Ineed help ansering the ones that have a red X on the left of the incorrect answers

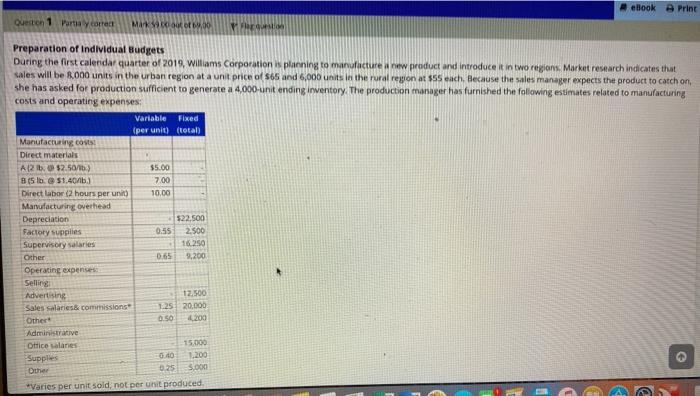

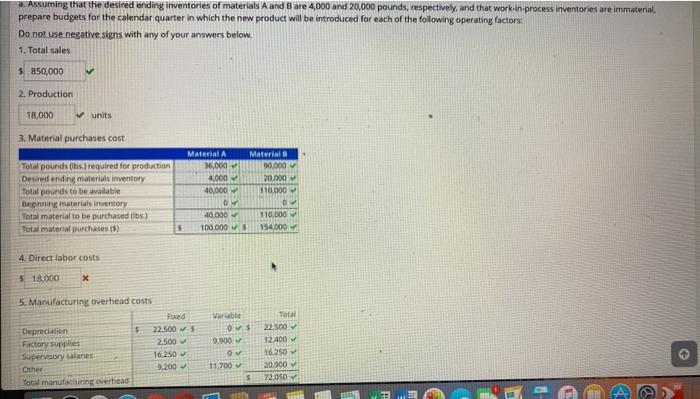

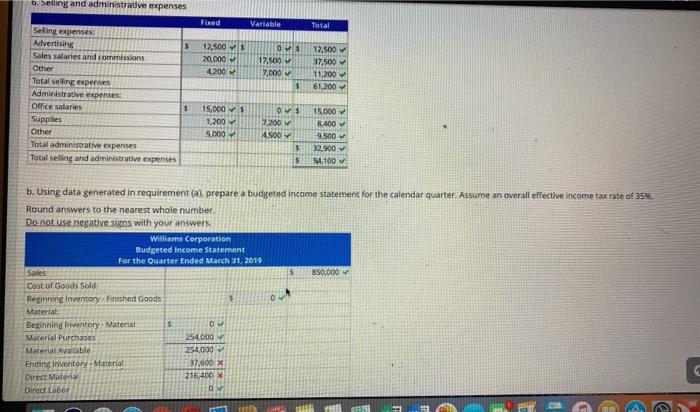

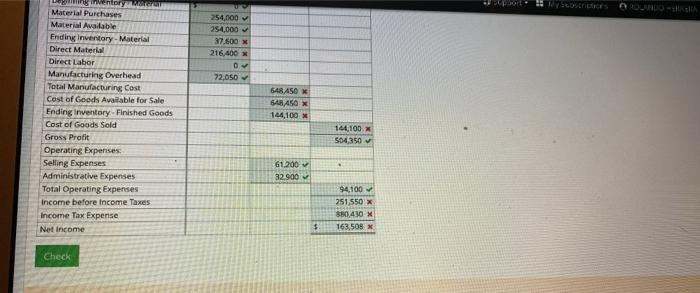

ellook Print Question 1 Partia y correct Maof00 agus Preparation of individual Budgets During the first calendar quarter of 2019, Williams Corporation is planning to manufacture nuw product and introduce it in two regions. Market research indicates that sales will be 8.000 units in the urban region at a unit price of $65 and 6,000 units in the rural region at 555 each Because the sales manager expects the product to catch on, she has asked for production sufficient to generate a 4,000-unit ending inventory. The production manager has furnished the following estimates related to manufacturing costs and operating expenses Variable Fixed (per unit) (total) Manufacturing costs Direct materials A2.0 52.50/16) $5.00 (5 lb @51.40/1b.) 7.00 Direct labor (2 hours per unit) 10,00 Marvufacturing overhead Depreciation 522.500 Factory supplies 0.55 2.500 Supervisory salaries 16.250 Other 0.65 3.200 Operating expenses Selling Advertising 12.500 Sales salaries commissions 125 20,000 Other 0.50 1200 Administrative Ottice alanes Supplies 0.40 1.200 Other 0.25 3.000 *Varies per unit sold, not per unit produced 15.000 a. Assuming that the desired ending inventories of materials A and Bare 4.000 and 20.000 pounds, respectively, and that work in process inventories are immaterial, prepare budgets for the calendar quarter in which the new product will be introduced for each of the following operating factors Do not use negative signs with any of your answers below. 1. Total sales $ 850,000 2. Production 18,000 units 3. Material purchases cost Total pounds (lbs required for production Desired ending materials inventory Total pounds to be available Benning materials inventory Total material to be purchased Total material purchases (5) Material A 16,000 4,000 40,000 O 40,000 100.000 Material 90.000 20.00 110.000 0 110.000 154,000 5 4. Direct labor costs 5. 18.000 x 5. Manufacturing overhead costs Foxed Depreciation $ 22.500 Factory supplies 2500 Supervisory Salaries 16,250 Other 9.200 Total manufacturing overhead Variable OS 9.900 O 11,700 Total 22,500 12.400 16,250 20.900 22.050 b. Selling and administrative expenses Fored Variable Total 5 12,500 VIS 20,000 4.200 OS 17,500 7.000 5 12,500 37,500 11,200 61,200 Selling expenses Advertising Sales salaries and commissions Other Total selling experses Administrative expenses Office salaries Supplies Other Total administrative expenses Total selling and administrative expenses 5 15,0001 1,200 5000 0 1 15.000 2.200 W 8.400 1500 9.500 15 32.900 SW4100 b. Using data generated in requirement (a) prepare a budgeted Income statement for the calendar quarter. Assume an overall effective income tax rate of 35%. Round answers to the nearest whole number Do not use negative signs with your answers Williams Corporation Budgeted Income Statement For the Quarter Ended March 31, 2019 Sales 5 850,000 Cost of Goods Sold Beginning Inventory Finished Goods Macerat Beginning Driventory. Material 5 Ou Material Purchases 254.000 Material Available 250.000 Ending Inventory - Material 37.600 Direct Materia 216.400 X Direct Labor 0 OV 254,000 254,000 37.600 x 216,400 72,050 Inventory Material Purchases Material Available Ending Inventory - Material Direct Material Direct Labor Manufacturing Overhead Total Manufacturing Cost Cost of Goods Available for Sale Ending Inventory - Finished Goods Cost of Goods Sold Gross Profit Operating Expenses Selling Expenses Administrative Expenses Total Operating Expenses Income before Income Taxes Income Tax Expense Net Income 548,450 M 648 AKO X 144,100 N 144.100 504,350 61.200 32.900 $4,100 251550 X 880430 M 163,508 X $ Check ellook Print Question 1 Partia y correct Maof00 agus Preparation of individual Budgets During the first calendar quarter of 2019, Williams Corporation is planning to manufacture nuw product and introduce it in two regions. Market research indicates that sales will be 8.000 units in the urban region at a unit price of $65 and 6,000 units in the rural region at 555 each Because the sales manager expects the product to catch on, she has asked for production sufficient to generate a 4,000-unit ending inventory. The production manager has furnished the following estimates related to manufacturing costs and operating expenses Variable Fixed (per unit) (total) Manufacturing costs Direct materials A2.0 52.50/16) $5.00 (5 lb @51.40/1b.) 7.00 Direct labor (2 hours per unit) 10,00 Marvufacturing overhead Depreciation 522.500 Factory supplies 0.55 2.500 Supervisory salaries 16.250 Other 0.65 3.200 Operating expenses Selling Advertising 12.500 Sales salaries commissions 125 20,000 Other 0.50 1200 Administrative Ottice alanes Supplies 0.40 1.200 Other 0.25 3.000 *Varies per unit sold, not per unit produced 15.000 a. Assuming that the desired ending inventories of materials A and Bare 4.000 and 20.000 pounds, respectively, and that work in process inventories are immaterial, prepare budgets for the calendar quarter in which the new product will be introduced for each of the following operating factors Do not use negative signs with any of your answers below. 1. Total sales $ 850,000 2. Production 18,000 units 3. Material purchases cost Total pounds (lbs required for production Desired ending materials inventory Total pounds to be available Benning materials inventory Total material to be purchased Total material purchases (5) Material A 16,000 4,000 40,000 O 40,000 100.000 Material 90.000 20.00 110.000 0 110.000 154,000 5 4. Direct labor costs 5. 18.000 x 5. Manufacturing overhead costs Foxed Depreciation $ 22.500 Factory supplies 2500 Supervisory Salaries 16,250 Other 9.200 Total manufacturing overhead Variable OS 9.900 O 11,700 Total 22,500 12.400 16,250 20.900 22.050 b. Selling and administrative expenses Fored Variable Total 5 12,500 VIS 20,000 4.200 OS 17,500 7.000 5 12,500 37,500 11,200 61,200 Selling expenses Advertising Sales salaries and commissions Other Total selling experses Administrative expenses Office salaries Supplies Other Total administrative expenses Total selling and administrative expenses 5 15,0001 1,200 5000 0 1 15.000 2.200 W 8.400 1500 9.500 15 32.900 SW4100 b. Using data generated in requirement (a) prepare a budgeted Income statement for the calendar quarter. Assume an overall effective income tax rate of 35%. Round answers to the nearest whole number Do not use negative signs with your answers Williams Corporation Budgeted Income Statement For the Quarter Ended March 31, 2019 Sales 5 850,000 Cost of Goods Sold Beginning Inventory Finished Goods Macerat Beginning Driventory. Material 5 Ou Material Purchases 254.000 Material Available 250.000 Ending Inventory - Material 37.600 Direct Materia 216.400 X Direct Labor 0 OV 254,000 254,000 37.600 x 216,400 72,050 Inventory Material Purchases Material Available Ending Inventory - Material Direct Material Direct Labor Manufacturing Overhead Total Manufacturing Cost Cost of Goods Available for Sale Ending Inventory - Finished Goods Cost of Goods Sold Gross Profit Operating Expenses Selling Expenses Administrative Expenses Total Operating Expenses Income before Income Taxes Income Tax Expense Net Income 548,450 M 648 AKO X 144,100 N 144.100 504,350 61.200 32.900 $4,100 251550 X 880430 M 163,508 X $ Check