Answered step by step

Verified Expert Solution

Question

1 Approved Answer

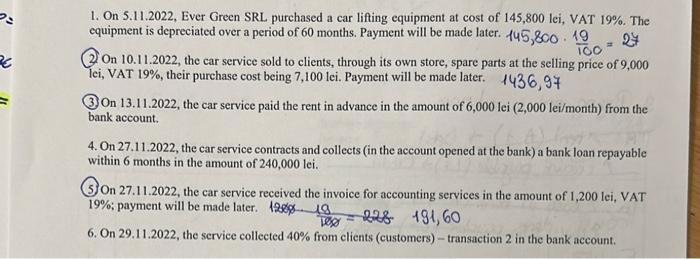

26 27 1. On 5.11.2022, Ever Green SRL purchased a car lifting equipment at cost of 145,800 lei, VAT 19%. The equipment is depreciated

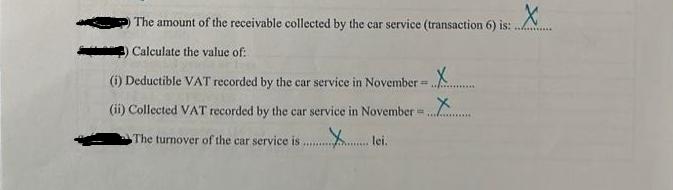

26 27 1. On 5.11.2022, Ever Green SRL purchased a car lifting equipment at cost of 145,800 lei, VAT 19%. The equipment is depreciated over a period of 60 months. Payment will be made later. 145,800 19 = TOO On 10.11.2022, the car service sold to clients, through its own store, spare parts at the selling price of 9,000 lei, VAT 19%, their purchase cost being 7,100 lei. Payment will be made later. 1436,97 3 On 13.11.2022, the car service paid the rent in advance in the amount of 6,000 lei (2,000 lei/month) from the bank account. 4. On 27.11.2022, the car service contracts and collects (in the account opened at the bank) a bank loan repayable within 6 months in the amount of 240,000 lei. 3 on 27.11.2022, the car service received the invoice for accounting services in the amount of 1,200 lei, VAT 19%; payment will be made later. 1209 19 Tex 228 191,60 6. On 29.11.2022, the service collected 40% from clients (customers)- transaction 2 in the bank account. X The amount of the receivable collected by the car service (transaction 6) is: Calculate the value of: (i) Deductible VAT recorded by the car service in November - X (ii) Collected VAT recorded by the car service in November ........... The turnover of the car service is ..... ..............

Step by Step Solution

★★★★★

3.58 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the VAT and total cost for each transaction 1 Car lifting ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started