INEED THE ANOTHER QUESTON

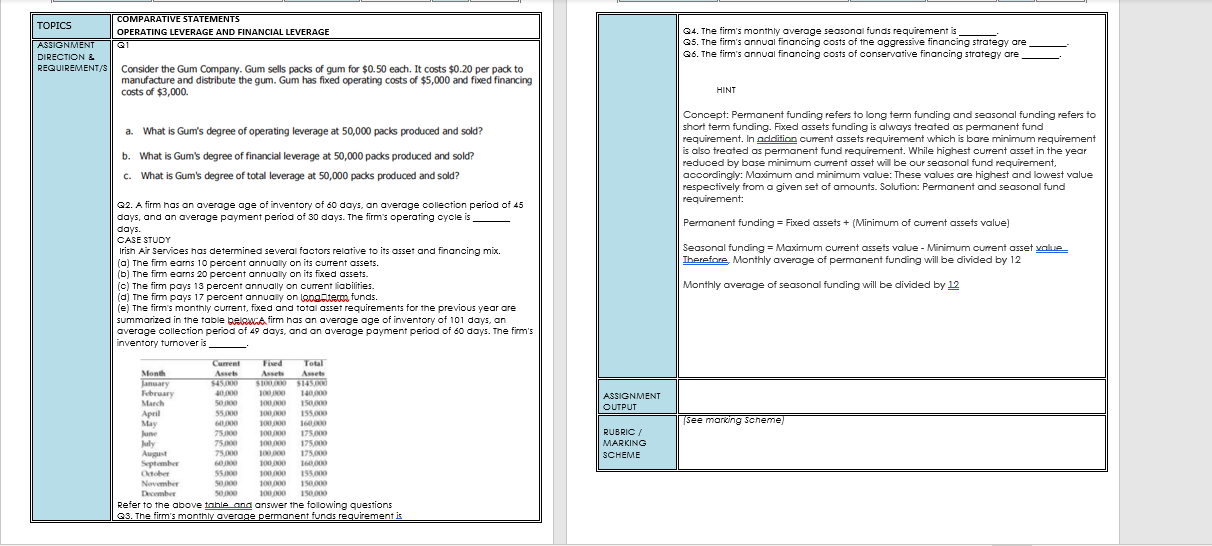

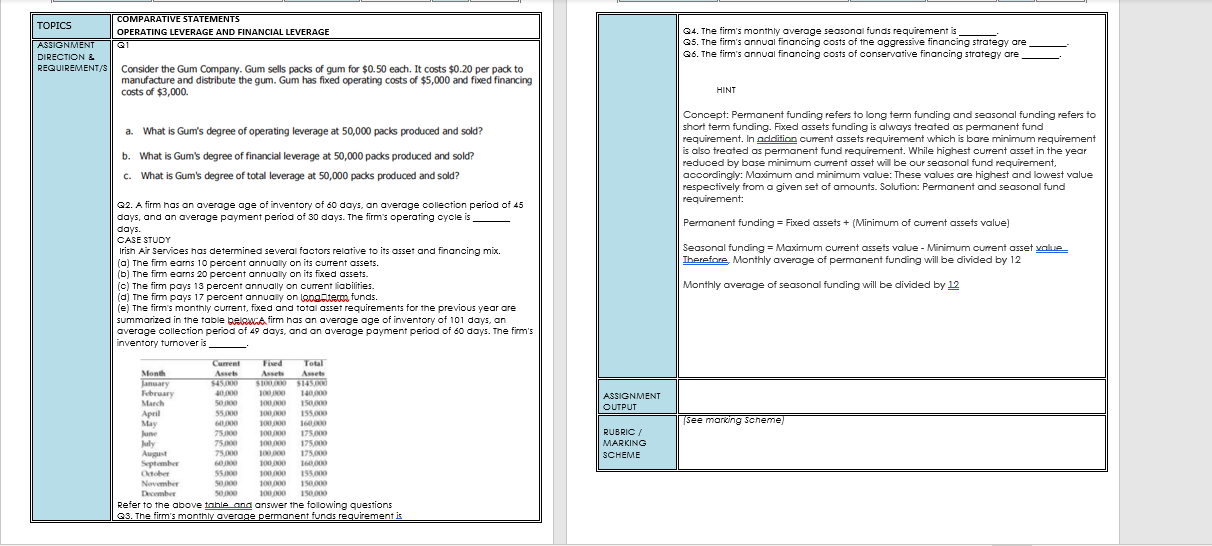

COMPARATIVE STATEMENTS TOPICS OPERATING LEVERAGE AND FINANCIAL LEVERAGE ASSIGNMENT Q1 DIRECTIONS REQUIREMENT/S | Consider the Gum Company. Gum sells packs of gum for $0.50 each. It costs $0.20 per pack to manufacture and distribute the gum. Gum has fixed operating costs of $5,000 and fixed financing costs of $3,000. G4. The firm's monthly average seasonal funds requirement is Q5. The firm's annual financing costs of the aggressive financing strategy ore Q6. The firm's annual financing costs of conservative financing strategy are HINT a. What is Gum's degree of operating leverage at 50,000 packs produced and sold? b. What is Gum's degree of financial leverage at 50,000 packs produced and sold? C. What is Gum's degree of total leverage at 50,000 packs produced and sold? Concept: Permanent funding refers to long term funding and seasonal funding refers to short term funding. Fixed assets funding is always treated as permanent fund requirement. In addition current assets requirement which is bare minimum requirement is also treated as permanent fund requirement. While highest current asset in the year reduced by base minimum current asset will be our seasonal fund requirement, accordingly: Maximum and minimum value: These values are highest and lowest value respectively from a given set of amounts. Solution: Permanent and seasonal fund requirement: Permanent funding = Fixed assets + (Minimum of current assets value) Seasonal funding = Maximum current assets volue - Minimum current asset value Therefore, Monthly average of permanent funding will be divided by 12 Q2. A firm has an average age of inventory of 60 days, an average collection period of 45 days, and an average payment period of 30 days. The firm's operating cycle is days. CASE STUDY Irish Air Services has determined several factors relative to its asset and financing mix. (a) The firm earns 10 percent annually on its current assets. (b) The firm earns 20 percent annually on its fixed assets. (c) The firm pays 13 percent annually on current liabilities. laj The firm pays 17 percent annually on langterm funds. (e) The firm's monthly current, fixed and total asset requirements for the previous year are summarized in the table belowna firm has an average age of inventory of 101 days, an average collection period of 49 days, and an average payment period of 60 days. The firm's inventory turnover is Monthly average of seasonal funding will be divided by 12 ASSIGNMENT OUTPUT (See mording scheme) Current Fixed Total Month Assets Assets Assets Lanuar S450 STORITROSISTER February 40 100JNO 140,000 March 500 100.00 150,000 April 55.000 DO 155.000 May 6000 INO 75 100,000 175.000 Nily 75 100.000 175.000 75.000 100.00 175.000 September GO 100.000 160.000 550 TODO 155.000 November SON 100 150.000 December SONO 100.000 150,000 Refer to the above table and answer the following questions 3. The firm's monthly average permanent funds requirement is RUBRIC/ MARKING SCHEME