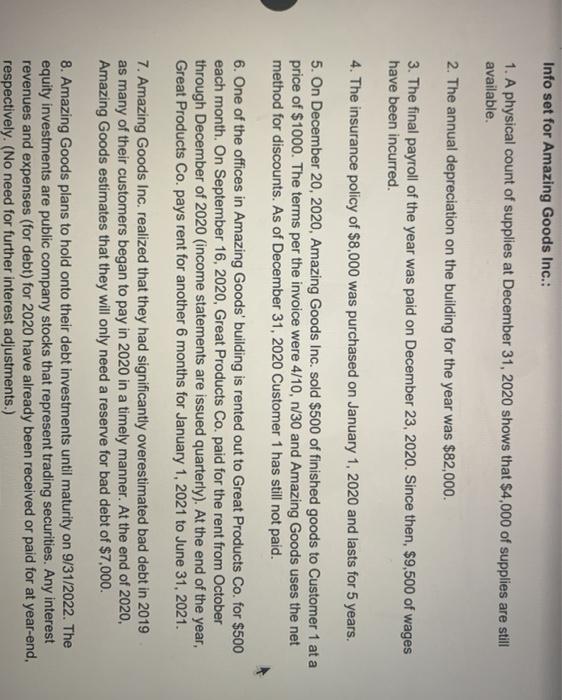

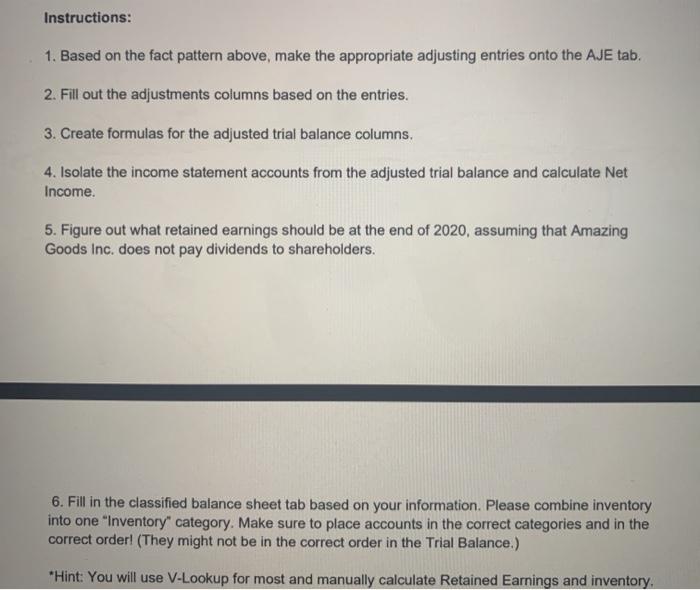

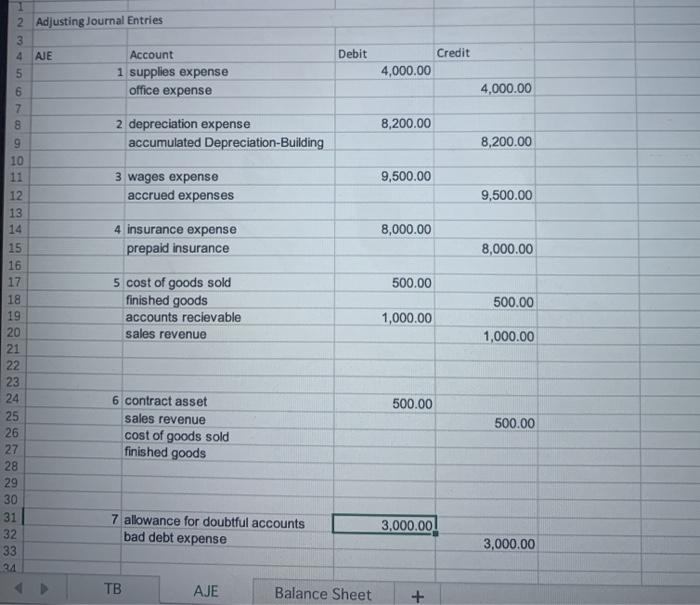

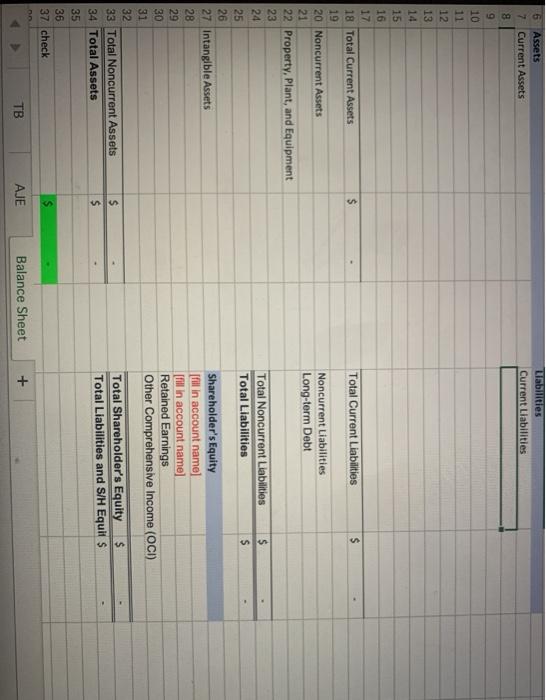

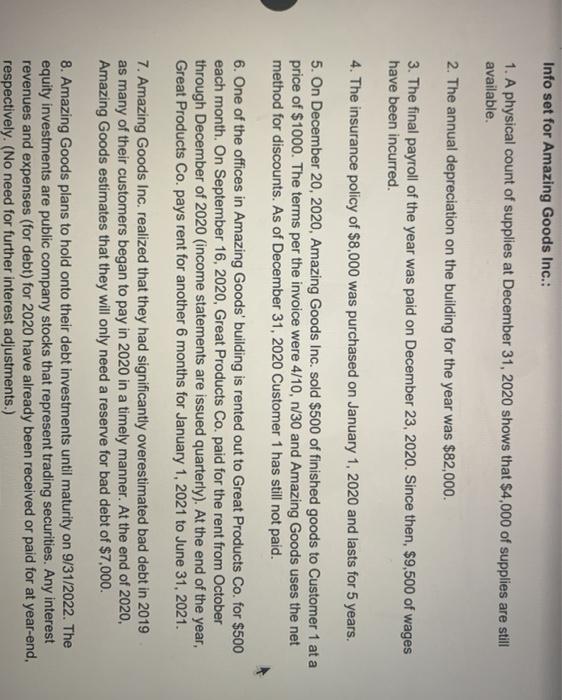

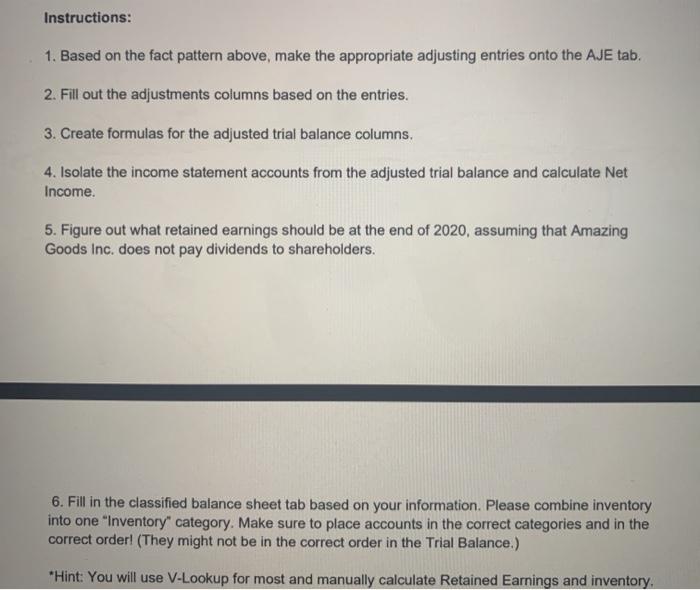

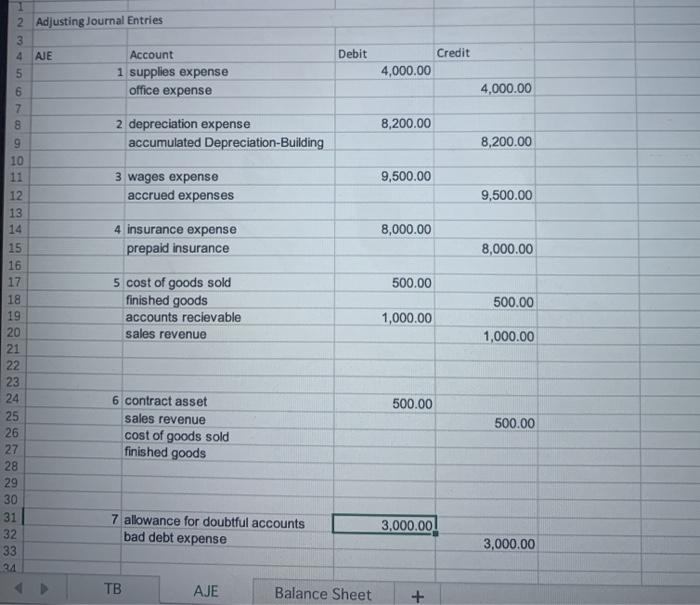

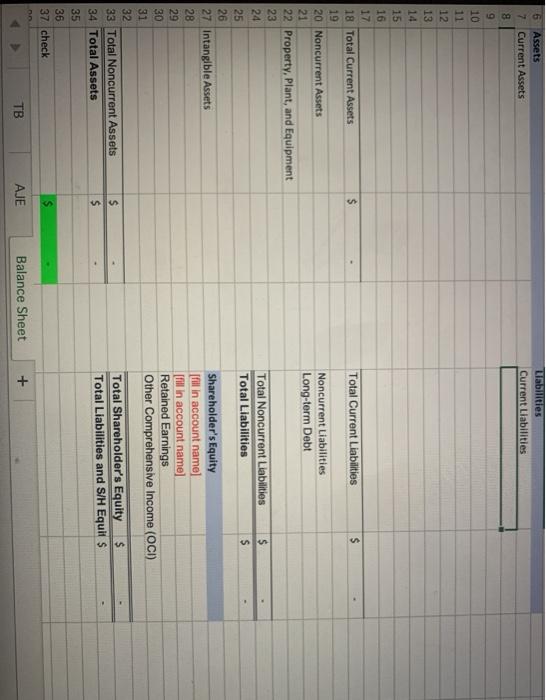

Info set for Amazing Goods Inc.: 1. A physical count of supplies at December 31, 2020 shows that $4,000 of supplies are still available 2. The annual depreciation on the building for the year was $82,000. 3. The final payroll of the year was paid on December 23, 2020. Since then, $9,500 of wages have been incurred. 4. The insurance policy of $8,000 was purchased on January 1, 2020 and lasts for 5 years. 5. On December 20, 2020, Amazing Goods Inc. sold $500 of finished goods to Customer 1 at a price of $1000. The terms per the invoice were 4/10, 1/30 and Amazing Goods uses the net method for discounts. As of December 31, 2020 Customer 1 has still not paid. 6. One of the offices in Amazing Goods' building is rented out to Great Products Co. for $500 each month. On September 16, 2020, Great Products Co. paid for the rent from October through December of 2020 (income statements are issued quarterly). At the end of the year, Great Products Co. pays rent for another 6 months for January 1, 2021 to June 31, 2021. 7. Amazing Goods Inc. realized that they had significantly overestimated bad debt in 2019 as many of their customers began to pay in 2020 in a timely manner. At the end of 2020, Amazing Goods estimates that they will only need a reserve for bad debt of $7,000. 8. Amazing Goods plans to hold onto their debt investments until maturity on 9/31/2022. The equity investments are public company stocks that represent trading securities. Any interest revenues and expenses (for debt) for 2020 have already been received or paid for at year-end, respectively. (No need for further interest adjustments.) Instructions: 1. Based on the fact pattern above, make the appropriate adjusting entries onto the AJE tab. 2. Fill out the adjustments columns based on the entries. 3. Create formulas for the adjusted trial balance columns. 4. Isolate the income statement accounts from the adjusted trial balance and calculate Net Income. 5. Figure out what retained earnings should be at the end of 2020, assuming that Amazing Goods Inc. does not pay dividends to shareholders. 6. Fill in the classified balance sheet tab based on your information. Please combine inventory into one "Inventory" category. Make sure to place accounts in the correct categories and in the correct order! (They might not be in the correct order in the Trial Balance.) *Hint: You will use V-Lookup for most and manually calculate Retained Earnings and inventory. 4,000.00 8,200.00 9,500.00 8,000.00 2 Adjusting Journal Entries 3 4 AJE Account Debit Credit 5 1 supplies expense 4,000.00 6 office expense 7 8 2 depreciation expense 8,200.00 9 accumulated Depreciation-Building 10 3 wages expense 9,500.00 12 accrued expenses 13 14 4 insurance expense 8,000.00 15 prepaid insurance 16 17 5 cost of goods sold 500.00 18 finished goods 19 accounts recievable 1,000.00 20 sales revenue 21 22 23 24 6 contract asset 500.00 25 sales revenue 26 cost of goods sold 27 finished goods 28 29 30 31 7 allowance for doubtful accounts 3,000.00 32 bad debt expense 33 34 TB AJE Balance Sheet + 500.00 1,000.00 500.00 3,000.00 Liabilities Current Liabilities $ Total Current Liabilities $ Noncurrent Liabilities Long-term Debt 6 Assets 7 Current Assets 9 9 10 11 12 13 14 15 16 17 18 Total Current Assets 19 20 Noncurrent Assets 21 22 Property, plant, and Equipment 23 24 25 26 27 Intangible Assets 28 29 30 31 32 33 Total Noncurrent Assets 34 Total Assets 35 36 37 check Total Noncurrent Liabilities Total Liabilities $ $ Shareholder's Equity fill in account namel (fill in account name] Retained Earnings Other Comprehensive Income (OCI) $ $ Total Shareholder's Equity $ Total Liabilities and S/H Equil $ TB AJE Balance Sheet + Info set for Amazing Goods Inc.: 1. A physical count of supplies at December 31, 2020 shows that $4,000 of supplies are still available 2. The annual depreciation on the building for the year was $82,000. 3. The final payroll of the year was paid on December 23, 2020. Since then, $9,500 of wages have been incurred. 4. The insurance policy of $8,000 was purchased on January 1, 2020 and lasts for 5 years. 5. On December 20, 2020, Amazing Goods Inc. sold $500 of finished goods to Customer 1 at a price of $1000. The terms per the invoice were 4/10, 1/30 and Amazing Goods uses the net method for discounts. As of December 31, 2020 Customer 1 has still not paid. 6. One of the offices in Amazing Goods' building is rented out to Great Products Co. for $500 each month. On September 16, 2020, Great Products Co. paid for the rent from October through December of 2020 (income statements are issued quarterly). At the end of the year, Great Products Co. pays rent for another 6 months for January 1, 2021 to June 31, 2021. 7. Amazing Goods Inc. realized that they had significantly overestimated bad debt in 2019 as many of their customers began to pay in 2020 in a timely manner. At the end of 2020, Amazing Goods estimates that they will only need a reserve for bad debt of $7,000. 8. Amazing Goods plans to hold onto their debt investments until maturity on 9/31/2022. The equity investments are public company stocks that represent trading securities. Any interest revenues and expenses (for debt) for 2020 have already been received or paid for at year-end, respectively. (No need for further interest adjustments.) Instructions: 1. Based on the fact pattern above, make the appropriate adjusting entries onto the AJE tab. 2. Fill out the adjustments columns based on the entries. 3. Create formulas for the adjusted trial balance columns. 4. Isolate the income statement accounts from the adjusted trial balance and calculate Net Income. 5. Figure out what retained earnings should be at the end of 2020, assuming that Amazing Goods Inc. does not pay dividends to shareholders. 6. Fill in the classified balance sheet tab based on your information. Please combine inventory into one "Inventory" category. Make sure to place accounts in the correct categories and in the correct order! (They might not be in the correct order in the Trial Balance.) *Hint: You will use V-Lookup for most and manually calculate Retained Earnings and inventory. 4,000.00 8,200.00 9,500.00 8,000.00 2 Adjusting Journal Entries 3 4 AJE Account Debit Credit 5 1 supplies expense 4,000.00 6 office expense 7 8 2 depreciation expense 8,200.00 9 accumulated Depreciation-Building 10 3 wages expense 9,500.00 12 accrued expenses 13 14 4 insurance expense 8,000.00 15 prepaid insurance 16 17 5 cost of goods sold 500.00 18 finished goods 19 accounts recievable 1,000.00 20 sales revenue 21 22 23 24 6 contract asset 500.00 25 sales revenue 26 cost of goods sold 27 finished goods 28 29 30 31 7 allowance for doubtful accounts 3,000.00 32 bad debt expense 33 34 TB AJE Balance Sheet + 500.00 1,000.00 500.00 3,000.00 Liabilities Current Liabilities $ Total Current Liabilities $ Noncurrent Liabilities Long-term Debt 6 Assets 7 Current Assets 9 9 10 11 12 13 14 15 16 17 18 Total Current Assets 19 20 Noncurrent Assets 21 22 Property, plant, and Equipment 23 24 25 26 27 Intangible Assets 28 29 30 31 32 33 Total Noncurrent Assets 34 Total Assets 35 36 37 check Total Noncurrent Liabilities Total Liabilities $ $ Shareholder's Equity fill in account namel (fill in account name] Retained Earnings Other Comprehensive Income (OCI) $ $ Total Shareholder's Equity $ Total Liabilities and S/H Equil $ TB AJE Balance Sheet +