Answered step by step

Verified Expert Solution

Question

1 Approved Answer

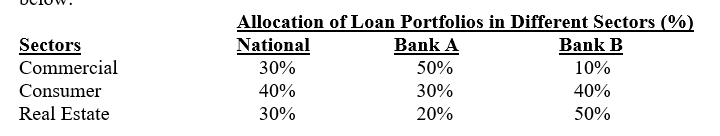

Information concerning the allocation of loan portfolios to different market sectors is given below: Bank A and Bank B would like to estimate how much

Information concerning the allocation of loan portfolios to different market sectors is given below:

Bank A and Bank B would like to estimate how much their portfolios deviate from the national average.

a. Which bank is further away from the national average?

b. Is a large standard deviation necessarily bad for an FI using this model?

\begin{tabular}{lccc} & \multicolumn{3}{c}{ Allocation of Loan Portfolios in Different Sectors (\%) } \\ \cline { 2 - 4 } Sectors & National & BankA & BankB \\ Commercial & 40% & 50% & 10% \\ Consumer & 30% & 30% & 40% \\ Real Estate & 20% & 50% \end{tabular} \begin{tabular}{lccc} & \multicolumn{3}{c}{ Allocation of Loan Portfolios in Different Sectors (\%) } \\ \cline { 2 - 4 } Sectors & National & BankA & BankB \\ Commercial & 40% & 50% & 10% \\ Consumer & 30% & 30% & 40% \\ Real Estate & 20% & 50% \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started