Answered step by step

Verified Expert Solution

Question

1 Approved Answer

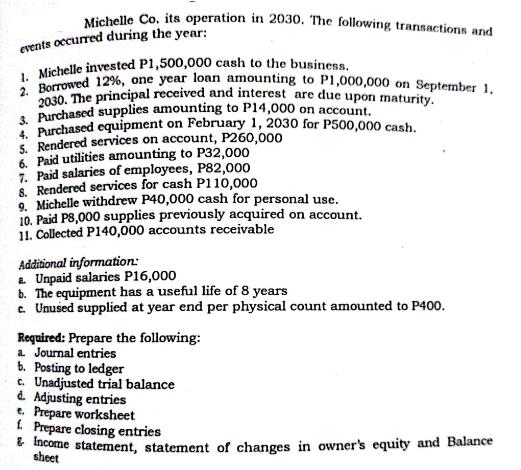

Michelle Co. its operation in 2030. The following transactions and events occurred during the year: 1. Michelle invested P1,500,000 cash to the business. 2.

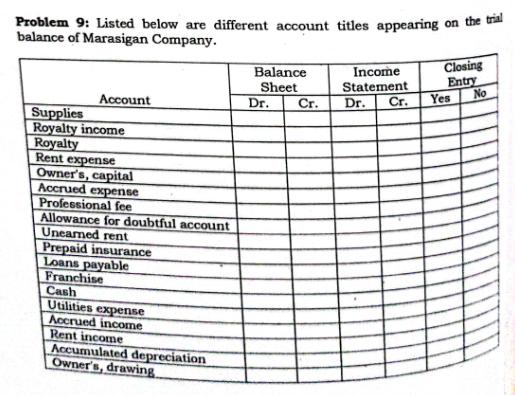

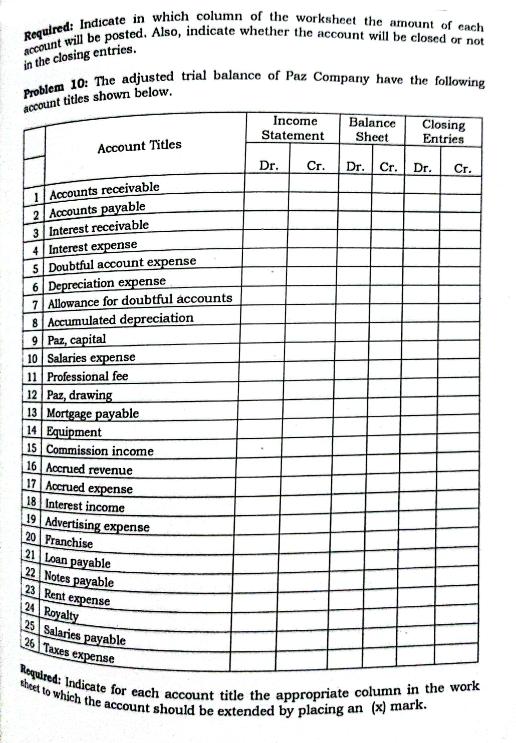

Michelle Co. its operation in 2030. The following transactions and events occurred during the year: 1. Michelle invested P1,500,000 cash to the business. 2. Borrowed 12%, one year loan amounting to P1,000,000 on September 1, 2030. The principal received and interest are due upon maturity. 3. Purchased supplies amounting to P14,000 on account. 3. Purchased equipment on February 1, 2030 for P500,000 cash. 5. Rendered services on account, P260,000 6. Paid utilities amounting to P32,000 7. Paid salaries of employees, P82,000 8. Rendered services for cash P110,000 9. Michelle withdrew P40,000 cash for personal use. 10. Paid P8,000 supplies previously acquired on account. 11. Collected P140,000 accounts receivable Additional information: a Unpaid salaries P16,000 b. The equipment has a useful life of 8 years c. Unused supplied at year end per physical count amounted to P400. Required: Prepare the following: a. Journal entries b. Posting to ledger c. Unadjusted trial balance d. Adjusting entries e. Prepare worksheet f. Prepare closing entries & Income statement, statement of changes in owner's equity and Balance sheet Problem 9: Listed below are different account titles appearing on the trial balance of Marasigan Company. Account Supplies Royalty income Royalty Rent expense Owner's, capital Accrued expense Professional fee Allowance for doubtful account Unearned rent Prepaid insurance Loans payable Franchise Cash Utilities expense Accrued income Rent income Accumulated depreciation Owner's, drawing Balance Sheet Dr. Cr. Income Statement Dr. Cr. Closing Entry No Yes Required: Indicate in which column of the worksheet the amount of each account will be posted. Also, indicate whether the account will be closed or not in the closing entries. Problem 10: The adjusted trial balance of Paz Company have the following account titles shown below. Account Titles 1 Accounts receivable 2 Accounts payable 3 Interest receivable 4 Interest expense 5 Doubtful account expense 6 Depreciation expense 7 Allowance for doubtful accounts 8 Accumulated depreciation 9 Paz, capital 10 Salaries expense 11 Professional fee 12 Paz, drawing 13 Mortgage payable 14 Equipment 15 Commission income 16 Accrued revenue 17 Accrued expense 18 Interest income 19 Advertising expense 20 Pranchise 21 Loan payable 22 Notes payable 23 Rent expense 24 Royalty 25 Salaries payable 26 Taxes expense Income. Statement Balance Sheet Dr. Cr. Dr. Cr. Closing Entries Dr. Cr. Required: Indicate for each account title the appropriate column in the work sheet to which the account should be extended by placing an (x) mark.

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a Journal Entries 1 Michelle Co its operation in 2030 Cash 1500000 Owners Capital 1500000 To record initial investment 2 Borrowed 12 one year loan amo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started