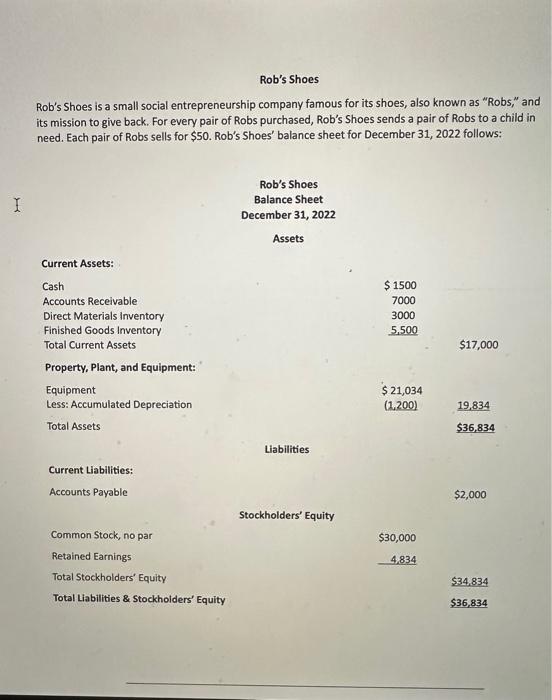

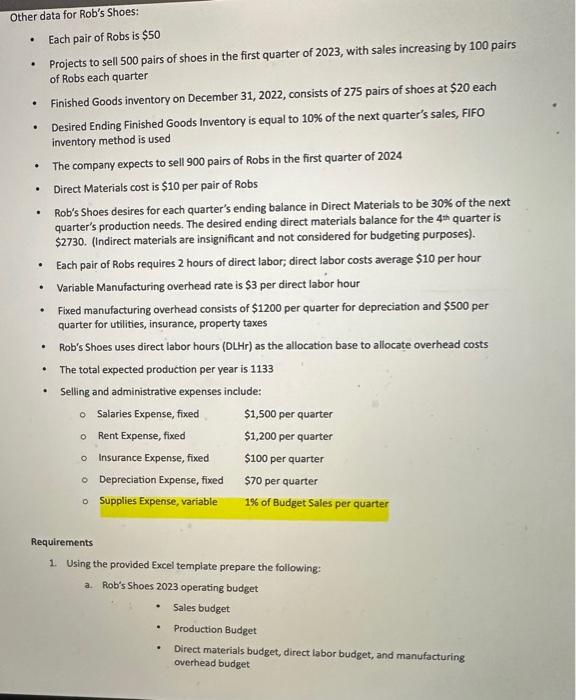

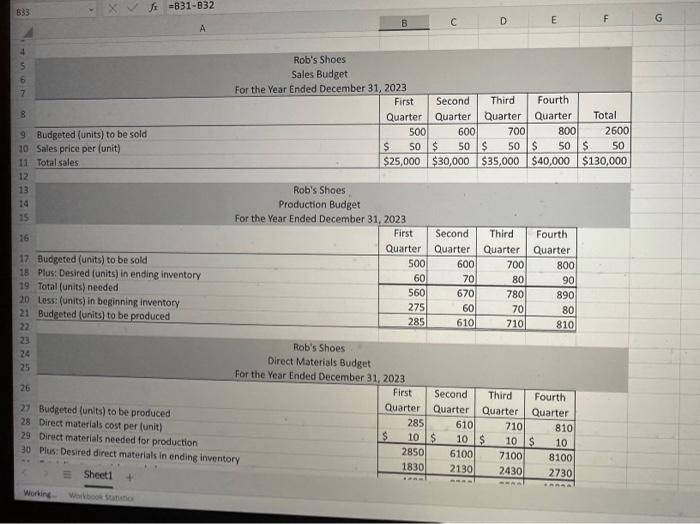

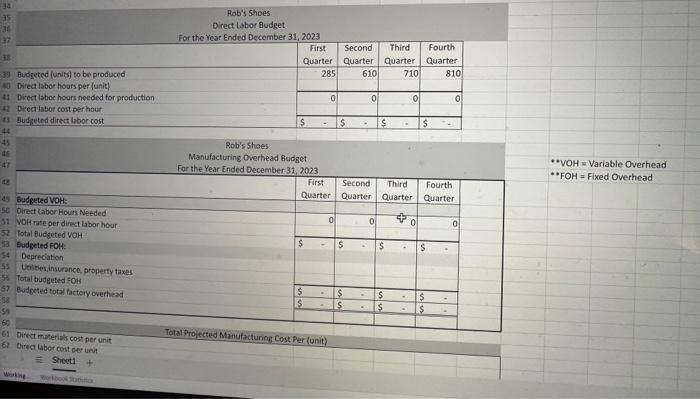

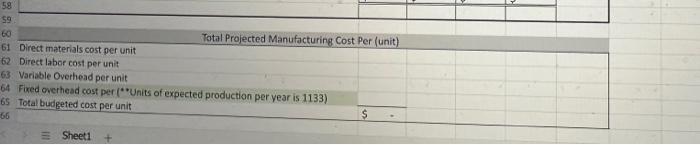

Rob's Shoes Rob's Shoes is a small social entrepreneurship company famous for its shoes, also known as "Robs," and its mission to give back. For every pair of Robs purchased, Rob's Shoes sends a pair of Robs to a child in need. Each pair of Robs sells for \$50. Rob's Shoes' balance sheet for December 31, 2022 follows: - Each pair of Robs is $50 - Projects to sell 500 pairs of shoes in the first quarter of 2023 , with sales increasing by 100 pairs of Robs each quarter - Finished Goods inventory on December 31,2022 , consists of 275 pairs of shoes at $20 each - Desired Ending Finished Goods Inventory is equal to 10% of the next quarter's sales, FIFO inventory method is used - The company expects to sell 900 pairs of Robs in the first quarter of 2024 - Direct Materials cost is $10 per pair of Robs - Rob's Shoes desires for each quarter's ending balance in Direct Materials to be 30% of the next quarter's production needs. The desired ending direct materials balance for the 4th quarter is $2730. (Indirect materials are insignificant and not considered for budgeting purposes). - Each pair of Robs requires 2 hours of direct labor; direct labor costs average $10 per hour - Variable Manufacturing overhead rate is $3 per direct labor hour - Fixed manufacturing overhead consists of $1200 per quarter for depreciation and $500 per quarter for utilities, insurance, property taxes - Rob's Shoes uses direct labor hours (DLHr) as the allocation base to allocate overhead costs - The total expected production per year is 1133 - Selling and administrative expenses include: - Salaries Expense, fixed - Rent Expense, fixed - Insurance Expense, fixed - Depreciation Expense, fixed $1,500 per quarter $1,200 per quarter $100 per quarter $70 per quarter 1% of Budget Sales per quarter Requirements 1. Using the provided Excel template prepare the following: a. Rob's Shoes 2023 operating budget - Sales budget - Production Budget - Direct materials budget, direct labor budget, and manufacturing overhead budget 633. fx=831B32 Rob's Shoes Sales Budget For the Year Ended December 31, 2023 * vOH = Variable Overhead * FOH= Fixed Overhead Total Projected Manufacturing Cost Per (unit) Direct materials cost per unit Direct labor cost per unit Variable Overhead per unit Fixed overhead cast per (" "Units of expected production per year is 1133) Total budgeted cost per unit Sheet1+ Rob's Shoes Rob's Shoes is a small social entrepreneurship company famous for its shoes, also known as "Robs," and its mission to give back. For every pair of Robs purchased, Rob's Shoes sends a pair of Robs to a child in need. Each pair of Robs sells for \$50. Rob's Shoes' balance sheet for December 31, 2022 follows: - Each pair of Robs is $50 - Projects to sell 500 pairs of shoes in the first quarter of 2023 , with sales increasing by 100 pairs of Robs each quarter - Finished Goods inventory on December 31,2022 , consists of 275 pairs of shoes at $20 each - Desired Ending Finished Goods Inventory is equal to 10% of the next quarter's sales, FIFO inventory method is used - The company expects to sell 900 pairs of Robs in the first quarter of 2024 - Direct Materials cost is $10 per pair of Robs - Rob's Shoes desires for each quarter's ending balance in Direct Materials to be 30% of the next quarter's production needs. The desired ending direct materials balance for the 4th quarter is $2730. (Indirect materials are insignificant and not considered for budgeting purposes). - Each pair of Robs requires 2 hours of direct labor; direct labor costs average $10 per hour - Variable Manufacturing overhead rate is $3 per direct labor hour - Fixed manufacturing overhead consists of $1200 per quarter for depreciation and $500 per quarter for utilities, insurance, property taxes - Rob's Shoes uses direct labor hours (DLHr) as the allocation base to allocate overhead costs - The total expected production per year is 1133 - Selling and administrative expenses include: - Salaries Expense, fixed - Rent Expense, fixed - Insurance Expense, fixed - Depreciation Expense, fixed $1,500 per quarter $1,200 per quarter $100 per quarter $70 per quarter 1% of Budget Sales per quarter Requirements 1. Using the provided Excel template prepare the following: a. Rob's Shoes 2023 operating budget - Sales budget - Production Budget - Direct materials budget, direct labor budget, and manufacturing overhead budget 633. fx=831B32 Rob's Shoes Sales Budget For the Year Ended December 31, 2023 * vOH = Variable Overhead * FOH= Fixed Overhead Total Projected Manufacturing Cost Per (unit) Direct materials cost per unit Direct labor cost per unit Variable Overhead per unit Fixed overhead cast per (" "Units of expected production per year is 1133) Total budgeted cost per unit Sheet1+