Question

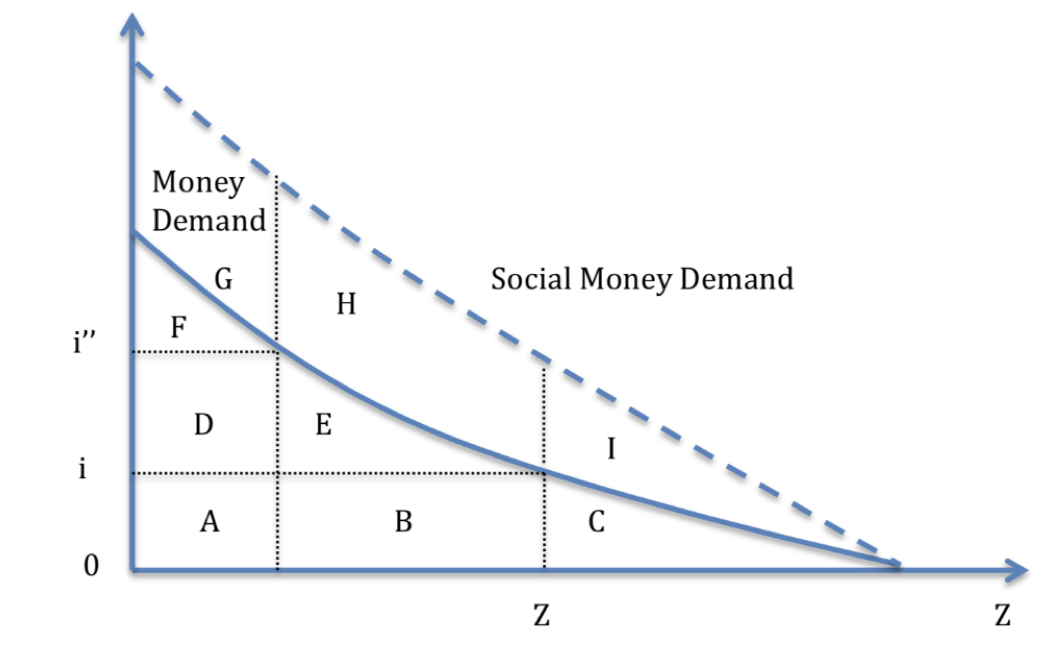

[Inflation in the long run] (15%) Consider the money demand curve (solid line) and the social money demand curve (dash line) in Figure 1 where

[Inflation in the long run] (15%) Consider the money demand curve (solid line) and the social money demand curve (dash line) in Figure 1 where z=real balances (the real value of buyers' money holding).

(a) Suppose the Federal Reserve increases the nominal interest rate from i to i''. What is the change in buyers' surplus, sellers' surplus and government income?

(b) According to the Friedman rule, what is the optimal nominal interest rate? What is the economics intuition behind the Friedman rule?

(c) Suppose the government runs the Friedman rule by setting i=0. What is the equilibrium level of real balances z? Explain why the Friedman rule is socially optimal.

(d) [Data Exercise] Collect US data on i=nominal interest rate, M=money supply (M1), y=GDP in the last 50 years. Then plot the money demand curve (namely i against M/y).

(e) Find a curve that fits the money demand data in (d) (you can either use a straight line or a curve). Use this as your estimate of the money demand curve.

(f) Using your estimate in (e), what is the change in the ratio M/y as the Federal Reserve raises the interest rate i from 2% to 3%? What is the loss in buyer's surplus?

Show transcribed image text

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started