Question

Information for James Company is as follows: Accounts Receivable at December 31, Year 1 $9000 Allowance for Impairment Accounts (Credit balance) $2000 Net Sales (85%

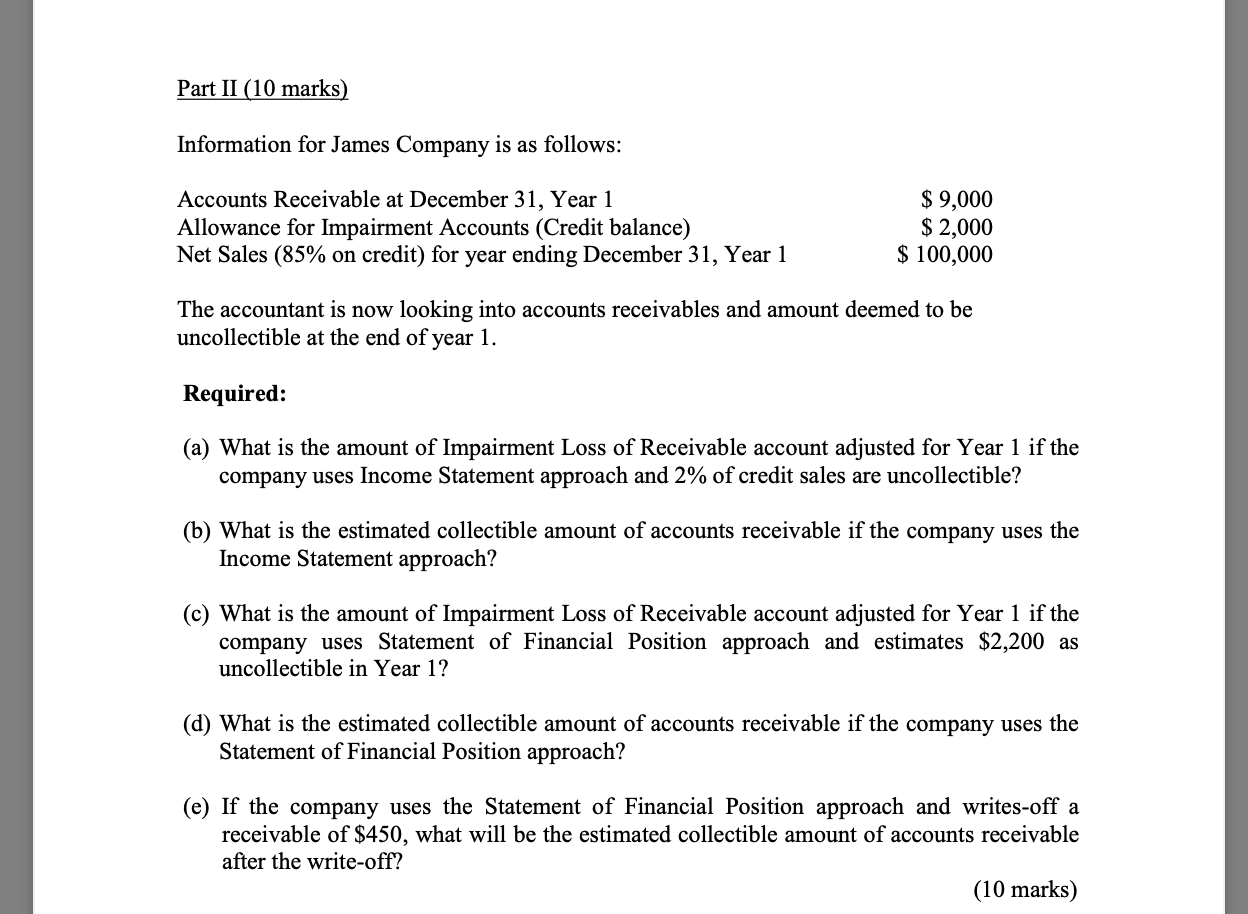

Information for James Company is as follows:

Accounts Receivable at December 31, Year 1 $9000 Allowance for Impairment Accounts (Credit balance) $2000 Net Sales (85% on credit) for year ending December 31, Year 1 $100,000

The accountant is now looking into accounts receivables and amount deemed to be uncollectible at the end of year 1.

Required:

(a) What is the amount of Impairment Loss of Receivable account adjusted for Year 1 if the company uses Income Statement approach and 2% of credit sales are uncollectible?

(b) What is the estimated collectible amount of accounts receivable if the company uses the Income Statement approach?

(c) What is the amount of Impairment Loss of Receivable account adjusted for Year 1 if the company uses Statement of Financial Position approach and estimates $2,200 as uncollectible in Year 1?

(d) What is the estimated collectible amount of accounts receivable if the company uses the Statement of Financial Position approach?

(e) If the company uses the Statement of Financial Position approach and writes-off a receivable of $450, what will be the estimated collectible amount of accounts receivable after the write-off?

Required: (a) What is the amount of Impairment Loss of Receivable account adjusted for Year 1 if the company uses Income Statement approach and 2% of credit sales are uncollectible? (b) What is the estimated collectible amount of accounts receivable if the company uses the Income Statement approach? (c) What is the amount of Impairment Loss of Receivable account adjusted for Year 1 if the company uses Statement of Financial Position approach and estimates $2,200 as uncollectible in Year 1? (d) What is the estimated collectible amount of accounts receivable if the company uses the Statement of Financial Position approach? (e) If the company uses the Statement of Financial Position approach and writes-off a receivable of $450, what will be the estimated collectible amount of accounts receivable after the write-off? (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started