Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Explain why the beta estimates make sense intuitively. Hint! Why does LVS have a high beta? etc. Assume the CAPM is correct. How should

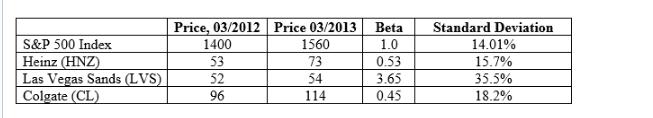

Explain why the beta estimates make sense intuitively. Hint! Why does LVS have a high beta? etc. Assume the CAPM is correct. How should you invest? Do you need more information to answer this question? Which stock has the highest expected return according to the CAPM? Why? Plot all the stocks and the S&P on the SML. The risk free rate is 2% and the expected return on the market is 10%. Consider a portfolio that allocates 25%, 40% and 35% to HNZ, LVS and CL respectively. What is the beta of this portfolio? What is the expected return (use the CAPM)? What is the expected return on the portfolio in (d) using historical information instead of the CAPM? CL has a higher standard deviation than HNZ. Is this consistent with the CAPM? Why or why not? S&P 500 Index Heinz (HNZ) Las Vegas Sands (LVS) Colgate (CL) Price, 03/2012 Price 03/2013 Beta 1.0 0.53 3.65 0.45 1400 53 52 96 1560 73 54 114. Standard Deviation 14.01% 15.7% 35.5% 18.2%

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Solution Okay lets break this down stepbystep 1 Why do the BEA estimates make sense intuitively The BEA estimates are based on real economic data and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started