Question

Information: 1.Analysis of the Allowance for Doubtful Accounts shows: Beginning of year balance $45,496 Provision for the year 19,567 Write-offs in the year (22,957) End

Information:

1.Analysis of the Allowance for Doubtful Accounts shows:

| Beginning of year balance | $45,496 |

| Provision for the year | 19,567 |

| Write-offs in the year | (22,957) |

| End of year balance on 12/31 | $42,106 |

2.All charitable contributions were made in cash to qualified organizations.

3.Four estimated federal income tax payments of $60,000 were made timely.

4.Entertainment expenses consist only of reimbursements for business meals & entertainment incurred by the company's officers & sales force.

5.$2,560 of the interest income was earned on investments in tax-exempt state bonds. The rest of the interest income was earned from investments in taxable corporate bonds. Dividend income is from shares of Microsoft Corporation. The company owns much less that 1% of the outstanding shares.

6.The company owns several insurance policies on the lives of its officers and key employees. The company is the beneficiary of these policies. Premiums on these policies cost $24,670 this year.

7.MACRS depreciation for tax purposes is $239,000.

8.The company sold some shares of stock this year and realized a gain of $30,890. The shares were purchased in 2010. There were no other asset sales in the current year.

9.All appropriate financial reporting adjustments have been made to the trial balance except for the provision for income taxes. You will need to calculate and record an adjusting journal entry for the book income tax expense to complete the book basis trial balance in order to produce the GAAP basis financial statements.

Requirements:

Part 1. A. Write the adjusting journal entry [in proper journal entry form] for book tax expense & tax liability AND prepare financial statements, specifically, a [book basis] balance sheet, income statement and retained earnings statement. Your tax expense adjusting entry should include a debit to book tax expense, a credit to tax prepayments and a debit or credit to deferred tax and a credit to tax liability (if any). Note: as per (3) above, the company has made timely estimated tax payments. Do you see these on the companys trial balance?

Part 1. B. Prepare a schedule (as we have done in class) showing the book to tax differences. Your schedule that you hand in should begin with book Net Income (after tax) and end with Taxable Income.

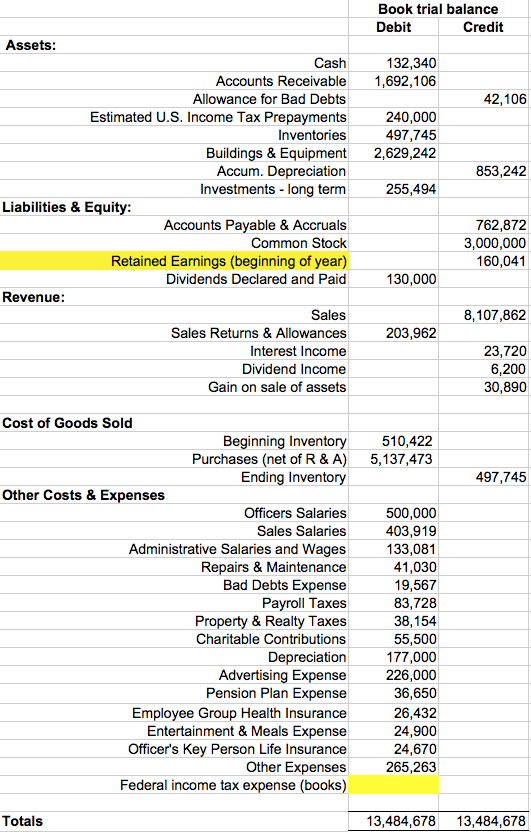

Book trial balance Debit Credit Assets: 132, 340 Accounts Receivable 1,692,106 42,106 Allowance for Bad Debts Estimated U.S. Income Tax Prepayments 240,000 Inventories 497,745 Buildings & Equipment 2,629,242 853,242 Accum. Depreciation Investments -long term 255,494 Liabilities & Equity: 762,872 Accounts Payable & Accruals Common Stock 3,000,000 160,041 Retained Earnings (beginning of year) 130,000 Dividends Declared and Paid Revenue: Sales 8,107,862 Sales Returns & Allowances 203,962 23,720 Interest Income 6,200 Dividend Income 30,890 Gain on sale of assets Cost of Goods sold Beginning Inventory 510,422 Purchases (net of R & A) 5,137,473 497,745 Ending Inventory other Costs & Expenses officers salaries 500,000 Sales Salaries 403,919 Administrative Salaries and Wages 133,081 41,030 Repairs & Maintenance Bad Debts Expense 19,567 83,728 Payroll Taxes Property & Realty Taxes 38,154 55,500 Charitable Contributions 177,000 Depreciation Advertising Expense Pension Plan Expense 36,650 Employee Group Health Insurance 26,432 24,900 Entertainment & Meals Expense Officer's Key Person Life Insurance 24,670 Other Expenses 265,263 Federal income tax expense (books Totals 13,484,678 13,484,678 Book trial balance Debit Credit Assets: 132, 340 Accounts Receivable 1,692,106 42,106 Allowance for Bad Debts Estimated U.S. Income Tax Prepayments 240,000 Inventories 497,745 Buildings & Equipment 2,629,242 853,242 Accum. Depreciation Investments -long term 255,494 Liabilities & Equity: 762,872 Accounts Payable & Accruals Common Stock 3,000,000 160,041 Retained Earnings (beginning of year) 130,000 Dividends Declared and Paid Revenue: Sales 8,107,862 Sales Returns & Allowances 203,962 23,720 Interest Income 6,200 Dividend Income 30,890 Gain on sale of assets Cost of Goods sold Beginning Inventory 510,422 Purchases (net of R & A) 5,137,473 497,745 Ending Inventory other Costs & Expenses officers salaries 500,000 Sales Salaries 403,919 Administrative Salaries and Wages 133,081 41,030 Repairs & Maintenance Bad Debts Expense 19,567 83,728 Payroll Taxes Property & Realty Taxes 38,154 55,500 Charitable Contributions 177,000 Depreciation Advertising Expense Pension Plan Expense 36,650 Employee Group Health Insurance 26,432 24,900 Entertainment & Meals Expense Officer's Key Person Life Insurance 24,670 Other Expenses 265,263 Federal income tax expense (books Totals 13,484,678 13,484,678Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started