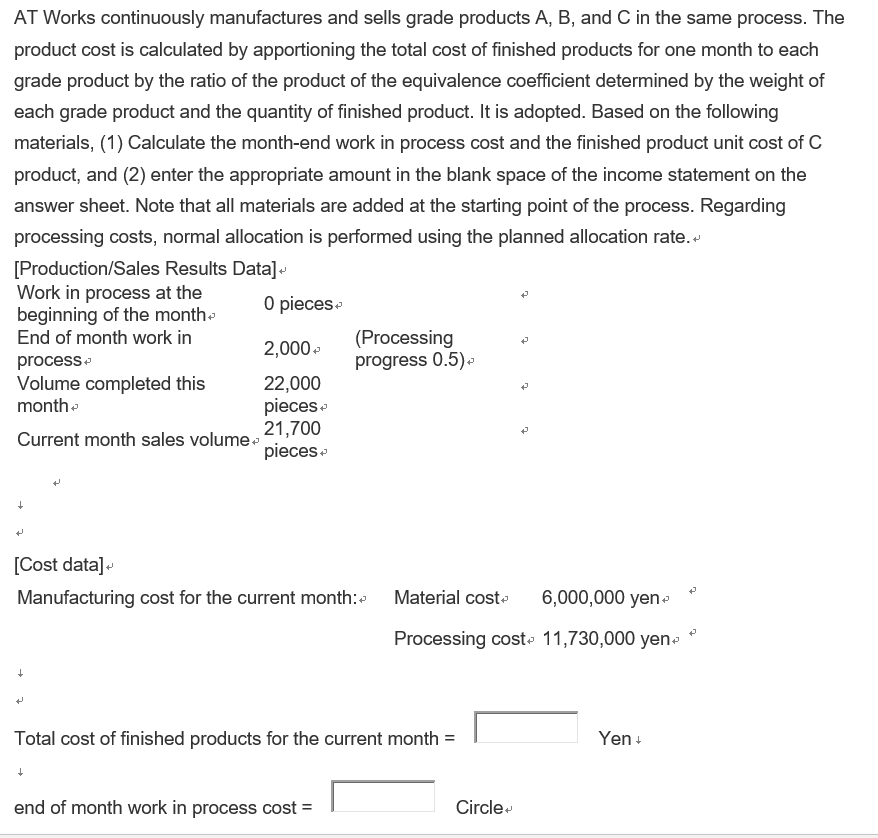

Question

[Information about breakdown by product] A product B product C product Equivalence coefficient 1.0 0.6 0.4 Volume completed this month 9,000 5,000 8,000 pieces Unit

[Information about breakdown by product]

| A product | B product | C product | |

| Equivalence coefficient | 1.0 | 0.6 | 0.4 |

| Volume completed this month | 9,000 | 5,000 | 8,000 pieces |

| Unit cost of finished product | @Circle | @Circle | @Circle |

| Current month sales volume | 9,000 | 5,200 pieces | 7,500 pieces |

| Actual selling price | @1,800 yen | @1,500 yen | @900 yen |

* The processing cost allocation difference of 78,000 yen (debit difference) will be charged to the cost of sales for the current month as a cost difference.

| Profit and loss statement | |||

| (Unit: Yen) | |||

| Sales | |||

| Cost of sales | |||

| January first product inventory | 1,700,000 | ||

| 2 Product manufacturing cost for the month | |||

| total | |||

| Product inventory at the end of March | 838,000 | ||

| Deduction | |||

| 4 Cost difference | |||

| Gross profit | |||

| Selling and general administrative expenses | 10,015,000 | ||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started