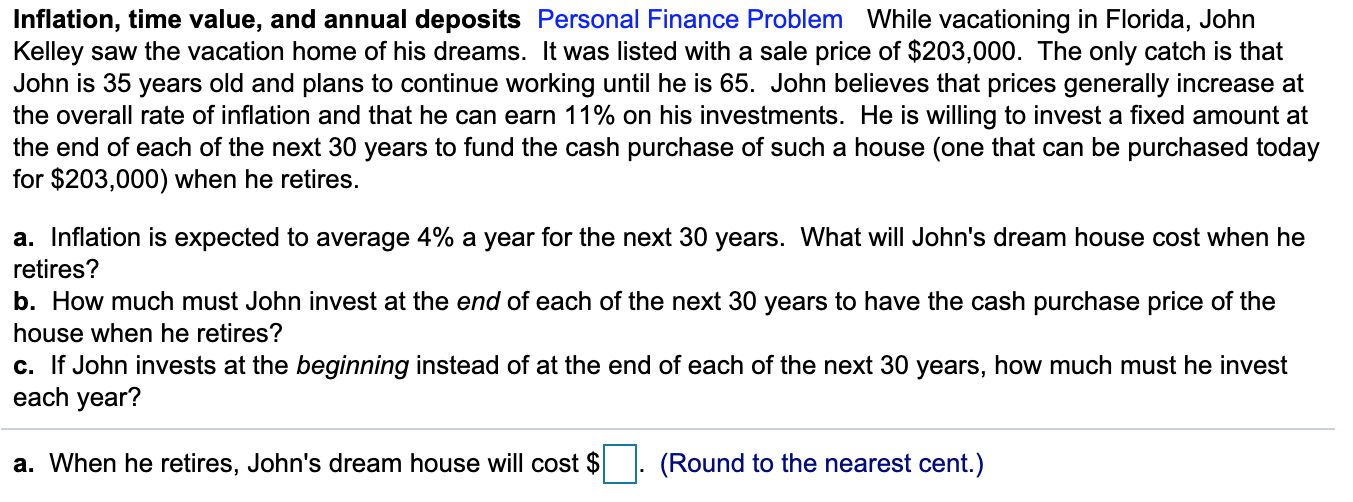

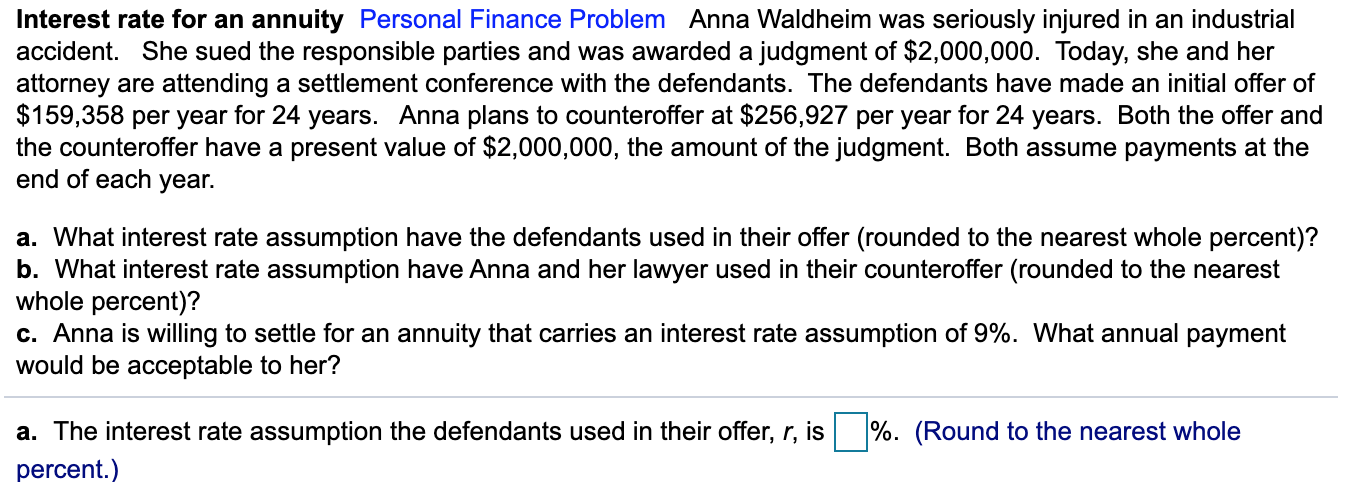

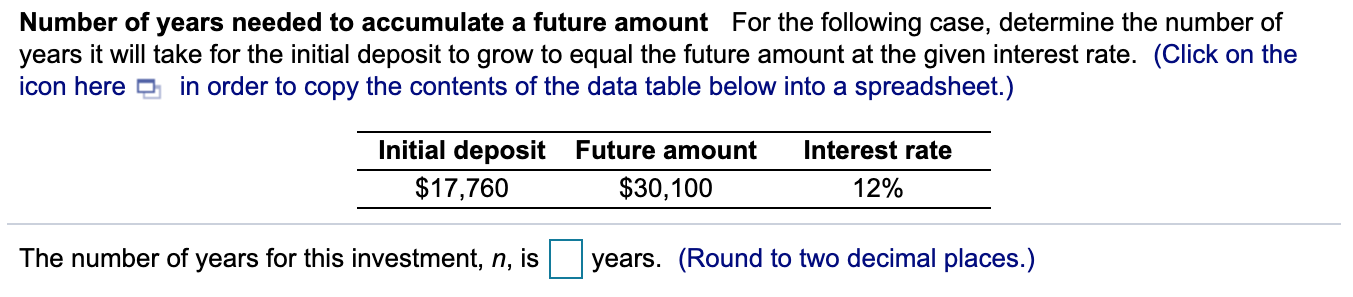

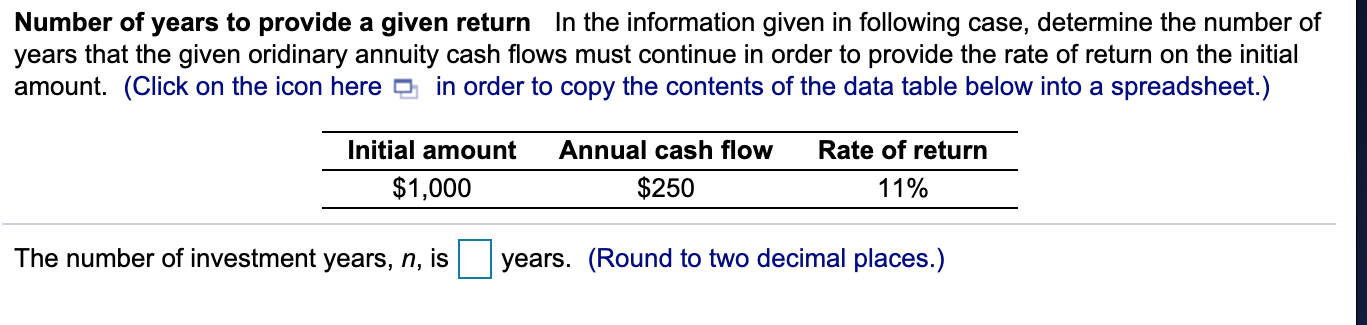

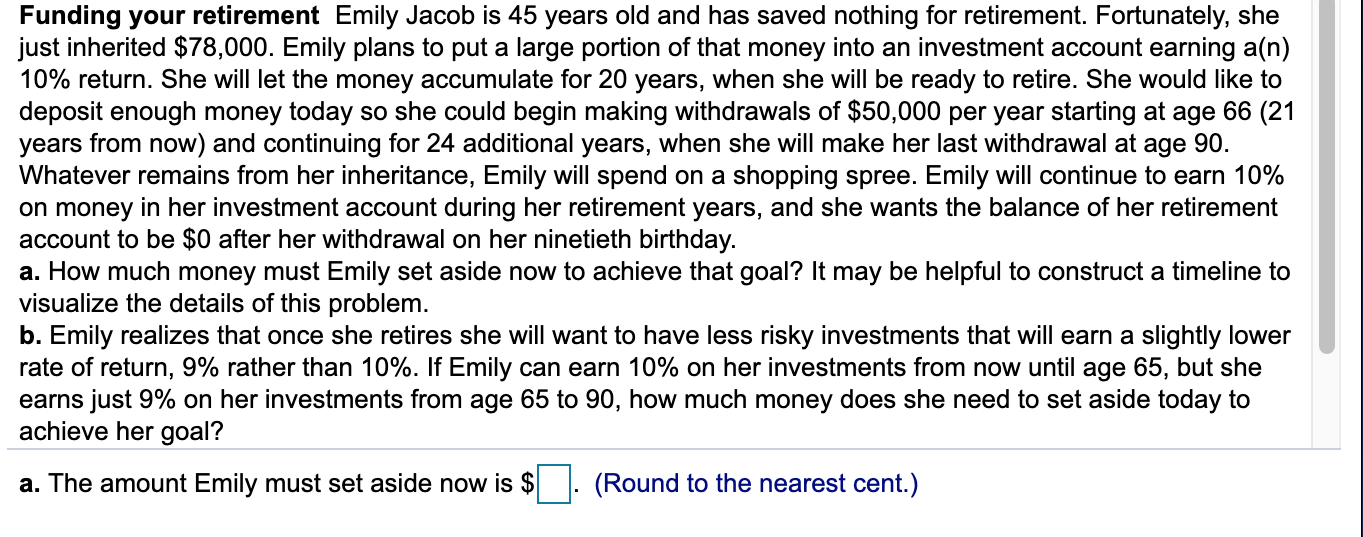

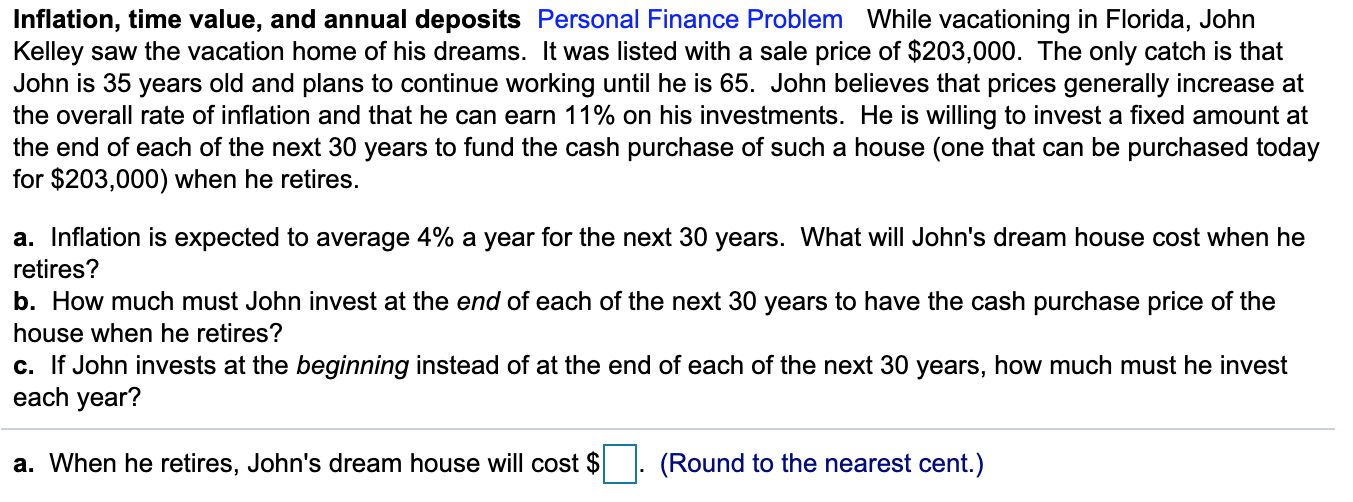

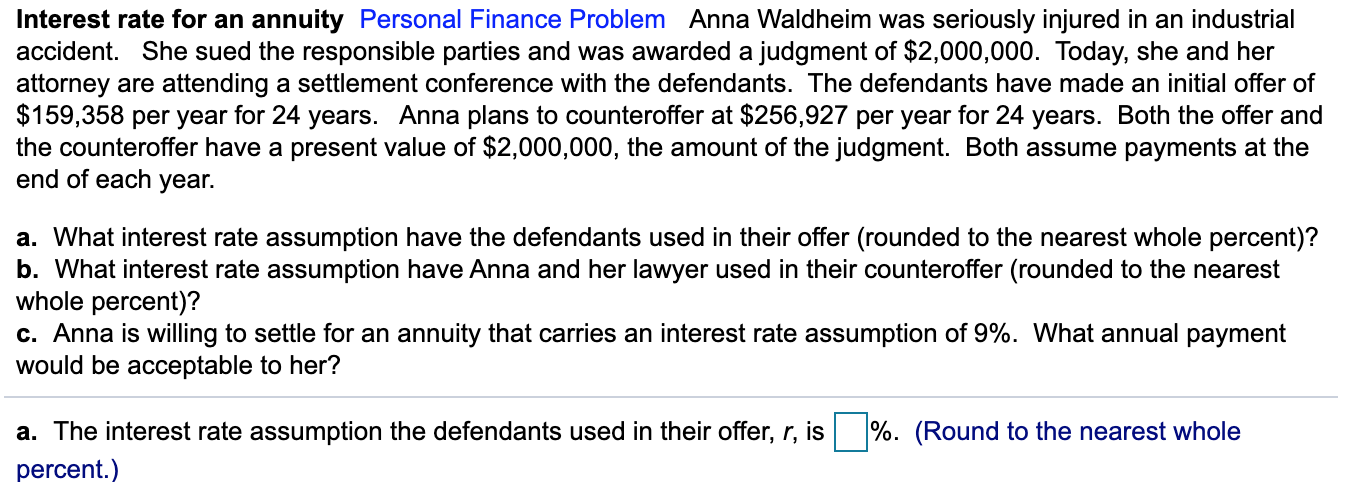

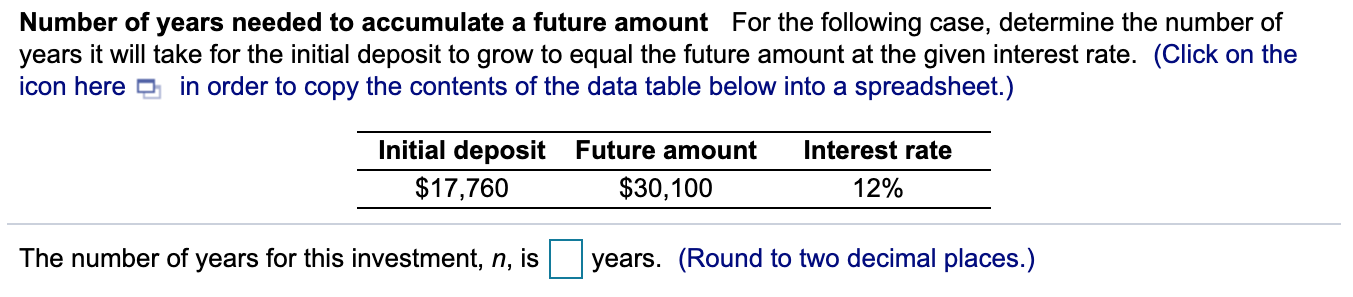

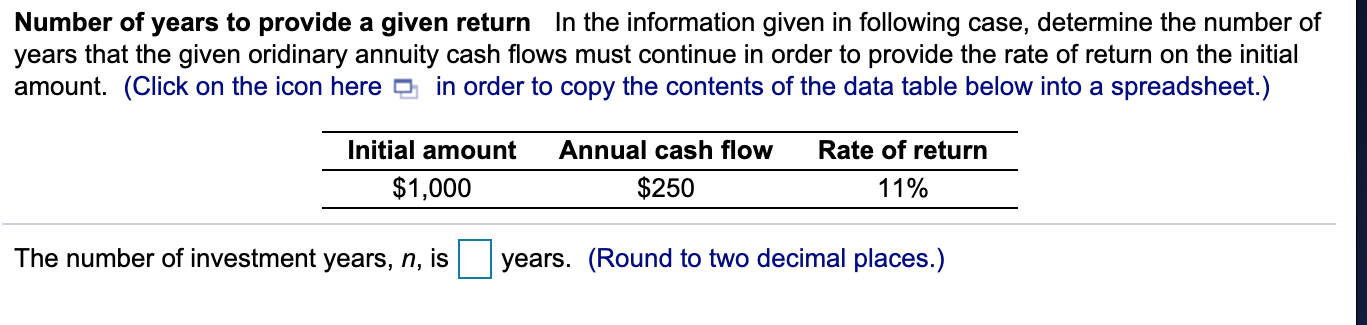

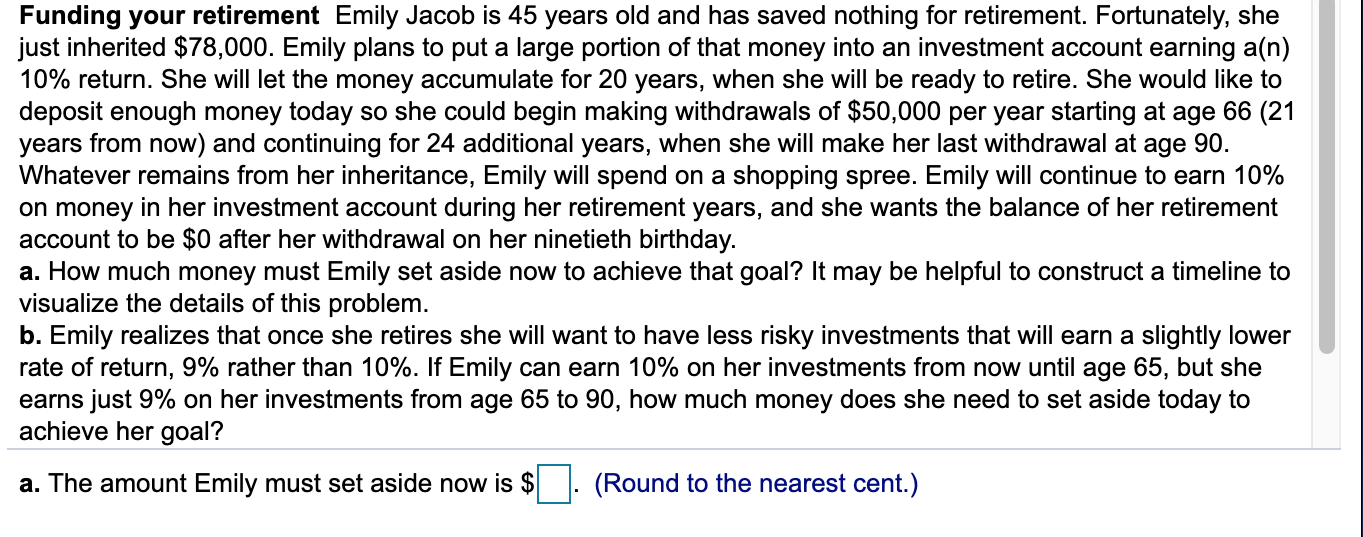

Inflation, time value, and annual deposits Personal Finance Problem While vacationing in Florida, John Kelley saw the vacation home of his dreams. It was listed with a sale price of $203,000. The only catch is that John is 35 years old and plans to continue working until he is 65. John believes that prices generally increase at the overall rate of inflation and that he can earn 11% on his investments. He is willing to invest a fixed amount at the end of each of the next 30 years to fund the cash purchase of such a house (one that can be purchased today for $203,000) when he retires. a. Inflation is expected to average 4% a year for the next 30 years. What will John's dream house cost when he retires? b. How much must John invest at the end of each of the next 30 years to have the cash purchase price of the house when he retires? c. If John invests at the beginning instead of at the end of each of the next 30 years, how much must he invest each year? a. When he retires, John's dream house will cost $ (Round to the nearest cent.) Interest rate for an annuity Personal Finance Problem Anna Waldheim was seriously injured in an industrial accident. She sued the responsible parties and was awarded a judgment of $2,000,000. Today, she and her attorney are attending a settlement conference with the defendants. The defendants have made an initial offer of $159,358 per year for 24 years. Anna plans to counteroffer at $256,927 per year for 24 years. Both the offer and the counteroffer have a present value of $2,000,000, the amount of the judgment. Both assume payments at the end of each year. a. What interest rate assumption have the defendants used in their offer (rounded to the nearest whole percent)? b. What interest rate assumption have Anna and her lawyer used in their counteroffer (rounded to the nearest whole percent)? c. Anna is willing to settle for an annuity that carries an interest rate assumption of 9%. What annual payment would be acceptable to her? a. The interest rate assumption the defendants used in their offer, r, is percent.) %. (Round to the nearest whole Number of years needed to accumulate a future amount For the following case, determine the number of years it will take for the initial deposit to grow to equal the future amount at the given interest rate. (Click on the icon here e in order to copy the contents of the data table below into a spreadsheet.) Initial deposit Future amount $17,760 $30,100 Interest rate 12% The number of years for this investment, n, is years. (Round to two decimal places.) Number of years to provide a given return in the information given in following case, determine the number of years that the given oridinary annuity cash flows must continue in order to provide the rate of return on the initial amount. (Click on the icon here e in order to copy the contents of the data table below into a spreadsheet.) Initial amount $1,000 Annual cash flow $250 Rate of return 11% The number of investment years, n, is years. (Round to two decimal places.) Funding your retirement Emily Jacob is 45 years old and has saved nothing for retirement. Fortunately, she just inherited $78,000. Emily plans to put a large portion of that money into an investment account earning a(n) 10% return. She will let the money accumulate for 20 years, when she will be ready to retire. She would like to deposit enough money today so she could begin making withdrawals of $50,000 per year starting at age 66 (21 years from now) and continuing for 24 additional years, when she will make her last withdrawal at age 90. Whatever remains from her inheritance, Emily will spend on a shopping spree. Emily will continue to earn 10% on money in her investment account during her retirement years, and she wants the balance of her retirement account to be $0 after her withdrawal on her ninetieth birthday. a. How much money must Emily set aside now to achieve that goal? It may be helpful to construct a timeline to visualize the details of this problem. b. Emily realizes that once she retires she will want to have less risky investments that will earn a slightly lower rate of return, 9% rather than 10%. If Emily can earn 10% on her investments from now until age 65, but she earns just 9% on her investments from age 65 to 90, how much money does she need to set aside today to achieve her goal? a. The amount Emily must set aside now is $ (Round to the nearest cent.)