INFORMATION

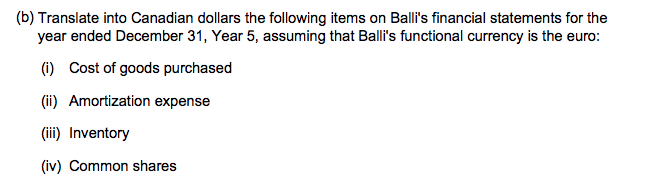

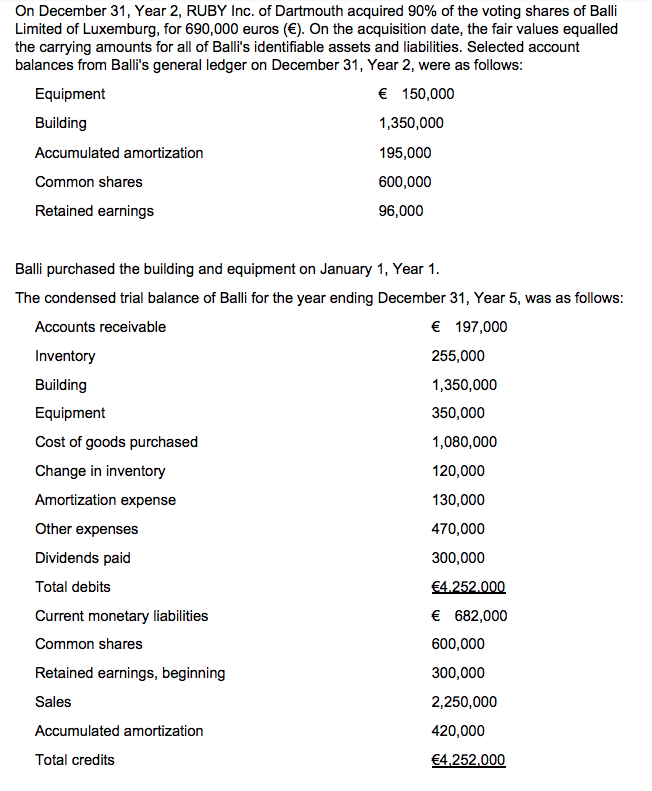

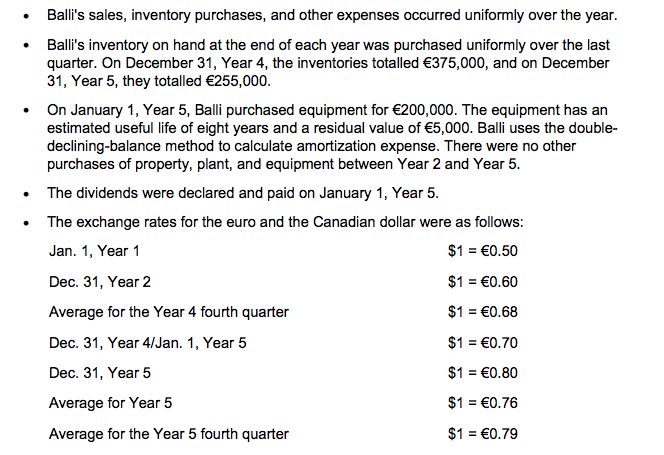

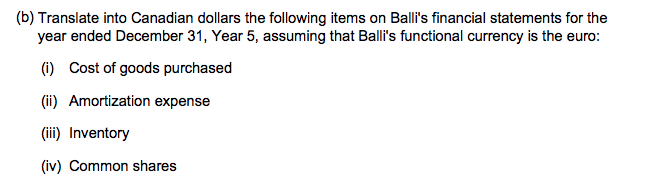

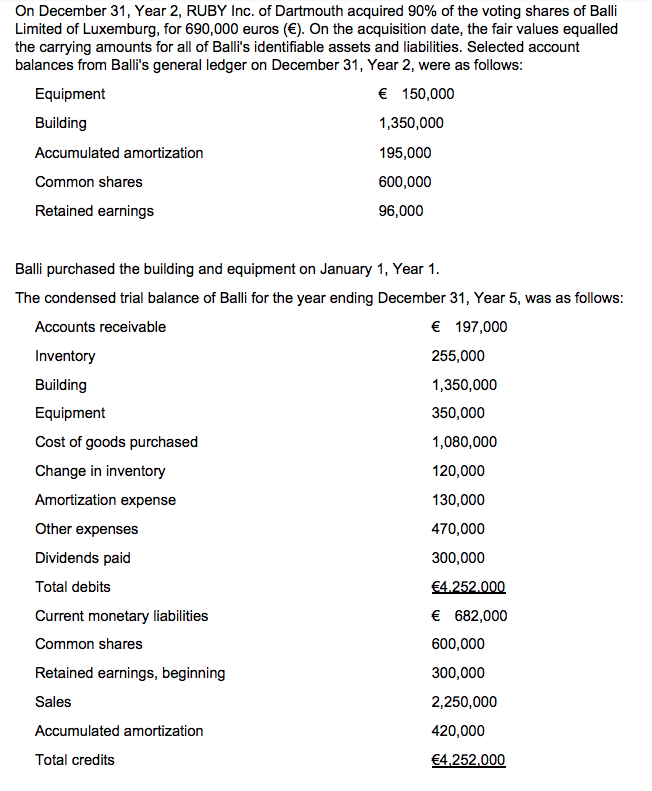

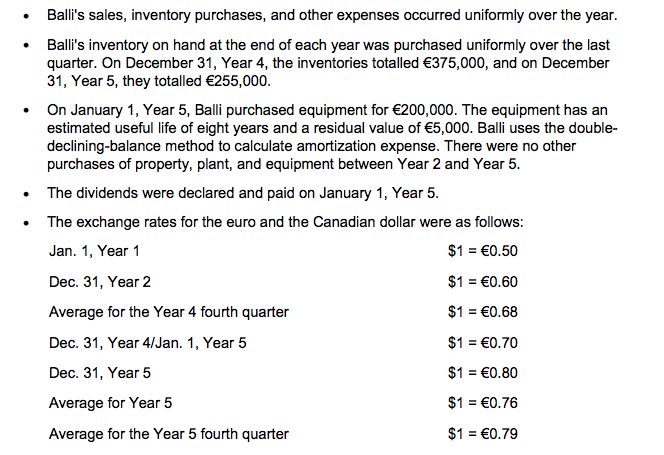

(b) Translate into Canadian dollars the following items on Balli's financial statements for the year ended December 31, Year 5, assuming that Balli's functional currency is the euro: (0) Cost of goods purchased (ii) Amortization expense (iii) Inventory (iv) Common shares On December 31, Year 2, RUBY Inc. of Dartmouth acquired 90% of the voting shares of Balli Limited of Luxemburg, for 690,000 euros (). On the acquisition date, the fair values equalled the carrying amounts for all of Balli's identifiable assets and liabilities. Selected account balances from Balli's general ledger on December 31, Year 2, were as follows: Equipment 150,000 Building 1,350,000 Accumulated amortization 195,000 Common shares 600,000 Retained earnings 96,000 Balli purchased the building and equipment on January 1, Year 1. The condensed trial balance of Balli for the year ending December 31, Year 5, was as follows: Accounts receivable 197,000 Inventory 255,000 Building 1,350,000 Equipment 350,000 Cost of goods purchased 1,080,000 Change in inventory 120,000 Amortization expense 130,000 Other expenses 470,000 Dividends paid 300,000 Total debits 4.252.000 Current monetary liabilities 682,000 Common shares 600,000 Retained earnings, beginning 300,000 Sales 2,250,000 Accumulated amortization 420,000 Total credits 4,252,000 Balli's sales, inventory purchases, and other expenses occurred uniformly over the year. Balli's inventory on hand at the end of each year was purchased uniformly over the last quarter. On December 31, Year 4, the inventories totalled 375,000, and on December 31, Year 5, they totalled 255,000. On January 1, Year 5, Balli purchased equipment for 200,000. The equipment has an estimated useful life of eight years and a residual value of 5,000. Balli uses the double- declining-balance method to calculate amortization expense. There were no other purchases of property, plant, and equipment between Year 2 and Year 5. The dividends were declared and paid on January 1, Year 5. The exchange rates for the euro and the Canadian dollar were as follows: Jan. 1, Year 1 $1 = 0.50 Dec. 31, Year 2 $1 = 0.60 Average for the Year 4 fourth quarter $1 = 0.68 Dec. 31, Year 4/Jan. 1, Year 5 $1 = 0.70 Dec. 31, Year 5 $1 = 0.80 Average for Year 5 $1 = 0.76 Average for the Year 5 fourth quarter $1 = 0.79