Answered step by step

Verified Expert Solution

Question

1 Approved Answer

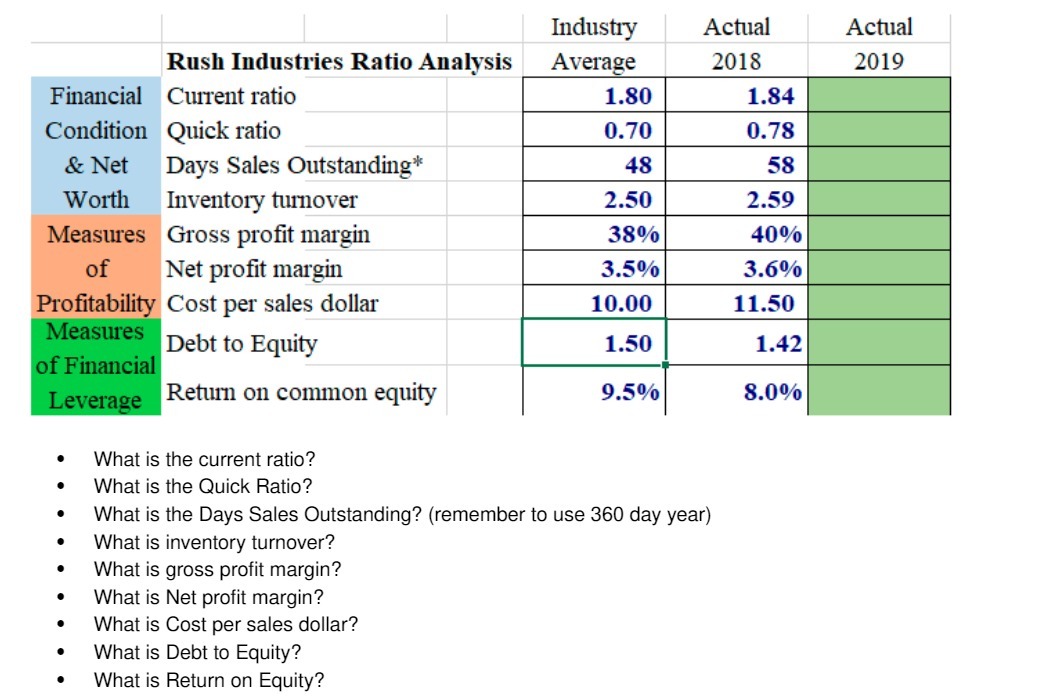

Industry Actual Actual Rush Industries Ratio Analysis Average 2018 2019 Financial Current ratio 1.80 1.84 Condition Quick ratio 0.70 0.78 & Net Days Sales

Industry Actual Actual Rush Industries Ratio Analysis Average 2018 2019 Financial Current ratio 1.80 1.84 Condition Quick ratio 0.70 0.78 & Net Days Sales Outstanding* 48 58 Worth Inventory turnover 2.50 2.59 Measures Gross profit margin of Net profit margin 38% 40% 3.5% 3.6% Profitability Cost per sales dollar 10.00 11.50 Measures Debt to Equity 1.50 1.42 of Financial Leverage Return on common equity 9.5% 8.0% What is the current ratio? What is the Quick Ratio? What is the Days Sales Outstanding? (remember to use 360 day year) What is inventory turnover? What is gross profit margin? What is Net profit margin? What is Cost per sales dollar? What is Debt to Equity? What is Return on Equity?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The information you provided is a breakdown of Rush Industries ratio analysis for 2018 and 2019 compared to industry averagesLets break down each term you requested Current Ratio Industry Average 180 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started