programmed in simple Binary, they are cheap and easy to repair, making them popular with everyone from moisture farmers on Tatooine to Tie Mechanics on space stations. - Cost of development: $15 billion - Potential ROI: 205\% - Customer Relations; 6 - New Products: 1 - Supplier Relations: 10 - Positive ROl: 10 Project Selection Matrix - Your team at Corellian Engineering has $1 billion to invest in new product development. This time, management has decided to invest in freighters with FTL Hyperdrives, so they have narrowed the selection down to two projects as described below. Your task is to calculate the Payback period and Rate of Return. Management will only accept a project if it has a payback period of fewer than 5 years AND the rate of return is at least 15\%. This Excel file will help you with the calculations. Practice Project 1.2 Minimize File Previen